As a landlord, understanding the myriad of fees associated with renting is crucial. Among these, the admin fee apartments often confuse both you and prospective tenants. Is it legal to charge an admin fee? What are the admin fees supposed to cover? How does it differ from a security deposit or an application fee?

This 2025 guide explains what an admin fee for apartments is, why it’s charged, what laws apply, and how to manage it legally and transparently.

What Is an Admin Fee for Apartments?

An admin fee apartment (short for administrative fee) is a one-time, upfront charge paid when a tenant signs a lease. It helps cover the time, labor, and costs involved in setting up the lease, managing applications, and preparing the unit for occupancy.

In simple terms, it compensates landlords or property managers for the administrative work that happens behind the scenes, such as verifying documents, preparing contracts, or handling move-in coordination.

Unlike a security deposit, an admin fee apartments are usually nonrefundable, even if the tenant decides not to move in after signing.

Are Apartment Admin Fees Legal in the U.S.?

Yes, admin fees are generally legal, but this is heavily regulated by state and local laws. Some states permit landlords to charge reasonable admin fees, while others limit or ban them entirely.

For instance:

- Massachusetts and Vermont prohibit most upfront administrative fees.

- New York, California, and Washington require transparency and often limit the amount or purpose of such fees.

- Texas and Florida allow admin fees but expect clear disclosure.

As a landlord, always review your state’s landlord-tenant laws before including admin fees in your lease. Charging unauthorized or hidden fees can lead to penalties or disputes.

Why Landlords Charge For Admin Fees?

Landlords charge admin fees to recover the time and expense required to process each new lease. Managing a property involves more than collecting rent - it includes administrative tasks that ensure compliance and readiness.

Typical reasons include:

- Covering staff time spent handling applications and leases.

- Offsetting costs for unit preparation and tenant onboarding.

- Maintaining transparent business operations without inflating rent.

What Do the Admin Fee Covers?

The admin fee apartments charge may include several smaller administrative costs. While it varies by property, here are the common items landlords often use it for:

1. Lease Preparation

Preparing the lease involves drafting, reviewing, and executing the agreement. This may include verifying identification, employment, and rental verification—all of which require administrative time.

2. Holding Costs

If a tenant pays the fee to reserve an apartment, a portion can cover the costs associated with taking the unit off the market, also known as “holding costs”. This compensates the landlord for lost marketing time (e.g., lost opportunity to rent while waiting for rental application to take and potential rental income. If the fee is non-refundable, this helps mitigate the risk if the approved applicant backs out.

3. Property Turnover

This includes administrative overhead related to the unit turnover process, which ensures the unit meets all legal habitability standards before the tenant receives their move-in checklist apartment. While cleaning and repair costs are often separate, the admin fee covers the administrative oversight of scheduling vendors, utility transfers, and key preparations.

4. General Overhead

From software systems to leasing staff salaries, the fee may also cover the prorated share of general operational expenses. For example, a utility admin fee meaning the cost of setting up the tenant's account with the property's shared utility billing system (see what utilities are included in rent). This fee is charged for the management of the utility billing, not the utility usage itself.

Difference Between Admin Fee, Application Fee, and Move-in Fee

Landlords often charge multiple fees, which can confuse tenants. While all three are one-time payments made at the start of the rental process, they serve distinctly different purposes and are applied at different stages.

Here is a breakdown of each fee:

Application Fee

- Purpose: Covers the hard, out-of-pocket cost of tenant screening (e.g., credit reports, background checks, and income/rental verification).

- When Paid: Paid first, at the time a prospective tenant submits their rental application.

- Refundable Status: Almost always non-refundable, as the cost for the screening service (e.g., pulling a credit report) has already been incurred by the landlord.

Administrative Fee (Admin Fee)

- Purpose: Covers the internal administrative overhead of the landlord. This includes the cost of taking the unit off the market (holding costs), preparing the final lease agreement, and managing the internal paperwork and coordination for move-in. This is the definition of what is the admin fee for apartments.

- When Paid: After the application is approved, but typically before the lease is signed. This answers the question: when do you pay admin fee for apartment?

- Refundable Status: Generally non-refundable, as it covers the landlord's time and effort already expended in processing the lease and unit holding.

Move-in Fee

- Purpose: A flat, non-refundable charge that covers the anticipated wear-and-tear and unit turnover costs (e.g., professional cleaning, lock changes, minor repairs) after a tenant moves out.

- When Paid: Just prior to or upon the move-in date, usually paid alongside the first month's rent.

