Tenant Credit Checks

for Landlords

Worried about risky tenants and missed payments? With LeaseRunner’s online tenant credit check, landlords can instantly access detailed credit reports for rental applicants, Experian credit check data, VantageScore 3.0, verified payment history, and our proprietary Tenant Risk Scores. Quickly spot high-risk applicants and select only tenants who are financially prepared to cover rent beyond their monthly bills.

What’s Included?

Comprehensive Credit Insights

at Your Fingertips

What’s included in our tenant credit report? LeaseRunner provides a comprehensive tenant credit report with detailed insights to help landlords make confident leasing decisions. Each section delivers clear financial insights, risk assessment, and verified data so you can understand your applicant’s ability to meet rent obligations and reduce potential rental risks.

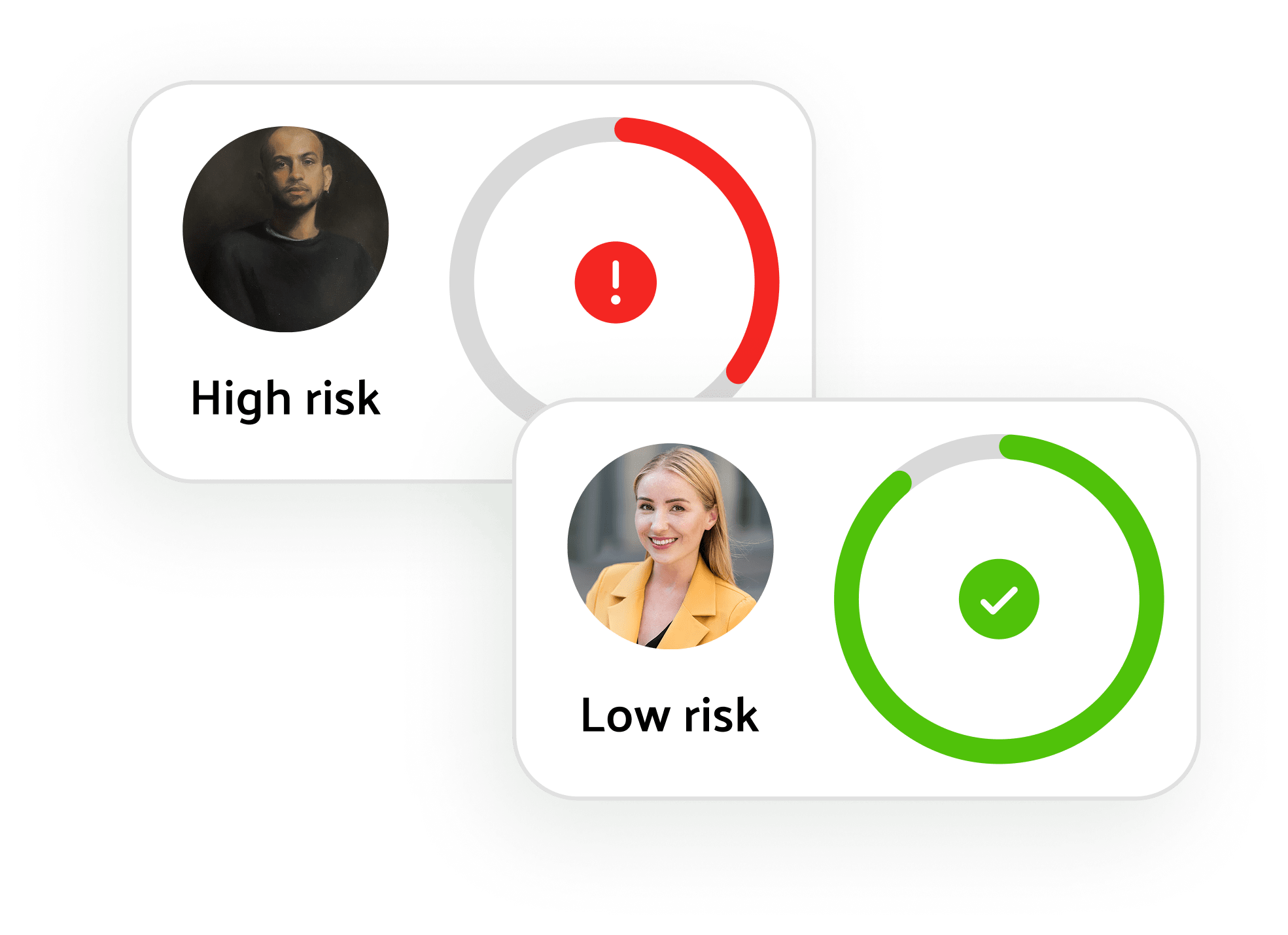

Tenant Risk Score

Quickly evaluate your tenant’s reliability with LeaseRunner’s proprietary risk assessment score, which summarizes historical credit behavior and financial data into an actionable rating.

