Tenant screening can feel like a guessing game sometimes. Someone seems polite and says all the right things, but how do you really know they’ll be a responsible renter? One of the most effective ways to find out is by checking their eviction history. Knowing how to check eviction history helps you spot serious red flags early—before they turn into costly mistakes. This article will break it down in a simple, straightforward way, so you know exactly what to do and what to look for!

What Is an Eviction History?

An eviction history is a record of any legal actions taken to remove a tenant from a rental property. It typically shows whether someone has been formally evicted through the court system, not just asked to leave, but taken through the full legal process by a landlord.

These records can appear on a tenant's credit report or be found in court databases and tenant screening reports. While not every issue with a past rental shows up here, a formal eviction on file is a strong indicator that there were serious problems (like non-payment of rent, lease violations, or property damage).

What an Eviction History Include?

Eviction reports can include a surprising amount of detail. You might see:

- The date the eviction was filed

- The reason for the eviction (like unpaid rent or lease violations)

- The outcome of the case (whether the tenant was evicted or the case was dismissed

- Judgments, if any money was awarded to the landlord

- And in some cases, how much rent was owed

Why Eviction History Matters?

Eviction history is more than just a line on a tenant screening report - it carries lasting effects on housing stability, financial well-being, and employment opportunities for renters.

Why Eviction History Matters for Tenants?

For tenants, a negative eviction history can lead to a series of serious, long-lasting problems that impact many aspects of their lives:

- Difficulty Securing Future Housing: An eviction record is one of the strongest red flags for landlords and property managers. It can limit housing options and force renters to accept less favorable terms, such as higher deposits, shorter leases, or requiring a guarantor.

- Risk of Homelessness and Instability: Being evicted often leads to sudden relocation and significantly increases the risk of homelessness, especially for low-income families. Studies link eviction to frequent moves and a higher chance of experiencing housing instability.

- Financial Strain: Eviction cases come with court fees, late charges, and moving expenses. Research shows that tenants may face around $180 in court-related costs alone, not including the actual costs of relocating, which can be much higher.

- Impact on Credit and Employment: Evictions can reduce credit scores — one study found an average drop of about 16.5 points within two years of an eviction judgment. This damage can also affect job opportunities, as many employers review credit history during the hiring process.

- Mental and Physical Health Effects: Research connects eviction with increased rates of depression, anxiety, and even higher hospitalization rates. The stress of losing housing impacts both mental and physical health, sometimes long after the eviction itself.

- Long-Lasting Consequences: The damage from eviction is not just short-term. It can lower future income, restrict access to stable housing, and limit credit opportunities for years — particularly for vulnerable households.

Why Eviction History Matters for Landlords?

Eviction history is one of the most important tools landlords use to mitigate risk when renting out their property. Many property owners often ask, how do landlord check for evictions and use the answer to shape their tenant screening process.

- Assessing Tenant Risk: Checking for past evictions helps a landlord determine if an applicant has a history of serious lease violations. A clean history indicates a responsible tenant, while a negative one is a major red flag for potential issues.

- Minimizing Costs and Hassles: The eviction process is both expensive and time-consuming. It involves legal fees, lost rental income while the unit is vacant, and the cost of repairing any damages. By screening thoroughly from the start, a landlord can avoid these burdens.

Ensuring a Safe, Stable Living Environment: A tenant with a history of eviction may also have a history of violating lease terms, causing disturbances, or failing to follow community rules. Selecting good tenants helps maintain a quiet, safe, and stable environment for all other residents.

How Tenants Can Check Their Own Eviction History?

Knowing your eviction history is an important step for renters who want to prepare for future housing applications. Checking your record helps you identify errors, understand how landlords might view your rental background, and plan to address any issues.

Here are practical ways tenants can check their own eviction history:

Check Court Records Online

Many courts provide online databases where you can search for cases by name. You'll need to know the specific county and state where the eviction may have occurred. Some records may be sealed or expunged after a certain period, so be aware of your state's laws.