- Refundable Status: Non-refundable. This is the main difference between a move-in fee and a refundable security deposit.

Understanding the difference ensures transparency and compliance.

Related: If you’re considering waiving an application fee, see waived application fee apartments.

States That Limit or Ban Apartment Admin Fees

Laws about admin fee apartments vary widely across the U.S. Some states restrict or prohibit these charges, while others only require transparency. Landlords must understand their state’s position to avoid violating local housing laws.

States That Ban Admin or Application Fees (MA, VT)

In Massachusetts and Vermont, landlords cannot charge admin or application fees. Tenants only pay rent and a security deposit.

States That Cap Fees or Require Transparency (NY, CA, CT, WA)

- New York’s Housing Stability and Tenant Protection Act limits application fees to $20. While a separate admin fee is not strictly capped statewide, any non-refundable fee must be justifiable and not excessive.

- California’s Civil Code §1950.6 caps screening fees at $65.37 (based on the Consumer Price Index (CPI)). Landlords in CA must be careful not to disguise a larger fee as an "administration charge."

- Connecticut (CT) and Washington (WA): Both states require fees to be non-excessive and fully disclosed. They often have caps on application fees, which influences the scrutiny applied to any additional admin fees.

States With Flexible or No Limit (IL, TX, FL)

- Texas allows landlords to charge reasonable admin fees if disclosed.

- Florida and Illinois also permit flexibility, though landlords must ensure fees aren’t excessive or deceptive.

How Much Is a Reasonable Admin Fee for Apartments?

Landlords often wonder: what is a reasonable administration charge? The most important thing is that the fee must be reasonable and directly related to the administrative costs.

Average Admin Fee Range in the U.S.

In 2025, the average administrative fee for apartments ranges from $150 to $400, depending on location and property type.

- Large apartment complexes in urban areas may charge up to $500.

- Smaller or privately managed rentals often stay between $100–$250.

Factors That Influence the Fee Amount

Several elements can affect how much admin fee apartments charge. Understanding these factors helps both landlords and tenants evaluate whether the amount is reasonable and aligned with local market standards.

- Location – Cities with higher administrative labor costs tend to charge more.

- Property Type – Luxury or corporate rentals may include higher admin fees due to added services.

- Lease Complexity – Multi-party leases or corporate rentals often require more paperwork.

- Market Competition – In tight rental markets, landlords may reduce or waive fees to attract tenants.

Tip: Always benchmark your fees against local averages to ensure they remain fair and defensible.

Best Practices for Charging Admin Fees Legally

Compliance is your best defense against legal challenges and ensures you can confidently collect the admin fee apartments.

Disclose All Fees Upfront

Transparency builds trust. Make all costs clear from the very first inquiry. Provide an easy-to-read document that details the admin fee vs application fee, security deposit, and other potential charges.