Risk rating (Low, Medium, High)

Weighted factors: payment records, outstanding debts, legal history

Comparison to similar applicants

Predictive insights for rental reliability

Visual gauge for easy interpretation

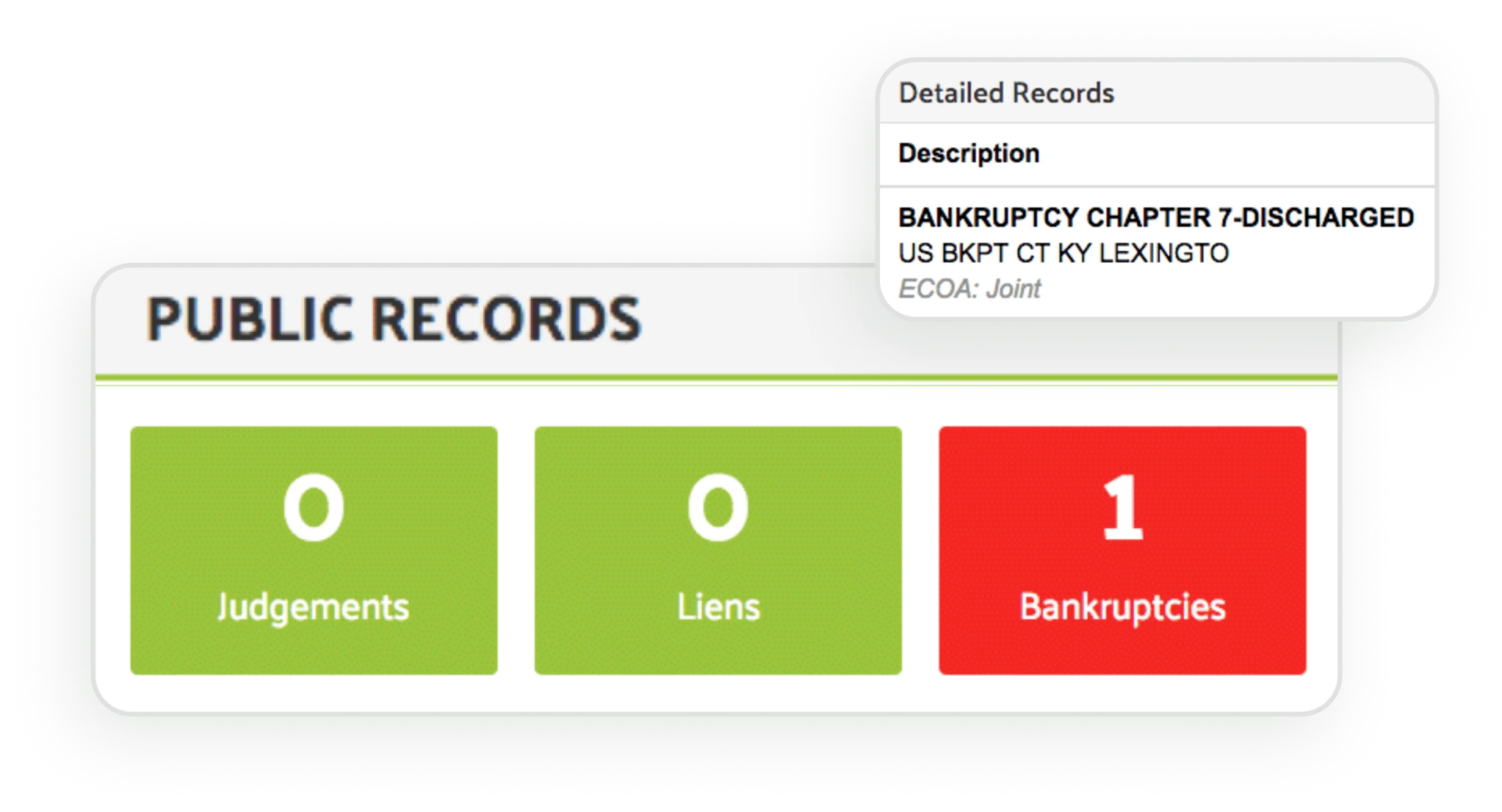

Public Legal Records

Discover the complete legal records of a tenant’s past financial issues that could impact their ability to pay rent reliably, including bankruptcies, judgments, and liens.