Use Tenant Screening Services

Tenant screening services collect public records, eviction filings, and rental history to provide a comprehensive report. You can request a copy of your own report to see what landlords will see. Popular services include TransUnion SmartMove and LeaseRunner.

Check Credit Reports

Evictions sometimes appear on your credit report if the landlord reported unpaid rent or court judgments. You are entitled to a free credit report once a year from each of the three major bureaus (Equifax, Experian, and TransUnion). Reviewing your credit report helps identify any financial entries related to eviction.

Contact the Court Clerk

If online access is limited, you can contact the clerk of the court where you rented. They can provide official records and clarify whether any eviction filings exist in your name. Some courts may allow in-person requests or written requests by mail.

Review State-Specific Eviction Databases

In some states, specialized databases or legal aid organizations track eviction filings. These can be valuable resources for finding your record, but they may not be available in all jurisdictions. For instance, The Eviction Lab has built the Eviction Tracking System (ETS) to fill this critical gap and to help monitor and respond to eviction hotspots as they emerge.

How Landlords Can Check for Tenants’ Evictions?

For landlords, knowing a prospective tenant’s eviction history is a key part of risk management. A thorough check helps reduce the chance of future rental loss, property damage, or legal disputes. Here’s how landlords can effectively review eviction history:

Step 1: Identify Tenant locations

Before you can search, you need to know where to look. Ask the applicant to provide all of their past addresses and the dates they lived there. This information is crucial for pinpointing the correct court jurisdictions where a potential eviction filing would have been recorded. You can't search for an eviction in one state if it happened in another.

Step 2: Search Public Records

Eviction records are legal filings, and in most U.S. states, they are a matter of public record. Landlords can perform their own "do-it-yourself" search.

- Online Court Databases: Many county and state court systems have online databases for public records. You can search for the tenant's name and look for civil cases, using keywords like “eviction," “unlawful detainer" or “forcible entry."

- In-Person Court Visits: If online records are not available or are incomplete, a landlord can visit the civil court clerk's office in the relevant county to request a record search.

Step 3: Use Tenant Screening Services

This is the most common and efficient method for landlords. Professional tenant screening services aggregate data from various sources, including court records, to provide a comprehensive report. Reputable services include TransUnion SmartMove, RentGrow, and Experian RentBureau.

