How It Works

Request & Purchase Renters Insurance 3 Steps

What's included

Renters Insurance, Designed for Your Peace of Mind

LeaseRunner’s renters insurance is built to make moving in easy and worry-free, offering complete protection for tenants and landlords alike

Integrated into the move-in process

Nationwide coverage in all 50 states + DC

Affordable, clear pricing with no hidden fees

Flexible, customizable coverage options

Automatic policy status updates

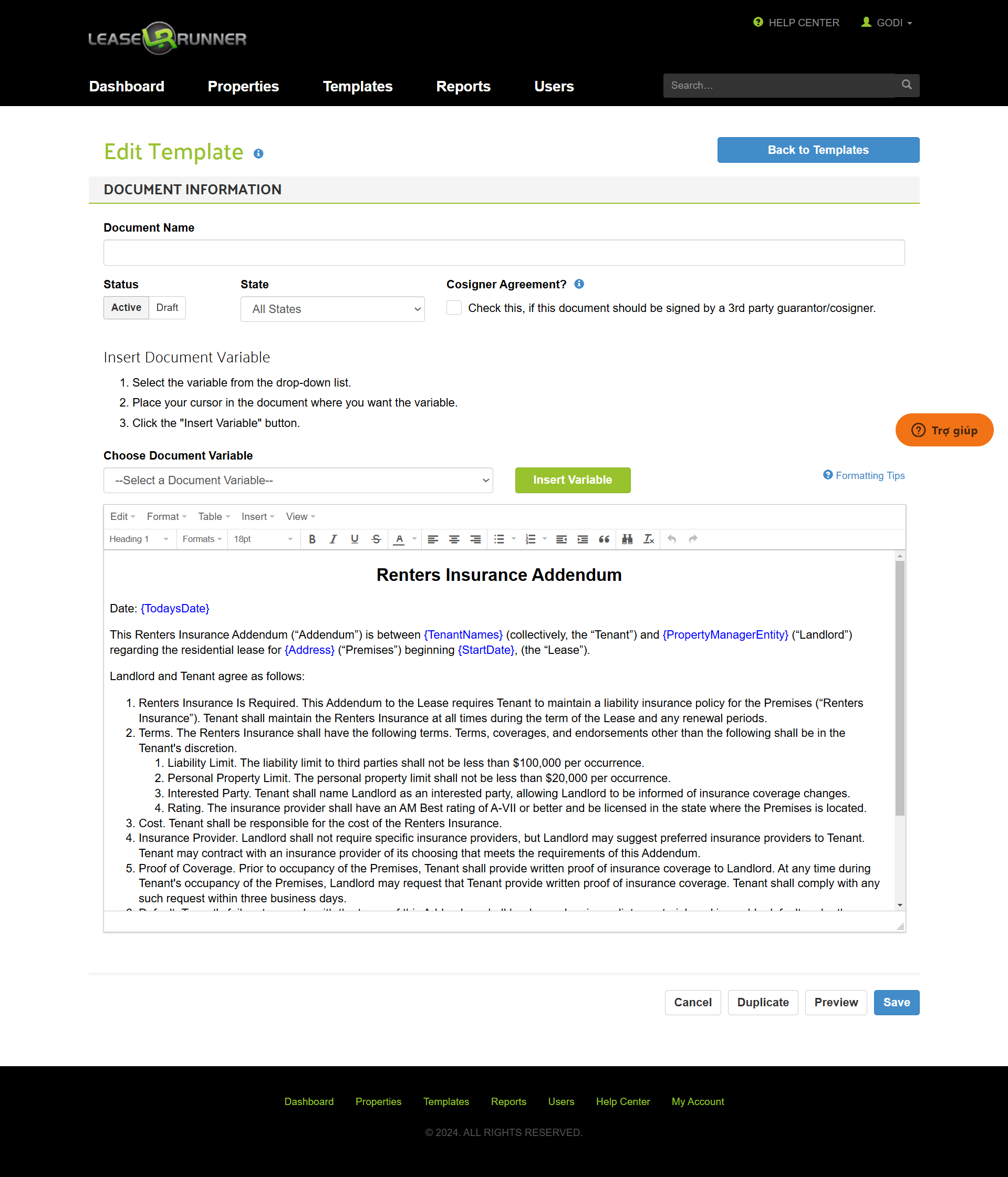

Built-in renters insurance addendum

LeaseRunner is not an insurance carrier or insurance producer and does not sell insurance. LeaseRunner provides a platform for Assurant to market and sell renters insurance to LeaseRunner’s customers. Assurant, a Fortune 500 company, is LeaseRunner’s preferred provider for renters insurance. Any insurance-related questions or matters should be directed to Assurant.

