Knowing the best way to collect rent is essential for landlords aiming to streamline their rental income in 2025. Combining ease, security, and automation helps landlords save time and avoid common hassles. While many still rely on traditional methods like checks or cash, digital tools are becoming the preferred choice.

For example, setting up direct deposit for tenants ensures payments go straight into bank accounts quickly and securely. Platforms like LeaseRunner automate rent reminders and provide clear rental collection payment proof, simplifying the process.

Knowing how to collect rent electronically helps reduce late payments and improves cash flow. This article covers top rent payment methods and practical advice for safe, efficient rent collection.

Quick Facts: Rent Collection Criteria for Landlords

How Do Landlords Collect Rent Payments Traditionally?

Many landlords still use traditional ways to collect rent. These methods work, but often take more time and effort. Knowing these methods helps landlords decide how to collect rent payments best.

In-Person Rent Collection

One old way is in-person rent collection. Tenants give cash or checks directly to the landlord. For example, a landlord might meet tenants once a month to collect rent. This lets landlords see the payment right away. But handling cash can be risky. It might get lost or stolen.

Also, if landlords do not give receipts, tenants have no proof of payment. Landlords must keep good records and give receipts to avoid problems.

Mailing Rent Payments

Another way is mailing rent payments. Tenants send checks or money orders by mail. For instance, a tenant emails a check on the first day of the month. The landlord deposits it when it arrives. This method gives a paper trail but can be slow.

Mail can get lost or delayed. This can cause late payments and confusion. Landlords may not know when rent was sent or received, making it hard to track payments.

Drop Box or Rent Payment Box

Some landlords use a drop box for rent payments. Tenants leave checks or money orders in a locked box. This cuts down on face-to-face meetings. But, landlords still have to collect and process payments by hand. There is no instant confirmation or automation. Landlords must track payments carefully to avoid mistakes.

These traditional methods work but are slow and need more effort. Learning how to collect rent payments electronically or how to collect rent online can help landlords get payments faster. These digital ways also give clear rental collection payment proof and reduce late payments.

How to Collect Rent from Tenants Electronically (or Online, for Short)

Many landlords now collect rent online. Tenants pay using bank transfers, apps, or credit cards. For example, landlords use platforms that send reminders before rent is due. Tenants pay with a few clicks. This method gives landlords instant rental collection payment proof. It helps avoid confusion and late payments.

Landlords can also set up direct deposit for tenants. Tenants send rent straight to the landlord's bank account. This way, payments can arrive on time. Landlords can track payments easily and reduce missed rent.

