When you're applying for a rental property, your potential landlord wants to know if you're reliable and trustworthy. Enter rental verification! This process helps landlords confirm your rental history, making sure you're someone who pays rent on time, takes care of the property, and follows the rules.

So, how exactly do landlords check your rental history? Let's dive into our article and find out why it’s so important for both tenants and landlords!

What is Rental Verification? How Landlords Check Rental History?

Rental verification is like your rental resume. It’s a way for landlords to check your past behavior as a tenant.

What does a rental verification include?

This typically involves contacting your previous landlords or property managers to ask questions like:

- Did you pay rent on time?

- Did you take care of the property?

- Were there any issues during your tenancy?

For landlords, they want to ensure they're renting to someone who won’t cause headaches later. For tenants, a strong rental history can be your ticket to securing your next dream apartment or home.

Online Rental Verification: How Does It Work?

Let’s face it, traditional rental history verification can be a hassle. Chasing down references and making phone calls to previous landlords isn’t exactly fun. That’s where online rental verification comes in. It’s the tech-savvy, fast-paced solution to rental history checks.

What is Online Rental Verification?9

Online rental verification is a digital approach to confirming a tenant's rental history using specialized tools. These tools allow landlords to instantly access rental history data through online databases or by securely sharing information with previous landlords.

How is rental history verified? The process typically involves the tenant giving consent for the landlord to check their rental history, and then the landlord can either request rental history from a previous landlord or pull it from an online service.

How LeaseRunner Streamlines Rental History Verification?

