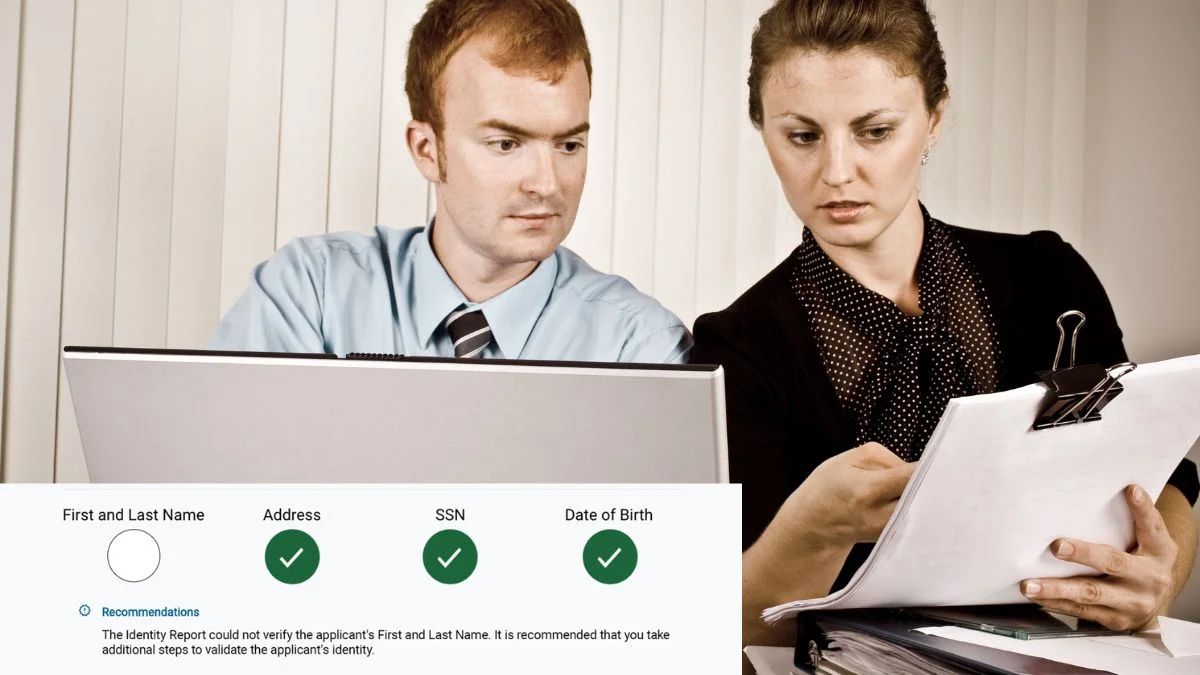

One of the threats to property owners that is expanding the fastest right now is rental fraud. Landlords frequently use digital records to approve tenants because more applications are being submitted online. This ease of use also makes it easier for identity theft, fraudulent documents, and rental scams to occur.

To protect your investment, you must understand the difference between identity proofing vs Identity verification. Each plays a key role in effective tenant screening. In this blog, we will break down the differences between identity proofing vs identity verification, explore identity proofing meaning and provide a step-by-step framework to protect your investment.

What Is Identity Verification?

Identity verification is the process of confirming that the person interacting with you online or in person matches the identity they are claiming. Identity verification typically involves checking personal information, documents, or biometric data to ensure that the claimed identity matches the real individual. This process helps prevent fraud, protect sensitive information, and ensure trust in digital and physical interactions.

Common methods of identity verification include:

- Document check: Comparing a government-issued ID with the person presenting it to ensure the photo and details match.

- Biometric matching: Using a live selfie or fingerprint to confirm it aligns with the ID on file.

- Two-factor authentication (2FA): Requiring an extra verification step for online portals to prevent unauthorized access.

- Database cross-check: Validating basic information against public or private databases to confirm accuracy.