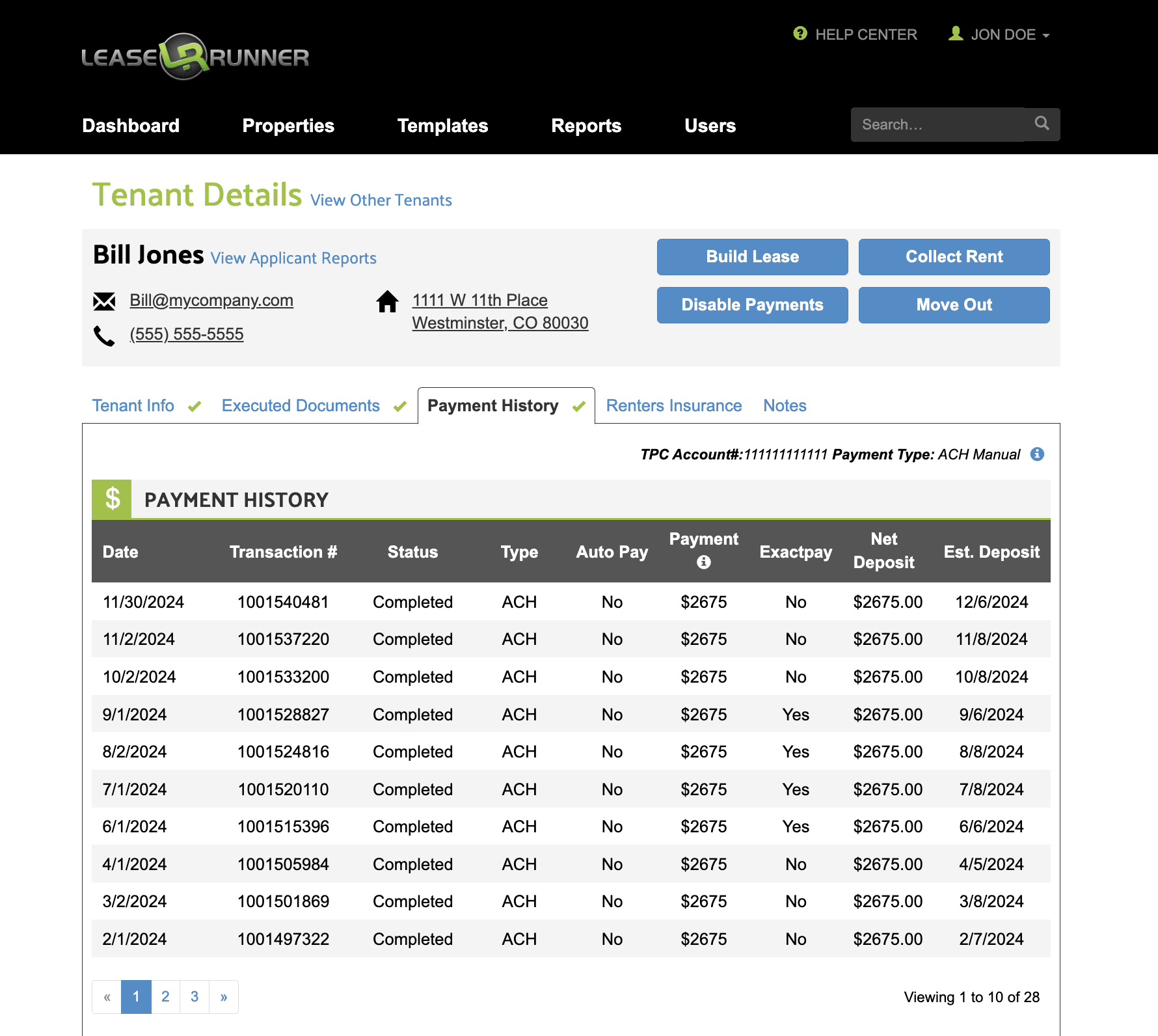

Some platforms automate rent collection. They send reminders, accept payments, and give receipts. For example, LeaseRunner shows all payments in one place. Landlords can download payment records anytime. This saves time and keeps things clear.

Online rent collection offers many rent payment methods. Tenants choose what works best for them. This reduces the need for cash or checks. Both landlords and tenants stay safe.

Knowing how to collect rent from tenants electronically saves landlords time. It lowers late payments and gives clear rental collection payment proof every month.

What Is The Best Way to Collect Rent for Busy Landlords? 10 Top Rent Payment Methods

Busy landlords need efficient, reliable ways to collect rent. Below is a detailed list of ten popular rent payment methods, highlighting their features, benefits, drawbacks, and who they best serve.

LeaseRunner Rent Collection

LeaseRunner offers a fully automated rent collection system tailored for landlords. Tenants can pay rent online using bank transfers (ACH). The platform allows you to set up Autopay and generates digital receipts instantly.

We provide seamless integration with lease agreements and tenant screening, making rent collection smooth and transparent. This method reduces administrative work and provides clear rental collection payment proof. LeaseRunner makes payment tracking and reconciliation easy with the Tenant Rent Payment report every month, which suits busy landlords managing multiple units who want automation and ease.

Zelle

Zelle is a bank-backed peer-to-peer payment system that allows instant, fee-free transfers between bank accounts. It is widely used and trusted for quick payments.

However, Zelle lacks rent-specific features like automated payments or payment tracking. It works well for small landlords with tech-savvy tenants who prefer simple, direct bank transfers.

Venmo

Venmo is popular among younger tenants due to its social payment features and ease of use. Payments are fast and convenient, but Venmo does not offer formal rent tracking or automated reminders.

Privacy concerns arise since transactions can be visible on social feeds unless settings are adjusted. Venmo fits informal rental agreements or roommate situations better than formal landlord-tenant setups.

Bank Direct Deposit

Setting up direct deposit for tenants allows rent to be transferred straight into landlords' bank accounts. This method is secure and bank-verified, giving landlords peace of mind.

However, it requires manual tracking of payments and does not include automation or reminders. It works best for landlords with a small number of tenants who prefer traditional banking methods.

PayPal

PayPal supports online rent payments and offers buyer/seller protection. It is widely trusted and easy to use. However, transaction fees apply, and PayPal lacks rent-specific features like automated reminders or integrated lease management. Landlords needing flexible payment options with some protection may find PayPal useful.