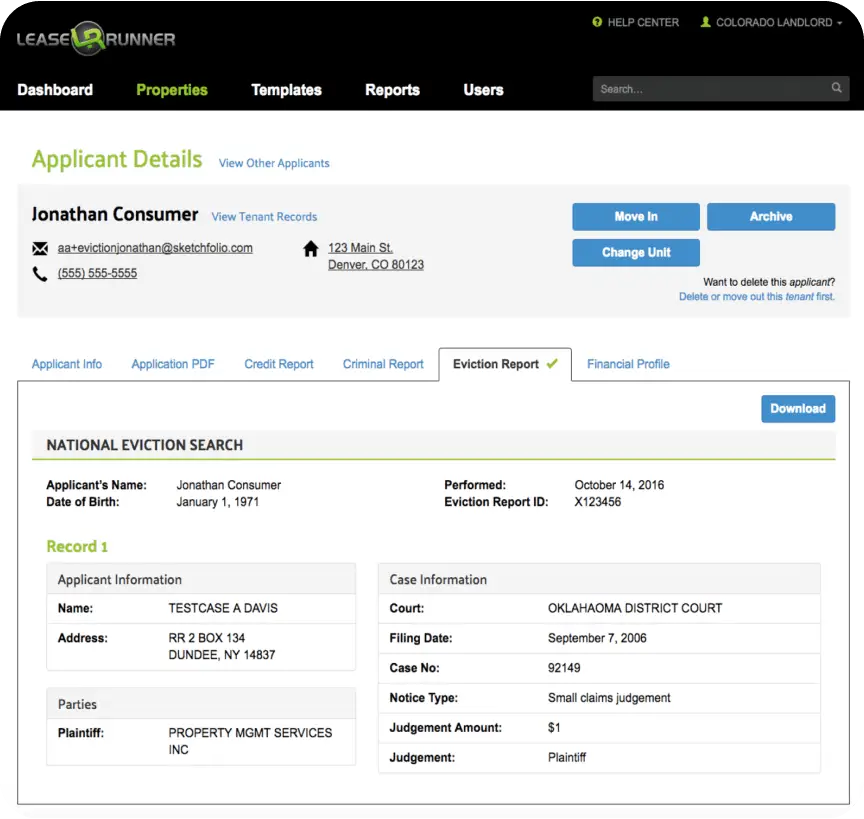

For landlords looking for a fast, reliable, and user-friendly solution, LeaseRunner offers comprehensive tenant screening with eviction history checks, credit reports, and income verification — all in one platform. LeaseRunner simplifies the process, helping you make informed leasing decisions while staying compliant with legal requirements.

Step 4: Verify With Past Landlords

A direct conversation with a previous landlord can provide valuable context that a report might not.

Ask Direct Questions: While a screening report might show a case was filed, a previous landlord can tell you the full story. Ask questions like:

- “Did the tenant pay rent on time?"

- “Were they ever formally evicted, or did they move out after a filing?"

- “Would you rent to this person again?"

Verify the Reference: Be sure to verify that the person you're speaking with is a legitimate landlord and not a friend or family member of the applicant. You can cross-reference the name and address with public property records.

Step 5: Analyze Rental History Details

When you review the eviction history and all other screening information, look for a complete picture. Review patterns such as multiple late payments, repeated disputes, or frequent moves. A complete rental history helps assess potential risks and tenant stability more accurately.

Step 6: Review Legal Compliance

Make sure your eviction checks comply with federal and state laws, including the Fair Credit Reporting Act (FCRA) and fair housing regulations. Improper use of eviction information can lead to legal liability. Always obtain tenant consent before running background checks.

How Long Does an Eviction Stay on a Tenant’s Record?

In most cases, eviction information can remain visible for up to 7 years. If a court issues an eviction judgment against a tenant, that judgment may appear on credit reports for as long as seven years and is also captured by many tenant-screening databases during that period. By contrast, an eviction filing—the landlord’s initial case submitted to court—usually does not affect credit scores, but it can still show up in public court records and third-party screening reports for several years and may influence a landlord’s decision.

Understanding this filing versus judgement distinction explains why two renters with “evictions” on record can face very different outcomes: a dismissed filing may still surface in a background check, while a judgment is the stronger red flag. Duration isn’t uniform everywhere, either.

Some states are starting to pass laws that limit how eviction records can be used, especially in cases where the eviction was dismissed or filed during emergency periods (like during the COVID-19 pandemic). In a few places, eviction records can even be sealed after a certain period. For example:

- California (AB 2819): This law requires that eviction records be sealed if the case is dismissed, or if the case is resolved without a judgment against the tenant. This prevents the record from being public.

- Other States: A few other places allow tenants to request that eviction records be expunged (removed from public records) after a certain period, especially in cases that occurred during emergency periods like the COVID-19 pandemic. For example, in New York, tenants can request that dismissed eviction cases be removed from public records relatively quickly.

So what does this mean for tenants? In fact, it can affect future housing opportunities, rental applications, and even financial credibility. By understanding the difference between filings and judgments, checking both public records and tenant screening reports, and being aware of state-specific protections, tenants can take proactive steps to address inaccuracies, seal eligible records, and plan for future rentals.

How to Rent an Apartment After an Eviction?

Being evicted can feel like a major setback, but it doesn’t have to end your renting journey. With the right approach, you can still rent a new apartment and rebuild trust with landlords.

One of the best things you can do is be honest. Some landlords are open to giving tenants a second chance if they understand what happened. Write a brief, honest letter explaining the circumstances behind the eviction (e.g., job loss, a medical emergency, a dispute with the previous landlord). Avoid making excuses; instead, own the situation and show what you’ve learned.