Reporting the court's name and number

Book and page number of the record

Filing date, status change date

Amount and type of public record

Plaintiff's name

Compliance condition code

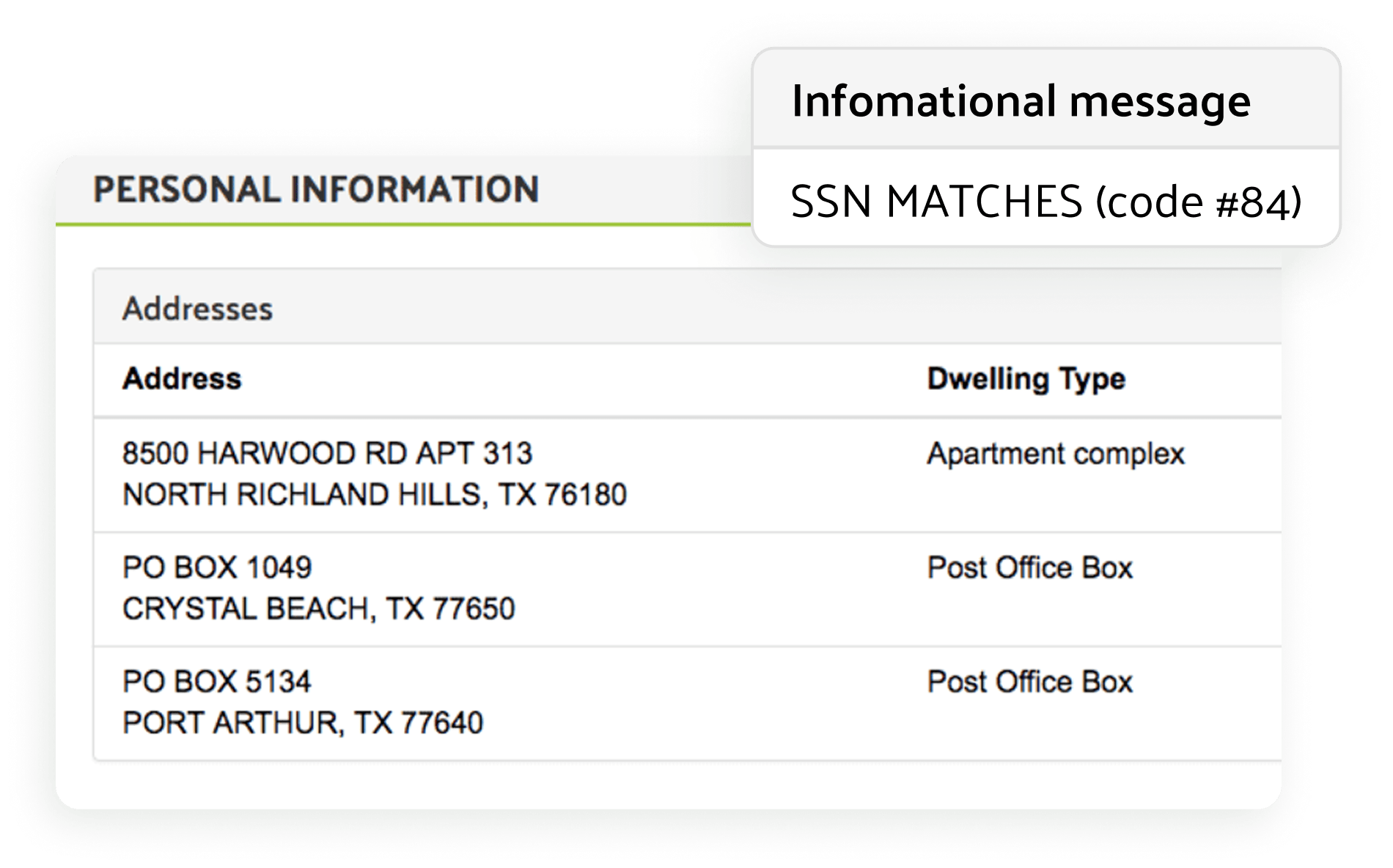

Identification & Background Information

Verify your tenant’s identity and history at a glance. Includes the applicant’s full name and any alternate names, addresses, and employment information.