Identity verification focuses on real-time access control. This is a core feature because it helps maintain continuous trust throughout the user’s interactions. For landlords, this means identity checks can be performed multiple times across a tenant’s lifecycle, such as when they log in, sign digital leases, or submit payments, to ensure that the individual accessing the account is always the rightful person.

Key Difference Between Identity Verification vs Identity Validation

- Identity validation focuses on confirming that the data provided—such as a name, address, phone number, or email—exists and is accurate in trusted databases. Identity validation answers the question: “Is this information real?” Yet, validation alone does not prove that the person using the data is its rightful owner.

- Identity verification takes it one step further. It connects the person to the data. This is where things like photo ID checks, selfies, biometric scans, or database cross-references come in—they confirm that the individual presenting the information is genuinely who they claim to be.

For landlords, this difference matters a lot. Validation might tell you an applicant’s address or phone number exists, but verification is what reassures you that the person signing the lease or paying rent is actually the right tenant. In practice, validation is fine for low-risk checks, while verification is what protects you when it really counts—like preventing fraud or unauthorized access to your property or systems.

What Is Identity Proofing?

Identity proofing is a more comprehensive process that goes beyond momentary verification. It evaluates whether the identity itself is authentic and belongs to a real, traceable individual.

In other words, identity proofing answers the question: “Does this identity truly exist, and does it belong to the applicant?” This step usually takes place once at the start of the rental application process. It often involves:

- Document collection: Gathering official documents from the tenant, such as passports, driver’s licenses, or Social Security numbers (SSNs).

- Data validation: Confirming the information on those documents against trusted government or commercial databases.

- Fraud detection: Looking for signs of identity theft, suspicious patterns, or mismatched details that may indicate a fraudulent application.

In rental context, identity proofing helps you establish trust with a potential tenant before any lease is signed or money changes hands.

In short, identity proofing is the "due diligence" phase. It’s the process you use to build a high-confidence digital or physical identity of an applicant, ensuring you’re not falling victim to identity fraud.

Why Landlords Must Understand Identity Screening Today?

The rental market has seen a dramatic increase in sophisticated fraud. According to a TransUnion study, fraud attempts in the rental industry have risen significantly, with perpetrators using fake identities, counterfeit documents, and stolen information.

Once they gain access to a property, the financial loss can be significant:

- Unpaid rent and eviction costs

- Property damage during unauthorized subletting

- Legal risks if fraudulent tenants engage in criminal activity

Fraud is increasingly happening during online applications and remote leasing, where traditional checks, like a quick visual ID review are no longer enough. Modern identity screening now relies on a multi-layered approach that combines:

- Identity proofing and verification to confirm both the tenant’s presence and the authenticity of their identity.

- KYC (Know Your Customer) processes and AML (Anti-Money Laundering) compliance checks.

- AI-powered fraud detection to identify synthetic identities or altered images.

- Document forensics to detect tampered or forged IDs.

By layering these checks, you not only confirm that the applicant is physically present but also that the identity itself is authentic and legally compliant, dramatically reducing the risk of fraud.

Identity Proofing vs Identity Verification: What’s the Difference?

Although the goal of both procedures is to stop fraud, their functions and schedules are different. Let's examine the main differences.

1. Purpose: Screening vs. Matching

- Identity Proofing (Screening): The goal is to establish a trusted identity from a blank slate. You are trying to answer the question, "Is this person who they say they are, and can I trust this new identity?" This is a proactive, risk-mitigation process.

- Identity Verification (Matching): Verifying an existing identity is the aim. In order to respond to the question, "Does this data match the existing record?" you are merely comparing the supplied information with a recognised source. This is an access-control, reactive procedure.

Think of proofing as the foundation and verification as the daily lock on the door.

2. Stage: Onboarding vs. Access Control

Verification happens at every stage of the procedure, including when leases are signed, money is paid, or data is updated.

- Identity Proofing: happens at the start of the rental application process, during tenant onboarding. It is often the first step in a landlord’s KYC workflow, before leases are signed or deposits are accepted.