Strong financial proof can also make a big difference. Bring pay stubs, bank statements, or other documents that show steady income. Landlords want to know that you can pay rent on time.

It also helps to provide references. A letter from a past landlord or your employer can highlight your reliability and good character, even if you’ve had challenges in the past.

If possible, offer to pay a higher security deposit. This shows good faith and reduces the landlord’s risk. Some may be more willing to approve your application if they see you’re committed.

Finally, consider flexible leasing options, such as month-to-month rentals. These shorter agreements give you a chance to prove yourself before committing to a long-term lease.

How to Avoid Evictions in the Future?

Once you find a new place, it’s important to protect your housing and avoid facing eviction again:

- Pay rent on time: Staying current with payments is the most effective way to avoid eviction. If financial issues arise, contact your landlord early to discuss a payment plan.

- Understand your lease: Review the contract carefully and follow its rules. Violations such as unauthorized pets or subletting can quickly become grounds for eviction.

- Respect the property: Keep the unit clean, prevent damage, and handle small repairs when needed. Treating the space well reduces disputes with your landlord.

- Communicate openly: Share concerns or problems as soon as they appear. Early, honest communication often prevents minor issues from escalating into eviction risks.

LeaseRunner: All-in-One Tenant Background Screening Service

Alternatively, if you're looking for a simple, no-fuss option, LeaseRunner is a great pick. It’s designed specifically for landlords, and it includes eviction lookup, credit reports, criminal background checks, and more.

You don’t need to collect sensitive information yourself. Just enter the tenant’s email, and they handle the rest (getting consent, verifying identity, and delivering the report straight to your inbox).

Then, how do you look up evictions? LeaseRunner makes the screening process feel less like a chore and more like a smooth step in finding the right tenant. Here’s how it works:

- Create a free LeaseRunner account. It only takes a minute, and there's no cost until you run a report.

- Navigate to your dashboard, select "Screen"

- Choose the "Eviction Check" option (and any others you’d like, such as credit or criminal checks). Enter the applicant’s name and email address.

- LeaseRunner sends an email to the applicant requesting their consent and any necessary personal details. This keeps you from having to ask for sensitive information directly.

- Wait for tenant approval. Once the applicant consents, LeaseRunner conducts a nationwide search across all major jurisdictions, covering over 36 million records. The eviction report, along with any other selected reports, will be available in your dashboard.

Bottom Line

Overall, tenant screening doesn’t have to be complicated. By checking eviction history along with credit reports, you can make better, more informed choices. Knowing how to check eviction history is key, and tools like LeaseRunner make it easy by providing quick access to all the essential tenant reports in one place!

FAQs

Q1: How to find out if I have an eviction?

To find out if you have an eviction on your record, you can check your public court records or tenant screening reports. You can search online court databases in the county where you lived, or request a copy of your eviction record from the courthouse. Additionally, you can use tenant screening services to run a background check that includes eviction history.

Q2: Where to find eviction records?

Eviction records are part of public court records and can usually be accessed through local government websites or directly at the courthouse. Many screening platforms will show you a tenant’s eviction history, including filing dates, reasons for eviction, and case outcomes.

Q3: Can I Remove or Dispute an Eviction Record?

Yes, tenants may have options to remove or dispute eviction records, but the process depends on whether it’s a filing or a judgment, and on state-specific laws. Some states allow eviction records to be sealed or expunged, especially if the case was dismissed. Records usually stay for up to 7 years.

Q4. Do Evictions Show Up on Credit and Background Checks?

Yes, they can show up on both, but they appear in different ways. This is a crucial distinction that can surprise many tenants. Landlords often ask how do landlord check for evictions, and the answer is that filings may appear in public records, while judgments typically show up on credit reports and background checks for up to 7 years.

![Can a Landlord Stop an Eviction? Comprehensive Guide [Update]](https://www.leaserunner.com/storage/442/01KEF27R27YC4D4GV44TKW9S8C.webp)