In the competitive rental market, landlords have to make sure they choose reliable tenants to safeguard their properties. Knowing “What is a tenant screening report?’ and using this necessary tool that provides landlords with information about the history of a possible renter, therefore influencing their decisions.

This article will examine the components, relevance, and interpretation of “what is a tenant screening reports?”, therefore offering expert guidance and free samples to assist landlords along the process.

Quick Facts Table About What Is a Tenant Screening Report and Criteria

Here's a quick review of the six most often searched aspects landlords give top priority throughout the tenant screening process before delving into the specifics:

What Is a Tenant Screening Report?

A tenant screening report is a detailed rental applicant background check that helps landlords judge whether to approve an application. Unlike a standalone credit report, a screening combines several key elements into one file, offering a full view for prospective renter evaluation and a renter’s profile assessment.

The main components usually include:

- Identity and SSN verification to prevent fake documents or a fake story during the application process.

- Credit history and payment history, which highlight credit scores, open debts, and late payment patterns. This section is also where a tenant's credit and eviction history are reviewed.

- Eviction records, which reveal past removals. A frequent eviction history is considered a strong red flag in tenant screening reports.

- Criminal background checks must follow rules such as the HUD criminal background check requirements.

- Income and employment verification, often checked through direct employer confirmation or pay stubs. Landlords may apply the income-to-rent ratio (three times rent rule), explained in this rent-to-income guide.

- Optional details like past landlords' references, which are based on real experiences but are not always part of a CRA report.

In some states, renters can share a portable tenant screening report (PTSR), reducing duplicate application fees and saving time. This flexibility benefits both landlords and renters when navigating the lease application screening process.

Why does this matter for landlords? A detailed rental screening process cuts the risk of late rent, lease violations, or property damage. Practical tips include asking pre-screening questions early, confirming tenant income, and reviewing documents closely.

By focusing on a consistent screening method, landlords make smart choices and avoid future disputes, while renters benefit from a transparent renter’s profile assessment.

What Is the Purpose of Tenant Screening?

The purpose of a tenant screening report is to protect property owners and ensure trustworthy renters. A clear rental screening process provides data for a fair rental applicant background check and supports confident prospective renter evaluation.

The first goal is risk control. Checking financial history, payment history, and tenant income confirms whether a renter can manage the monthly rent. Many landlords apply the income rule, often called the three-times rent guideline. Employers may confirm income during the employment verification process.

Landlords also review eviction records. Repeat eviction history often shows up as a serious red flag in tenant screening reports. Another layer involves spotting fake documents or a fake story during the application process. Both signal possible fraud.

Another purpose is efficiency. Landlords ask pre-screening questions to filter renters early. This saves time and avoids wasting money on unnecessary checks. Reviewing fair application fees is also important, as explained in this application fee guide.

Some states let renters share a portable tenant screening report (PTSR). In Colorado, PTSR rules help cut costs and speed the lease application screening. Screening also improves long-term matches.

Past landlords' references show rental behaviour from earlier leases. A tenant screening checklist guides each step. Together, these details form a full renter's profile assessment. This lowers trouble after move-in and creates stronger rental relationships.

Why Is Tenant Screening Report Crucial for Landlords?

For these several reasons, including many tenant screening report implementation is really crucial:

- Risk Mitigation: Identifies possible red flags, including bad credit or prior evictions, thereby lowering the possibility of future problems.

- Financial Assurance: Ensures the renter has the background to pay rent regularly, therefore preserving the money flow to the landlord.

- Property Protection: Neglect any criminal history that can endanger the property or another renter.

- Legal Compliance: Shows adequate attention to tenant selection, which is very important in legal conflicts.

Key Components of a Tenant Screening Report

After knowing basically what is a tenant screening report, it’s time to know what are its key components:

1. Credit Check

An applicant's financial responsibility is assessed in the part on credit checks in a tenant screening document. It covers credit ratings, unpaid debt, payment history, and any bankruptcy. Good credit indicates the renter is probably going to pay rent on schedule.

2. Criminal Background Check

This component examines the applicant's criminal history. While small violations may not disqualify, major crimes might point to potential risks. When reviewing this data, landlords have to make sure they follow Fair Housing Laws.

3. Eviction History

An eviction record shows if the applicant has ever been kicked out. Several evictions or recent ones might raise questions about possible future tenancy problems.

4. Rental History

References from past landlords in this part help to provide light on the applicant's tenant behavior. Positive references may point to dependability; negative ones could call for caution.