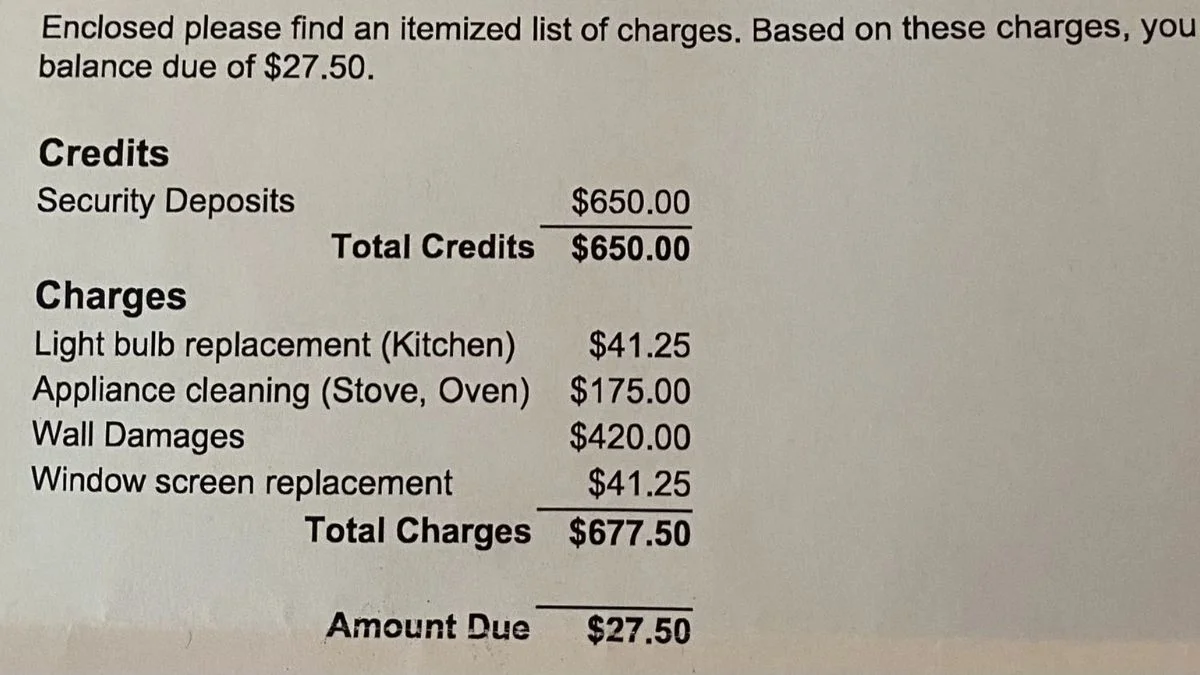

Itemize Fees Clearly in the Lease Agreement

Always include a section in your lease that details what the administration fee covers and when it’s due. This prevents disputes during move-in or move-out.

Keep the Fee Reasonable and Justified

Always be prepared to justify the amount. If a tenant asks for the utility admin fee meaning breakdown, you should be able to explain how it covers staff time and billing system costs. An unreasonable fee, one that is disproportionate to the administrative work, is a red flag for legal action.

Avoid Double-Charging or Hidden Fees

Never charge for the same service twice. For example, if you’ve already included cleaning in the move-in fee, don’t repeat it under the admin fee. Hidden or duplicate charges may be viewed as unfair or deceptive practices.

Follow Local and State Regulations

Regularly review and update your fee structure. Check city council websites and state housing authority publications. In cities with strict renter protections (like San Francisco or NYC), an administrative fee must be tightly scrutinized.

Common Mistakes Landlords Make When Charging Admin Fees

Charging the wrong admin fee apartments can turn a simple transaction into a major legal headache.

Charging Unlawful or Hidden Fees

Some landlords unintentionally include fees not allowed in their jurisdiction. Always verify legality before charging anything beyond rent and deposits.

Failing to Provide Receipts or Proof of Cost

Keep documentation for administrative expenses—especially if a tenant challenges the charge. Proof adds legitimacy and ensures compliance.

Mixing Nonrefundable Fees with Security Deposits

The administration fee must be kept entirely separate from the security deposit. The security deposit is heavily regulated and is generally refundable. Confusing the two is a major legal risk, especially with the rise of the move-in fee vs security deposit trend, where states are increasingly limiting security deposit amounts.

Not Updating Fee Policies After Law Changes

Regulations change quickly. What was legal in 2023 may not be in 2025. Keep policies updated to prevent violations and maintain tenant trust.

How to Disclose Admin Fees in a Lease Agreement

When including an admin fee clause, the disclosure must explicitly state:

- The exact amount of the admin fee apartments.

- The fee is non-refundable under all circumstances (except where required by law).

- What the fee specifically covers (e.g., lease preparation, verification, coordination, administrative processing).

- The exact time when do you pay admin fee for apartment (e.g., "payable concurrently with the Security Deposit upon lease signing").

Example: Initial Move-In Payments. Tenant agrees to pay the following non-refundable fees prior to receiving keys:

- Administration Fee: $200.00

- Pet Fee: $300.00

- First Month's Rent: $1,500.00

Conclusion

The admin fee apartments are a legitimate tool for landlords to manage their operational overhead. By clearly defining what are the admin fees, keeping the charge reasonable, and strictly adhering to local disclosure laws, you can ensure a smooth, transparent, and legally sound move-in process. Focus on professionalism and clarity to set your tenancy off on the right foot.

Mastering the complexities of rental fees and legal compliance requires reliable tools. Don't let confusing state laws or outdated forms put your business at risk. LeaseRunner offers state-specific, attorney-reviewed digital lease agreements that simplify the disclosure process for the administrative fee for apartments, security deposits, and all other non-refundable charges.

FAQs

Are Apartment Admin Fees Refundable?

Typically, admin fees are nonrefundable because they cover services already performed. However, if the tenant backs out before any work begins, partial refunds may be appropriate.

Can a Tenant Avoid an Admin Fee?

In states that ban or cap fees, tenants can legally refuse excessive or hidden admin fees. Landlords should instead recover costs through legitimate rent adjustments or service charges.