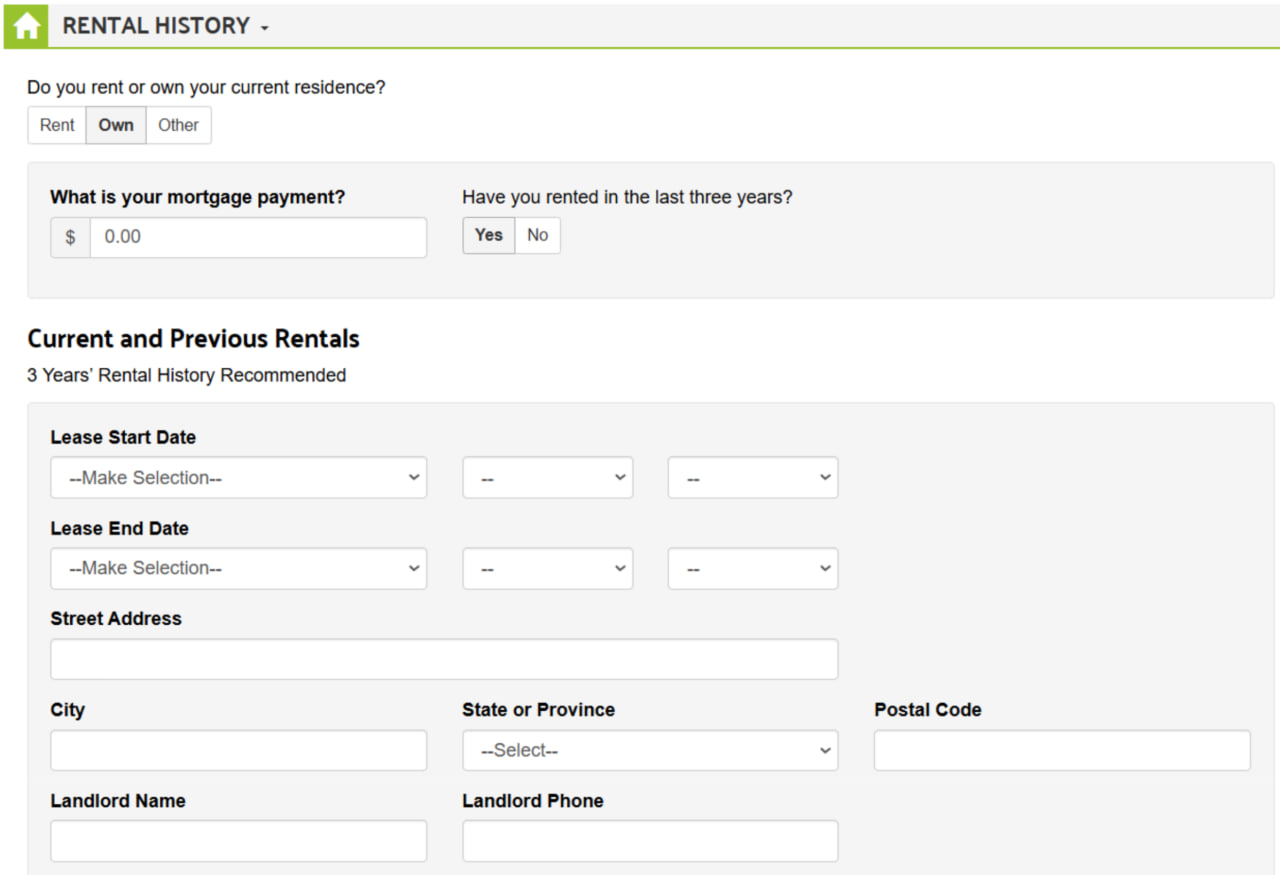

LeaseRunner simplifies the process of verifying rental history with the help of our online rental application process. To help landlords assess an applicant's rental background, the applicant must provide details about their current and previous residences, covering up to three years of rental history. This information is crucial for establishing a record of reliable tenancy.

The platform automates the entire process, including lease signing and payment collection, which makes it ideal for landlords looking to save time and reduce paperwork.

How Do Landlords Verify Rental History? 2 Ways to Verify Rental History

What does landlord verification entail? Let's examine the common methods landlords use to verify your rental history.

1. Contacting Previous Landlords for Reference

One of the oldest and most reliable methods is good old-fashioned reference-checking. Landlords will contact your past landlords to ask about your time as a tenant. They’ll want to know how you behaved during your lease and whether you met your obligations.

While it may feel a little nerve-wracking, providing good references can make all the difference.

2. Checking Tenant Screening Reports

In the digital age, your potential landlord will use a tenant screening report. LeaseRunner's all-inclusive reports include a variety of useful information, such as your credit score, criminal background check, and rental history. Landlords can use these reports to get a comprehensive look at how you’ve managed past rental properties.

Tenant screening reports give landlords a lot of insight into your overall reliability and help them spot any potential red flags quickly. It’s a fast, efficient way for landlords to verify you’re a good tenant without having to call up a bunch of previous landlords.

What Rental History Details Can a Landlord Legally Disclose?

Let’s clear something up: landlords can’t just spill the beans on everything when they’re asked about your rental history. There are rules about what’s considered legal to share, and your privacy matters.

Generally, landlords can share basic information like:

- Dates of tenancy (when you rented)

- Payment history (whether you paid on time or missed payments)

- Condition of the property (if you took good care of it)

However, they can’t legally disclose certain personal details, like:

- Your personal reasons for leaving (unless they were related to breaking the lease)

- Discriminatory or biased opinions about you as a person (based on race, religion, gender, etc.)

How Can I Rent a House Without Rental History?

So, you’re new to renting or you've been living with family for a while and now you’re ready to strike out on your own. There are plenty of ways to rent a house even without a long history of leases behind you.

How First-Time Renters Can Get Approved

First-time renters face a unique challenge: They must prove that they’re responsible tenants, even if they don’t have a long rental history.

To increase your chances of approval, you should:

- Offer a larger security deposit: This shows the landlord that you're financially prepared to handle the lease.

- Get a co-signer or guarantor: If a family member or friend has a solid rental history, they can vouch for you, giving the landlord peace of mind.

- Show proof of income: Demonstrating that you can comfortably afford the rent is a huge plus.

Alternative Proof Landlords Accept

While rental history is important, it’s not the end-all-be-all. If you don’t have a previous lease to refer to, landlords might be open to alternative proofs that showcase your reliability. Some of these include:

- Bank statements: Proof of steady income and financial responsibility can go a long way. Even if you don’t have a formal lease history, showing that you’ve been able to make rent payments on time can give landlords confidence in your ability to pay rent in the future.

- Letters of recommendation: A glowing reference from your employer or someone who knows your character can help convince landlords you’ll be a good tenant.

- LeaseRunner’s Online Rental Application: LeaseRunner offers a comprehensive online rental application platform designed to streamline the leasing process for landlords and tenants. This digital solution allows prospective tenants to securely provide personal, financial, and rental history information, enabling landlords to efficiently review applications and make informed decisions.