Applicant's information with SSN verification

Previous addresses

Employer's name, address, time frame

Previous employer's name, address, time frame

Alternate names

Financial Credit Summary

Get a clear credit summary of your tenant’s financial situation, including credit scores, payment status, outstanding balances, adverse credit events, and overall financial reliability.

VantageScore 3.0 credit score from Experian

Bankruptcy, foreclosure, repossession

Payment amount and status

Open, balance, and last payment dates

Original amount and current balance

Credit Account Information

Review detailed credit account history and tradelines to understand how tenants manage individual accounts, helping you make informed decisions.

Creditor's name

Type and terms of the credit accounts

Account condition

Payment history (current or past due)

Account limit and highest balance

Open, balance, and last payment dates

Collections, charge-offs

Credit Report Sample

Want to edit and create a customized form? Download now to get started!

LeaseRunner’s Tenant Risk Score

A Smarter Way to Evaluate

Tenant Rental Risk

Tenant Risk Score is your quick, reliable snapshot of an applicant’s financial trustworthiness. Instead of sorting through complex credit reports and raw data, LeaseRunner translates key indicators of rental reliability — such as rent payment patterns, credit utilization, and overall financial stability — into one simple score, showing how likely tenants are to pay rent on time, every time.

One simple score, solidify insights

Landlords get a simple, easy-to-read score that quickly shows how financially dependable an applicant is.

High Risk

History of late payments or high debt levels. Proceed with caution and verify additional financial details before moving forward.

Medium Risk

Mostly reliable, with some past credit fluctuations. Review details carefully to ensure consistent payment behavior.

Low Risk

Strong credit history and consistent on-time payments. Tenant shows excellent financial reliability.

Analyzes multiple financial factors

The Tenant Risk Score reviews key financial factors to judge how well an applicant manages credit and how likely they are to pay rent responsibly, including

Credit usage

Credit history

Payment habits

Legal records

Saves time, reduces tenant turnover

Make confident leasing decisions faster. Tenant Risk Score provides a clear picture of each applicant's reliability in their rental history. As a landlord, this helps you

Identify reliable, long-term renters

Spot risks early (evictions, unpaid rent,…)

Compare applicants with data-driven insights

Prevent turnover and reduce leasing mistakes

How It Works

Run a Tenant Credit

Check Online in Minutes

Experience a fast, paperless process built for landlords. Our FCRA-compliant system delivers credit reports with

secure digital delivery — no paperwork, no waiting, all within the same day.

Send the screening request to the tenant

Invite your tenant to complete the online screening for landlords by sending a secure email request or sharing your custom LeaseRunner application link.

Applicant authorizes the credit check

The tenant securely provides personal information and gives consent for LeaseRunner to access their credit data from Experian. The system uses a soft inquiry, so it won’t affect the applicant’s credit score. This step ensures the entire process is safe, transparent, and compliant with FCRA regulations.

Instant report generation

Once the applicant authorizes and payment is complete, your detailed credit report is generated instantly, on the same day. Landlords receive secure digital delivery of the credit report right on their dashboard. Review tradelines, payment history, credit limits, and the Tenant Risk Score — all in one place.

Send the screening request to the tenant

Invite your tenant to complete the online screening for landlords by sending a secure email request or sharing your custom LeaseRunner application link.

Applicant authorizes the credit check

The tenant securely provides personal information and gives consent for LeaseRunner to access their credit data from Experian. The system uses a soft inquiry, so it won’t affect the applicant’s credit score. This step ensures the entire process is safe, transparent, and compliant with FCRA regulations.

Instant report generation

Once the applicant authorizes and payment is complete, your detailed credit report is generated instantly, on the same day. Landlords receive secure digital delivery of the credit report right on their dashboard. Review tradelines, payment history, credit limits, and the Tenant Risk Score — all in one place.

Complete Financial Profile

See Even More with Income Verification & Cash Flow Reports

A strong credit report offers valuable insight into a tenant’s reliability — but LeaseRunner helps you go further. Combine LeaseRunner’s tenant credit check, income verification, and cash flow report to assess both financial trustworthiness and real-time affordability before approving your next tenant.

Credit check reports

Understand how applicants have managed credit in the past.

Credit reports

VantageScore 3.0

Payment records

Income verification

Confirm whether your applicant can truly afford the rent at the current time.

Source of income

90-day average

Recurring expenses

Cash flow reports

Go beyond static numbers with a snapshot of monthly cash inflow and outflow.

Spending patterns

Rent amount graph

Net balance trends

Benefits

Protect Your Rental Income with

Smarter Tenant Screening

Our tenant credit report insights go beyond just the credit score, giving you complete transparency on an applicant’s financial stability before you hand over the keys.