Google Pay / Apple Pay

Mobile wallets like Google Pay and Apple Pay offer quick, convenient payments through smartphones. They are easy for tenants to use but do not have rent tracking or rent collection features. These methods suit tech-savvy tenants and landlords who want fast payments without formal tracking.

Cash App

Cash App allows instant payments with minimal setup. However, it lacks rent-specific tools and may raise security concerns. It is better suited for informal or short-term rental arrangements.

Checks with Digital Tracking

Some landlords accept checks but scan or upload payment proof to digital systems. This method provides a paper trail and rental collection payment proof, but it is slow and requires manual processing. It suits landlords who prefer traditional methods but want some digital record-keeping.

Property Management Software Portals

Many property management platforms include rent collection modules with automation, reminders, and digital receipts. These all-in-one solutions simplify managing multiple properties but often require subscription fees. They are ideal for landlords with several units who want comprehensive management tools.

Cryptocurrency (Emerging)

Accepting cryptocurrency payments is an innovative option gaining traction. It offers fast, borderless transactions but comes with volatility and complexity. Tech-forward landlords interested in cutting-edge payment methods may consider this option.

Comparison Table: Top Rent Payment Methods for Busy Landlords

How to Choose the Right Rent Collection Method for Your Property and Tenants

Picking the best way to collect rent depends on your property size, tenant needs, and how much time you have to manage rent. Taking time to think about these helps you find a method that works well and saves effort. Here is a clear guide to help you decide.

Step 1: Check Your Property Size and Management Needs

If you have many rental units, automation is key. Using a tool like LeaseRunner rent collection helps a lot. LeaseRunner lets tenants pay online by bank transfer, and gives instant rental collection payment proof.

This cuts down on chasing late payments. For example, a landlord with ten units can see all payments in one place and keep track easily.

Step 2: Know Your Tenants' Payment Preferences

Many tenants like digital payments. Offering options through LeaseRunner lets tenants pay from wherever they are while staying on time. Clear info about due dates and payment choices makes it easier for tenants to follow the rules.

Step 3: Think About Traditional Payment Methods

Some tenants prefer checks or bank transfers without apps. Setting up direct deposit for tenants lets them send rent straight to your bank. This way, payments come on time. You must track payments yourself and remind tenants if needed. Keeping copies of checks or bank records gives you rent payment proof.

Step 4: Balance Safety and Ease

Safety matters when collecting rent. LeaseRunner uses secure payment systems to protect tenant information and cut fraud risk. Automated tools give clear payment proof. Easy portals help tenants pay on time and make your job simpler.

By thinking about your property size, tenant needs, and safety, you can choose the best way to collect rent payments. Using LeaseRunner adds ease, speed, and peace of mind. And in case there are any unpaid rent, this helpful unpaid rent collection guide will help make rent collection smooth and safe for everyone.

Common Challenges Landlords Face When Collecting Rent (and How to Solve Them)

Collecting rent can be difficult. Landlords often face issues like late payments, resistance to electronic payments, technical problems, and partial payments. Here is a step-by-step guide to handling these challenges.

Late or Missed Payments

Late payments disrupt cash flow and cause stress. To prevent this, set clear rent deadlines in the lease. For example, specify that rent is due on the first of each month, with a three-day grace period. Use automated systems like LeaseRunner to make payments on the due date.

These reminders help tenants remember to pay on time. If a payment is late, follow up quickly. Automated platforms also provide rent payment proof, showing when payments are made or missed. This proof helps avoid disputes.

Tenants Refusing to Pay Electronically

Some tenants do not want to pay rent online. To accommodate them, offer multiple ways to pay rent. Accept checks or cash if necessary. However, encourage electronic payments by showing tenants how easy and safe it is.

For example, explain how to use LeaseRunner's online portal to pay rent quickly. Offering several payment options keeps tenants comfortable and helps landlords get rent reliably.

Technical Issues with Payment Platforms

Technical problems can slow payments and frustrate tenants. Choose reliable rent collection platforms with strong customer support. For instance, LeaseRunner offers help if tenants have trouble online. Provide tenants with clear, step-by-step instructions on how to use the platform. This reduces confusion and speeds up payments.

Handling Partial Payments

Sometimes tenants pay only part of the rent. Communicate your policy on partial payments clearly before signing the lease. If partial payments are accepted, document every transaction carefully. Use digital tools to keep records and generate rent payment proof. This helps avoid misunderstandings and keeps accounts accurate.