- Identity Verification: usually used for tenancy-wide access control. To confirm their identity before giving them the key, you might, for instance, ask for a piece of information they gave you during their initial screening (such as their move-in date) if a current tenant calls you for a spare key.

For example, a tenant might be approved during their initial rental application, and then verified each time they log in to pay rent online.

3. Risk Tolerance and Compliance Level

When handling sensitive rental data or high-value properties, proofing is non-negotiable.

- Identity proofing aligns with basic KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, helping landlords filter out fake applicants early and meet fraud prevention or Fair Housing compliance requirements.

- Identity verification serves as the lighter, ongoing security layer. Instead of collecting new documents each time, it allows landlords to confirm that the person accessing portals, signing leases, or making payments is still the verified tenant. This step is particularly valuable for remote leasing, online transactions, or high-risk rental scenarios, where continuous protection and regulatory compliance are critical.

4. Real-Life Example: Rental Application vs. Account Login

Imagine a prospective tenant applies for your property:

- Identity proofing happens when you collect and validate their driver’s license, ID, Social Security Number, and employment documentation. You then use these documents to cross-reference their information against multiple databases to build a robust profile and decide if they are a legitimate applicant. This is a clear example of identity proofing.

- Identity verification happens later, when they log into your tenant portal to pay rent or upload documents, confirming the person is still the rightful account owner. To protect against a scammer posing as your tenant, you reply by asking them to confirm a specific detail only the real tenant would know, such as the date their lease started or their pet's name. This is an act of identity verification.

This layered approach protects against both initial rental fraud and ongoing account misuse.

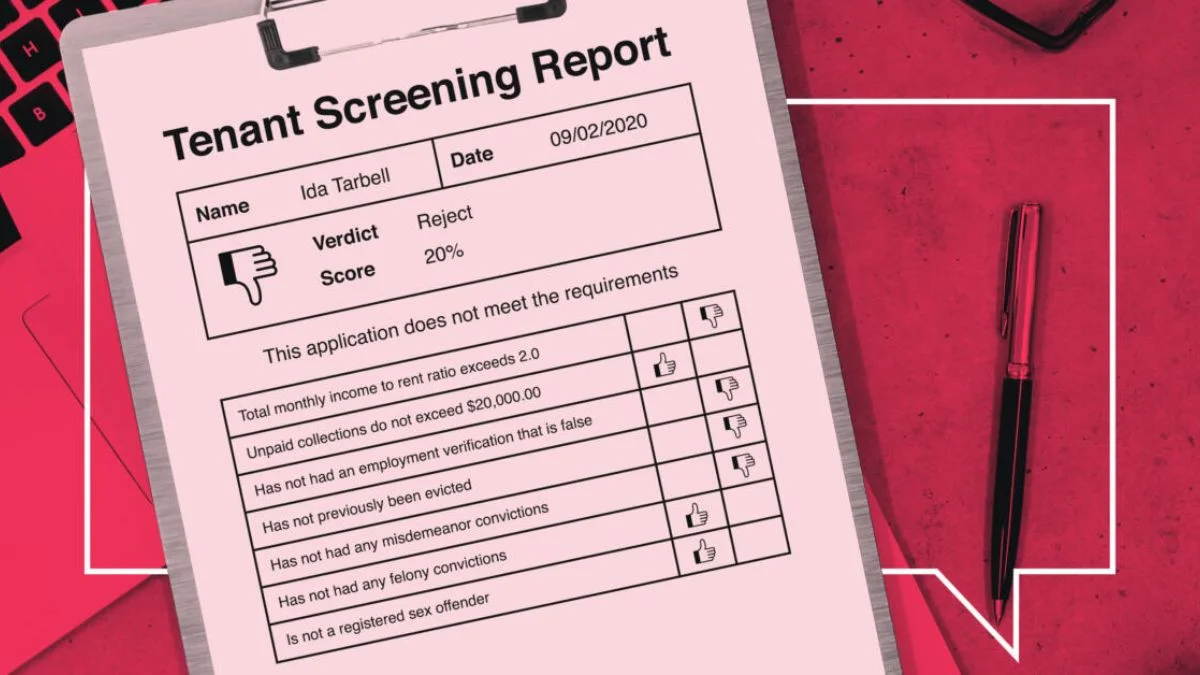

What Happens If Landlords Skip Proofing?