5. Income & employment verification

This part confirms whether the applicant earns a steady income and has reliable work. Verification often involves pay stubs or direct employer confirmation. Many landlords also apply the “three times rent rule” when reviewing tenant income, which helps decide if the applicant can afford the lease.

How Much Does Tenant Screening Cost?

Besides understanding what a tenant screening report is, knowing the cost of a background check for renters is also important. The price for this service varies depending on the service provider and the depth of the report. Tenant screening usually costs between $15 and $50 per person.

A basic check, like a credit report or criminal background check, costs about $15 to $25. More detailed reports that include credit history, eviction records, criminal checks, job, and income verification can cost from $40 to $100 or more. The price depends on several things:

- How much detail you want: Basic checks may only include credit or criminal history. Full reports include several types of checks.

- Which company you use: Different companies charge different rates.

- Where you live: Big cities usually have higher prices than rural areas.

- Who pays the fee: Sometimes landlords pay. Other times, tenants pay when applying.

- Laws in your area: Some places limit how much landlords can charge for screening. For example, New York limits fees to $20. California says fees must only cover the real cost of screening.

Here is an example of typical costs:

- Credit report and score: $23

- Criminal background check: $17

- Eviction check: $14

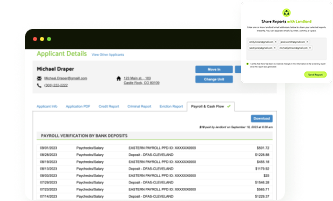

- Payroll Verification & Cash Flow Report: $10

- Full packages: $64 or more

Though costs vary, good tenant screening is worth it. Evictions can cost landlords $3,500 to $10,000. Screening helps landlords find renters who pay on time and follow rules. Many landlords ask tenants to pay the screening fee to keep only serious applicants.

How the Tenant Screening Process Works with LeaseRunner?

LeaseRunner offers a streamlined and efficient explanation of what a tenant screening report is and how this screening process works, designed to assist landlords in making informed leasing decisions. By integrating various components such as credit screening, criminal background checks, and eviction history, LeaseRunner simplifies the apartment screening process.

Step 1. Initiate the Screening

Landlords begin by logging into their LeaseRunner account and navigating to the 'Screen' section. Here, they can order the desired screening reports, including options like credit screening, criminal background checks, and eviction reports.

Landlords can choose who will bear the cost of a background check for renters, whether it's themselves or the applicants. Once the order is placed, LeaseRunner sends a secure email link to the applicant to commence the rental screening report process.

Step 2. Applicant Provides Information

After getting the email invitation, applicants click the given link to enter Lease Runner's secure platform. They are pushed to finish the rental application and approve the publication of their background data. This includes adding personal information such as name, address, birthdate, and Social Security number.

Depending on their credit history, applicants may have to respond to identification verification inquiries for credit screening. In this stage, following Fair Housing rules and FCRA, all data should be handled securely.

Step 3. Report Generation

LeaseRunner handles the data after the applicant has supplied the required information and approved the checks to provide extensive answers for those who are asking “what is a tenant screening report?” and the tenant screening documents. This report encompasses various aspects, including:

- Credit Screening: Evaluates the applicant's financial responsibility through credit scores and payment history.

- Criminal Background Check: Assesses any potential risks by reviewing criminal records.

- Eviction History: Provides insights into any past eviction proceedings.

- Income Verification & Cash Flow Report: Analyzes the applicant's income stability and financial health.

The generated report is then made available to the landlord through the LeaseRunner dashboard.

Step 4. Review and Decision

Landlords are notified when the tenant screening report is available. They may use their LeaseRunner account to examine the complete details. This detailed research allows landlords to make educated conclusions about the applicant's appropriateness.

If the landlord agrees to continue, LeaseRunner provides tools to help with lease negotiations and rent collection, significantly expediting the apartment screening process.

FREE Tenant Screening Report Samples with LeaseRunner

Landlords often want to see what an actual rental applicant background check looks like. LeaseRunner provides FREE Tenant Screening Report Samples that include credit history, eviction records, and criminal background checks. These templates help landlords learn how to read and understand each part of a lease application screening report.

When reviewing tenant credit and eviction history reports, focus on four areas:

- Financial History: Check payment history, debt levels, and if they meet the three-times rent rule.

- Eviction Records: Even one entry matters. Always compare with past landlords’ references for balance.