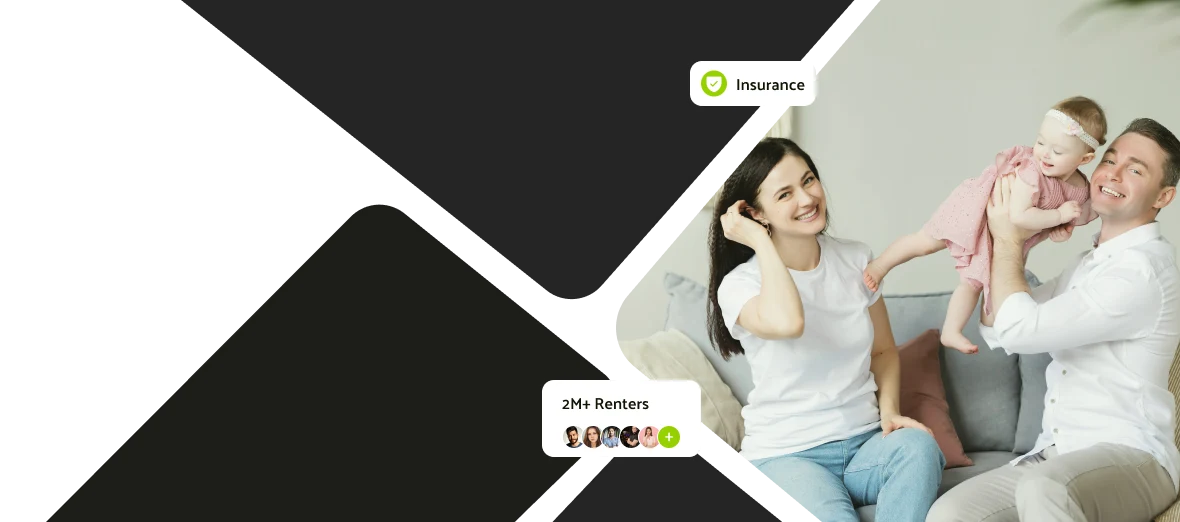

Who we serve

Protecting What Matters Most with Renters Insurance

Renters insurance safeguards your tenant’s valuables so you are not liable in the event of a flood, fire, etc. caused by the property. Provides liability coverage, and covers additional living expenses if your rental becomes uninhabitable—ensuring you're protected when it matters most.

Cover costly incidents like fires, flooding, and pet damage, reducing financial risk.

First-line protection for saving landlords from filing claims on their own policy, which helps keep insurance rates low.

Legally require renters insurance, adding extra protection at no additional cost to them.

Liability Coverage

Protects tenants if they accidentally cause damage or if a guest is injured, with a recommended minimum of $100,000.

Personal Property Coverage

Covers repair or replacement of belongings, like furniture and electronics. LeaseRunner recommends $20,000 in coverage.

Clear and Simple StepsAdditional Living Expenses

Covers costs for temporary housing if the rental becomes uninhabitable, ensuring financial security in unexpected events.

*LeaseRunner integrates SSL encryption, secure sessions, and strict password protocols to protect data throughout the screening and consent process.

Testimonials

Over 12 Years of Trust and Success

A few words from our client

Don’t Risk It—Protect Your Property with Renters Insurance!

Safeguard your property and your tenants today. Sign up with LeaseRunner today or reach out to explore how our coverage solutions can secure your investment.

Discover More Features

FAQs

Frequently Asked Questions

Renters insurance typically includes:

- Personal Property Coverage: Protects your belongings, such as clothing, furniture, and electronics, against risks like fire, theft, and vandalism.

- Liability Coverage: Covers legal expenses and damages if you're found responsible for injury to others or damage to their property.

- Additional Living Expenses: Pays for temporary housing and related costs if your rental becomes uninhabitable due to a covered event.

Renters insurance policies are typically quoted based on liability and personal property limits, such as $100,000 for liability and $20,000 for personal property, with deductibles like $250 or $500. The specific terms and costs of a renters insurance policy may vary from state to state starting at $8 per month

LeaseRunner partners with Assurant, a Fortune 500 company, to offer renters insurance to its customers. While LeaseRunner is not an insurance carrier or producer, we provide a platform for Assurant to market and sell renters insurance. For insurance-related questions or to obtain a policy, please contact Assurant directly.