Tips to Protect Yourself from Rent Payment Fraud and Scams

To help landlords ensure rent payments go smoothly, it's important to know a few tips to prevent fraud and scams:

- Double-check the tenant's identity: Always ask for a valid photo ID and run a full background check. This includes their credit, eviction history, and criminal records.

- Stick to trusted rent platforms: Use services like LeaseRunner that are built for landlords. They offer more protection than cash or peer-to-peer apps.

- Say no to cash payments: Cash is hard to track. Avoid using payment apps like Venmo or Zelle, especially if they’re linked to personal accounts.

- Ask for payment confirmation: Whether it’s a receipt or a screenshot, get proof of payment and store it in your records.

- Spot red flags early: Be cautious if the rent comes from a third party, is overpaid, or if a tenant is rushing the process without proper screening.

- Write clear lease terms: Set rules around payment methods, late fees, and what happens if rent isn’t paid. Put it all in writing.

- Act fast if something feels off: If a payment seems shady, reach out to your platform’s support and consider reporting the incident to local authorities or the FTC.

Best Practices for Fast & Safe Online Rent Collection

Collecting rent online can be quick and safe. Landlords should follow simple steps to make it work well.

Step 1: Set Clear Payment Rules in the Lease

Write down when rent is due, what late fees apply, and how tenants can pay. For example, say rent is due on the first, with a five-day grace period. List payment methods like bank transfer or credit card. Clear rules help tenants pay on time and avoid confusion.

Step 2: Know Your State's Rules on Payments

Each state has laws about rent payments and security deposits. Some states require landlords to accept certain payment types or limit fees. Check your local laws to follow the rules. This keeps landlords safe from legal trouble.

Step 3: Use Automated Payments and Receipts

Use tools like LeaseRunner to make rent payments on the due date thanks to Autopay. Tenants get emails that help them track their payments. When tenants pay, the system sends a digital receipt. This gives landlords clear rental collection payment proof and cuts down on missed payments.

Step 4: Use Secure Payment Platforms

Choose platforms that protect tenant data with encryption. For example, LeaseRunner uses secure systems to keep payments safe. Avoid platforms without strong security to protect tenant privacy.

Step 5: Keep Communication Clear

Tell tenants how to pay rent and whom to contact for help. For example, send a welcome email with instructions on using the online system. Clear communication builds trust and helps tenants pay on time.

Conclusion

The best way to collect rent in 2025 is through secure, automated electronic platforms. These platforms simplify payment processing and provide clear rental collection payment proof. For example, LeaseRunner rent collection offers automation, tenant portals, and easy setup, making it ideal for busy landlords.

While traditional methods like in-person payments or mailed checks still exist, they take more time and carry risks. Choosing the right rent payment method depends on your property size, how comfortable your tenants are with technology, and your need for convenience.

Finally, using modern rent collection tools like LeaseRunner helps landlords reduce late payments, avoid scams, and save valuable time.

FAQs

Q1. What is the safest way to pay rent?

The safe way to pay rent is through verified online platforms like LeaseRunner. These platforms use encryption to protect tenant data and track every payment.

For example, LeaseRunner processes rent via secure ACH transfers, which pull funds directly from the tenant's bank account. This method avoids bounced checks and offers clear rental collection payment proof through digital receipts.

Q2. How do I set up direct deposit for tenants?

To set up direct deposit for tenants, provide your bank details or use rent collection platforms that handle the setup. With LeaseRunner, landlords add their bank account to the system, then send payment instructions to tenants.

Tenants create profiles in the Tenant Payment Center and submit payments via ACH transfers. This setup ensures rent goes directly into your account, reducing delays.

Q3. Can I accept multiple rent payment methods?

Yes, offering tenants different rent payment methods increases convenience and lowers missed payments. For example, LeaseRunner supports ACH payments with options for manual or automatic payments. While it does not currently support credit cards, landlords can still accept checks or money orders as alternatives for tenants who prefer them.

Q4. How do I get proof of rent payment?

Most online platforms, including LeaseRunner, automatically generate rent payment proof. After tenants pay, the system sends both digital receipts to the landlord and the tenant. These receipts serve as official proof and help track payment history easily.

Q5 What happens if a tenant refuses to pay electronically?

If tenants refuse electronic payments, provide alternatives like checks or money orders. However, encourage electronic payments by explaining their benefits: faster processing, fewer errors, and instant confirmation. For example, show tenants how to use LeaseRunner's online portal to pay rent securely and on time.