Ignoring identity verification can lead to expensive and time-consuming issues:

- Fraudulent tenants moving in under stolen or fake identities.

- Unpaid rent, property damage, or illegal subletting.

- Complex evictions that take months to resolve.

- Legal liability if a fraudulent tenant uses the property for criminal activity or money laundering.

To put it briefly, proofing is your first line of defence. Without it, you never verified the tenant's identity in the first place, making every subsequent verification step less trustworthy.

What’s More Secure - Identity Proofing or Identity Verification?

When it comes to preventing rental fraud, identity proofing is generally more secure than identity verification. Proofing digs deeper. It confirms that the applicant’s identity truly exists and belongs to a real person, not just that the person presenting the ID looks like the photo.

During the initial tenant screening process, this step is crucial for landlords. Proofing compares government databases and credit records with documents such as driver's licenses or Social Security numbers. Before a lease is signed, this procedure may expose identities that have been stolen or created artificially.

Identity Verification, in contrast, focuses on real-time confirmation. It ensures the person logging into a portal, signing a lease, or paying rent is the rightful holder of an identity that was already approved. While this is essential for ongoing security, verification alone cannot detect fraudulent applications at the start.

For example, imagine two rental applicants:

- Alex submits a genuine application. His driver’s license, Social Security Number, and rental history all match when proofed against official records. He clears the screening and is approved.

- Jordan, on the other hand, applies using a stolen identity with a convincing fake ID. If you only relied on verification, Jordan might pass because he matches the photo. But proofing would flag the application. A check with credit bureaus and government databases would show that the SSN is already tied to a different address or has suspicious activity.

This layer of security prevents costly mistakes, such as handing over keys to someone who never intends to pay rent or worse, disappears after causing property damage.

What Does a Complete Identity Screening Look Like for Landlords?

An effective screening process blends identity proofing vs identity verification with other key steps. Here’s a 9-step workflow that helps landlords minimize fraud risk:

1. Document Collection

The first step is to collect all the necessary documents from the applicant. This includes: Government-issued ID, Social Security Number, Proof of income, and Rental history.

2. Document Verification

After obtaining the documents, you must confirm their legitimacy. Signs of tampering, like changed dates or mismatched fonts, can be detected by modern fraud detection tools.

A basic visual check is a good place to start, but automated tools that authenticate barcodes, holograms, and other security features can offer a far higher level of security.

3. Identity Matching

Once a document has been validated, you need to make sure the individual presenting it is the legitimate owner. Make sure the applicant's signature, photo, and personal information appear on all of the documents they have submitted.

This just entails comparing the subject's face to the picture in a real-world context. To stop fraudsters from using stolen identification, this is an essential identity verification step.

4. Data Validation

Compare data against credit bureaus, utility records, or other trusted databases to confirm accuracy.

This aligns with identity validation vs verification, as validation checks the data itself rather than just the document.

This step involves cross-referencing the information provided on the application and ID with independent, authoritative sources. For example, you can validate an applicant’s address history against public records or utility databases. This helps confirm that the information is accurate and consistent across different sources.

5. Background and Credit Checks

A thorough tenant background screening check will reveal criminal history, eviction records, and other potential red flags. This step involves comparing data against credit bureaus, utility records, or other trusted databases to confirm accuracy.

For example, you can validate an applicant’s address history against public records or utility databases. This helps confirm that the information is accurate and consistent across different sources.

6. Employment and Income Verification

A critical component of a secure screening process is verifying the applicant’s ability to pay rent. You should contact their employer directly to confirm their job title, length of employment, and salary. This prevents applicants from falsifying income information to qualify for a property. For more detailed tips, you can read our guide on how landlords verify employment.