Reliable Tenant Evaluation

Access detailed tenant credit insights, including payment history, open accounts, and tradelines, so you can assess tenant financial stability with confidence.

Accurate Credit Check Results, Instantly

Get verified data sourced directly from Experian, including income-to-rent ratio and current balances, to make faster, smarter, and more secure leasing decisions.

Prevent Costly Evictions

Protect your rental income and reduce default risks with deeper credit insights and full visibility into a tenant’s financial background—helping you lease confidently every time.

Simple, Secure & Tenant-Friendly

Tenants authorize their credit release through a soft inquiry (does not affect credit score), ensuring accurate credit check results while maintaining a smooth, secure experience for both sides.

Our Offerings

Pricing Options

Pay-as-you-go, free to choose who covers the fee, and enjoy no hidden costs—complete

transparency for every applicant.

Residential Tenant

Screening Packages

LeaseRunner provides multiple tenant screening options, helping landlords and property owners

quickly identify and choose reliable renters.

Basic Screening

$17/per applicant

*Paid by applicant or landlord.

Pro Screening

$40/per applicant

*Paid by applicant or landlord.

Ultimate Screening

$54/per applicant

*Paid by applicant or landlord.

Most popular

Premium Screening

$64/per applicant

*Paid by applicant or landlord.

Criminal Background Records

Custom URL and Applications

State-Compliant Data

Address History

Identity Verification

Full Credit Report

VantageScore 3.0

Eviction Records

Nationwide Eviction Database

Judgment Amount Details

Income Verification & Cash Flow Report

Payroll Deposits

Income & Expense Summary

Bank Account Balance

Awards & Recognitions

Recognitions That Speak Volumes

From industry innovation awards to nationwide adoption, LeaseRunner is trusted by thousands of landlords,

property professionals, and organizations across the country.

10,000+

Trusted by landlords across over 10,000 ZIP codes nationwide.

50+

Providing seamless leasing solutions in all 50 states.

500,000+

Serving over 500,000 clients and growing every day.

Testimonials

Over 12 Years of Trust and Success

Insights

More Insights Credit Check

FAQs

Frequently Asked Questions

A credit report is a detailed summary of a tenant’s financial history compiled by credit bureaus like Experian. It includes:

- Payment history on loans and credit cards

- Outstanding debts and credit utilization

- Public records, such as bankruptcies or judgments

- Credit inquiries from lenders or landlords

At LeaseRunner, the cost to run a credit report on a tenant is $21 per applicant. This includes a complete credit report, with a VantageScore 3.0 credit score and more. Tenants pay the fee directly during the application process, so landlords don’t have to handle payments or billing.

With LeaseRunner, a credit check on a tenant is completed instantly once the tenant submits their application and consents to screening. No delays, no paperwork—just fast, secure access to tenant screening data.

A good credit score for tenants generally starts at 670 or higher, based on the VantageScore 3.0 model. Here's how to interpret tenant credit scores:

- 750 and above – Excellent: Low risk, highly reliable tenant

- 700–749 – Good: Financially stable and likely to pay on time

- 670–699 – Fair: Acceptable, but may warrant additional screening

- Below 670 – Riskier: Review full credit report and rental history carefully

When landlords run a credit check for apartment rentals, they’re looking for signs of financial responsibility to ensure you can reliably pay rent. Here’s what they typically focus on:

- Payment History: A track record of paying bills on time, including credit cards, loans, or previous rent, shows the applicant is dependable.

- VantageScore: A good score from 650 gives landlords a snapshot of your creditworthiness. The higher the Vantagescore, the easier it is to qualify for an apartment.

- Debt-to-Income Ratio: Landlords check how much of the applicant’s income goes toward debt payments to confirm he or she can afford rent alongside other obligations.

- Public Records: Issues like bankruptcies and legal judgments may raise concerns for landlords.

- Length of Credit History: A longer credit history helps landlords see how well you’ve managed your finances over time.

With LeaseRunner, the cost of credit checks, priced at $23 per applicant, can be paid by either the landlord or the tenant. Landlords have the flexibility to choose who covers the fee based on their preferences or local regulations. This ensures a smooth tenant screening process while providing clarity on payment responsibilities.

LeaseRunner uses Experian as the credit bureau for tenant screening, providing detailed credit reports. These reports include the VantageScore 3.0 credit score, along with information on addresses, employment (if available), and any liens, bankruptcies, or judgments.