- Criminal Records: Federal and state laws ban blanket denials. Stay aligned with Fair Housing Laws.

- Application Data: Spot mistakes, fake documents, or a fake story in income or employment claims.

These examples match what you see in the tenant background screening samples. Real reports will include score ranges, alerts, and flags that guide smart prospective renter evaluations.

How Long Does a Tenant Screening Take?

The time frame for a prospective renter evaluation can vary. A typical tenant screening process takes between 24 to 72 hours. Basic checks like credit and eviction history are often completed within a few minutes to a few hours, while verifying employment and past landlord references can take 2 to 3 days, depending on response times.

LeaseRunner explains this in their guide on how long tenant screening takes. Automated data like financial history appears quickly, though delays are common when employers or landlord references respond slowly.

For Section 8 applicants, extra compliance checks are always needed. LeaseRunner’s guide on how to screen Section 8 tenants shows how to confirm voucher details and also check whether the applicant meets the income-to-rent ratio, often called the three-times rent rule. These steps must always follow fair housing and discrimination laws.

Key Benefits of Using a Tenant Screening Report

A keycheck tenant screening tool helps landlords avoid financial and legal issues. Some major benefits include:

- Time Efficiency: Streamlined processes save time in the tenant selection process.

- Legal Protection: Proper documentation and due diligence can protect landlords in legal scenarios.

- Informed Decision-Making: Access to comprehensive information enables landlords to choose the most qualified renters via informed decision-making.

- Reduced Risk: Finding any problems early on helps to lower the likelihood of more problems down the road.

Legal Considerations and Compliance for Landlords

Landlords must follow both federal and state screening laws. Each rule exists to protect fairness in the rental screening process.

- The Fair Credit Reporting Act (FCRA) regulates tenant data. It controls how information is collected, stored, and shared between parties.

- Fair Housing Laws ban discrimination. Landlords cannot reject applicants due to race, religion, gender, disability, or family status.

- Some states add geographic tenant screening restrictions. Others have strict sources of income discrimination laws that cover housing vouchers or government aid.

- When you deny an applicant, issue an Adverse Action Notice. An Adverse Action Notice is a written explanation sent to applicants when they are denied housing due to information in their tenant screening report. This kind of notice is required if the denial comes from tenant credit, eviction history, or any criminal record.

Incorrect data creates serious risks, and denying an applicant based on errors in eviction records can lead to lawsuits. Therefore, always allow applicants to dispute errors in a rental applicant background check. Reviewing corrections before the final decision avoids legal conflict.

What are red flags in Tenant Screening for landlords?

During tenant screening, landlords watch for red flags that indicate potential problems. These warning signs help avoid risky renters and reduce future issues. Key red flags include:

- Bad payment history: late payments or unpaid rent may mean money problems.

- Eviction history: past evictions can cause trouble for landlords.

- Fake papers: forged pay stubs or fake IDs need close checking.

- Low credit score and high debts: these may mean the tenant struggles to pay rent.

- Criminal records: some crimes matter, but landlords must follow fair housing rules.

- No landlord references or missing info: this might hide past rental problems.

Spotting these red flags early in the rental screening process helps landlords choose reliable tenants and avoid costly problems later.

Conclusion

For landlords trying to find dependable renters, knowing “what is a tenant screening report?” and applying it is a great tool. Understanding its components and using reliable services helps landlords make wise choices, safeguard their assets, and build good relationships between them and their tenants.

If you wish to find the best tenant screening report providing service, don’t hesitate and refer to the LeaseRunner packages. With clear explanations and transparent pricing, we help you choose the best renters and protect your properties.

FAQs

Q1. Is tenant screening legal?

Yes, tenant screening is legal as long as landlords follow federal laws like the Fair Credit Reporting Act and state regulations, ensuring fair and non-discriminatory treatment of applicants.

Q2. How much does a tenant screening report cost?

Costs vary depending on the service provider and the depth of the report, ranging from free to around $45.

Q3. What is a screening for an apartment?

Renters are evaluated by landlords via apartment screening. Often it entails looking into the applicant's salary, criminal record, rental history, financial background, and present employment. This lets owners decide if the applicant will be able to pay rent on schedule, keep the property in great shape, and follow lease terms.

Q4. How do I read a tenant screening report?

To read a tenant screening report, carefully check the applicant’s credit score, eviction history, criminal records, and income verification to make an informed decision about their suitability.