7. Consistent Application of Procedures

To avoid legal issues related to discrimination, you must apply the same screening standards to every applicant. This means every person who submits an application should go through the exact same identity screening process, with no exceptions.

8. Documentation and Record Keeping

Keep thorough records of each stage of the screening procedure. Copies of every document, the outcomes of your credit and background checks, and notes from your conversations with prior employers and landlords are all included in this. If a rejected applicant alleges that you discriminated against them, this documentation may provide you with legal protection.

9. Legal Compliance

Finally, ensure your entire screening process is compliant with federal, state, and local laws, including the Fair Housing Act and the Fair Credit Reporting Act (FCRA). For instance, you must obtain a signed consent form from the applicant before you can run a background or credit check.

Best Practice for Landlords: Prevent Identity Fraud

Even with strong screening, fraud attempts may occur. Here are seven proven best practices to reduce risk:

1. Rigorous Tenant Screening

Even if a candidate seems ideal, landlords should never cut corners or expedite the screening process. Those who look the most authentic are frequently the most convincing scammers. To obtain a comprehensive picture of the applicant's rental history, make sure to get in touch with previous landlords and ask a series of questions. This is a crucial step in establishing their identity.

2. Government-Issued ID Verification

Always require a government-issued photo ID. A social security card alone is not sufficient, as it lacks a photo for visual confirmation. Be sure to check the ID for any signs of tampering or forgery.

3. Use of Automated Fraud Detection Technology

Make the most of technology. Automated tools that can identify application irregularities, confirm the legitimacy of documents, and identify possible fraud attempts are frequently included in contemporary tenant screening platforms. Red flags that the human eye might overlook can be detected by these tools.

4. Secure Payment and Leasing Processes

Use secure online platforms for collecting rent and application fees. This helps protect your financial information and the tenant's from being compromised. LeaseRunner, for instance, provides a secure way to collect a rental application fee, which can also help weed out non-serious applicants.

5. Strict Lease and Subletting Policies

Clear, non-negotiable provisions regarding subletting and guest policies should be included in your lease agreement. This stops your legal tenant from renting out the property to an unscreened person who might cause problems.

6. Face-to-Face or Video Verification

Whenever feasible, verify applicants' physical identities in person or via video call. This enables you to ask them clarifying questions regarding their application and visually verify their identity.

7. Regular Property Monitoring

Periodically inspect properties to look for suspicious activity or unapproved sublets. Check that the tenant you screened is living there. Also, ensure no illegal activity is happening. Do this by doing regular inspections, but remember to give proper notice first.

Conclusion

Identity proofing vs. identity verification is a multi-layered defence strategy in today's digital rental market, not a binary decision. This strategy helps landlords fight rental fraud. It works best with background checks, employment and income verification, and secure leasing steps.

For property owners, we streamline this process at LeaseRunner. Our platform helps landlords screen applicants easily and securely. It combines online leasing tools, document verification, and tenant background screening all in one place.

By using a reliable, all-in-one screening solution, you can:

- Catch fraudulent applications before they become a problem

- Protect your rental income and property value

- Save time with streamlined digital workflows

In the battle against rental fraud, knowledge plus the right tools is your best defense. With LeaseRunner, you can confidently approve tenants, avoid costly mistakes, and enjoy the peace of mind that comes from knowing your investment is protected.

FAQs

Do landlords need both verification and proofing?

Yes. In order to establish a reliable identity during the initial tenant screening, identity proofing is crucial. Following that, identity verification is used continuously during the tenancy to verify the tenant's identity in a variety of circumstances, such as when they request maintenance or a new key.

Can I verify tenant identity without meeting them in person?

Yes. Digital verification tools and secure video calls allow you to validate identities remotely without sacrificing security.

Is it legal to deny a tenant based on identity screening?

Yes. You can deny a tenant if your screening shows:

- Fraudulent information

- A fake identity

- A history of crime or financial issues

However, it is crucial that your denial is based on legitimate and non-discriminatory reasons, and that you apply the same screening standards to all applicants to comply with Fair Housing laws.