In short, landlords need to feel confident that you can meet your obligations.

Can Landlords See Your Rental History?

Yes! But only if you give them permission.

What’s Included in a Rental History Report?

Your rental history report is about the details that help landlords gauge your overall reliability.

- Past addresses: Where you’ve lived and how long you stayed at each place (included on the Credit Report).

- Rent payment history: Did you pay your rent on time? Were there any late payments or missed rent checks? Past landlords can provide a report on on-time payments.

- Property condition: How well you took care of the property. Did you leave it in good shape when you moved out, or were there damages? This is typically requested from the past landlords.

- Lease violations: Any warnings, complaints, or lease violations during your tenancy, such as noise complaints or breaking lease terms. Don’t forget to request this information from the past landlord.

- Evictions: If you’ve ever been evicted or an eviction was filed but settled, this will show up on your Eviction Report. Though, eviction is typically a last resort for landlords.

It’s the kind of snapshot that provides a lot of insight into how you’ve handled previous rental situations.

How to Check Your Own Rental History Before Applying

It’s a smart move to check your own rental history first.

- Request a tenant screening report: You can get a copy of your own rental history report through websites like RentBureau or Experian RentBureau. These services can provide information on your rental payments and lease history if your rent payments were reported

- Review your credit report: While your credit report won’t show everything about your rental history, it can provide some insight. For example, landlords may look at your credit score to assess whether you’re financially responsible.

- Ask previous landlords for a reference: Reach out to them and ask for a letter of recommendation. It’s always a good idea to get ahead of things by having a reference ready.

Common Rental Verification Mistakes (and How to Avoid Them)

We all make mistakes, but when it comes to rental verification, these mistakes can cost you an apartment. To help you avoid potential pitfalls, here are some common rental history verification mistakes and tips for steering clear of them.

- Not Being Honest About Your Rental History: Whether it's hiding a past eviction or failing to mention late payments, landlords can often spot these discrepancies, especially with the help of background checks. Honesty is always the best policy.

- Failing to Provide Complete or Accurate Information: Sometimes, tenants rush through applications and forget to provide complete details or include accurate information, especially regarding past rental addresses. Therefore, double-check your application before submitting it.

- Not Having References Ready: Providing strong references (from previous landlords or employers) helps paint you as a reliable, responsible tenant.

- Waiting Too Long to Follow Up: Landlords get a lot of rental applications, and they won’t always chase you down. Be proactive and follow-up! A simple, polite email or call asking about the status of your application shows that you’re committed and interested.

Summary

Ultimately, knowing what rental verification is and why it matters can save you time and stress in the rental process. With tools like LeaseRunner, landlords can easily verify rental history, ensuring that both parties are confident and informed. It’s an efficient way to get your rental applications approved faster.

FAQs

Q1: How do landlords check rental history?

Landlords verify rental history by contacting previous landlords or using tenant screening services. LeaseRunner helps by collecting rental history details through its online rental application and offering tenant screening services, including credit checks, background reports, and income verification. However, landlords should still confirm past tenancy records directly for accuracy.

Q2: What is landlord verification?

Landlord verification refers to the process in which a landlord confirms a potential tenant’s rental history. This is done by reaching out to previous landlords or using tenant screening reports to check details like payment history, lease compliance, and the tenant’s overall behavior during their previous tenancy.

Q3: What questions do landlords ask previous landlords during rental history verification?

When verifying a tenant’s rental history, landlords typically ask a series of questions to get a clear picture of the tenant’s behavior.

- Did the tenant pay rent on time?

- Were there any issues with property maintenance or cleanliness?

- Was the tenant respectful to neighbors and the property?

- Did the tenant follow the lease terms and conditions?

- Were there any complaints or violations during their tenancy?

Q4: What information can a previous landlord disclose?

A previous landlord can legally disclose certain details about a tenant’s rental history, including:

- Dates of tenancy: The start and end dates of the tenant’s lease.

- Payment history: Whether rent was paid on time, including any late payments.

- Property condition: Whether the tenant left the property in good condition or caused damage.

- Lease violations: Any breaches of the lease terms, such as noise complaints or unauthorized pets.

- Evictions: If the tenant was ever evicted during their stay.

However, landlords cannot disclose personal opinions, discriminatory comments, or anything not related to the tenant’s rental history.