There are numerous credit-monitoring tools available to consumers today helping them manage their credit score, credit history, and monitor fraudulent activity on their credit file. These services are valuable to the consumer but can they help you as a landlord to make a decision on your prospective tenant and should you accept these reports?

Some prospective tenants may utilize such services and when you mention running a credit check on them, they may slide their most recent credit report from their credit monitoring service in front of you. Should you accept it? Should you trust it?

Permissible Purpose

Credit-monitoring services, such as CreditKarma, LifeLock, or IdentityGuard are consumer reporting agencies that serve a specific permissible purpose, which is credit monitoring. All consumer reporting agencies are required to follow the Fair Credit Reporting Act (FCRA), specifically section 604(a) that describes the primary purposes for which consumer reports may be provided by the consumer reporting agency. For example, credit reports processed through credit-monitoring services must be used for credit-monitoring only.

Requiring credit-monitoring report from your tenant would be in violation of FCRA.

That being said, you as a landlord shouldn’t make your decision based on a credit-monitoring report delivered to you by your tenant. Requiring such a report from your tenant would be in violation of FCRA. However, if your prospective tenant offers you her credit-monitoring report it may provide you with a starting point where you can then decide which applicants to screen using a tenant screening service.

Credit Scores Can Vary by Permissible Purpose

Permissible purpose could be insurance underwriting, debt-collections, employment screening, credit granting, government benefit or licensing eligibility, or tenant screening. An individual’s credit score can even vary depending on which permissible purpose the credit report was processed for.

For example, if you apply for a mortgage loan today and the officer runs your credit, your credit score might be different from the score on your credit-monitoring report processed at the same time.

Generic Credit Score

The credit-monitoring service offers more of a generic credit score, which serves as an educational tool for the consumer and to help the consumer uncover potentially fraudulent activity in their credit file. Credit scores created for tenant screening purposes will serve the landlord as a real data point created specifically for making a tenancy decision.

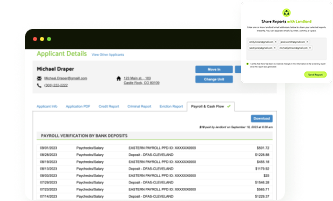

Tenant Credit Check Done by You

While this doesn’t happen frequently, credit reports can be doctored by your potential tenant. Image editing tools are prevalent and simple to use, and it is possible to go to work in one of these photo editing tools to repair the credit report more to an applicant’s liking. This is another reason not to accept a credit report directly from your potential tenant. Have the tenant authorize a fresh report designed specifically for tenant screening, and that effort will reward you with peace of mind.