Keeping an accurate record of rent payments protects both landlords and tenants. Whether for loan applications, rental history verification, or legal proof, a proof of rent payment letter provides clear documentation of consistent payments.

In this guide, we’ll provide a comprehensive breakdown of the document, a ready-to-use proof of rent payment letter template, and an overview of the legal landscape surrounding rent verification in the U.S.

What Is a Proof of Rent Payment Letter?

A proof of rent payment letter, sometimes called a letter of proof of rent payment, is an official document from a landlord verifying that a tenant has paid rent for a specific period. It confirms payment history, the rental amount, and any related details such as payment method or outstanding balance.

This letter can be used as evidence in financial applications, lease renewals, or disputes. It’s similar to a letter of proof of residency, but focuses exclusively on financial transactions related to rent.

When Do You Need a Proof of Rent Payment Letter?

Both parties may need this document in different circumstances.

For Tenants

Tenants frequently need a proof of rent payment letter for financial and residential applications. The most common uses include:

- Loan Applications: Mortgage lenders or other financial institutions often require official documentation to verify consistent housing expenses. This helps assess a borrower’s financial stability and responsibility.

- Applying for a New Rental: Future landlords often request a letter from landlord proving rent paid as part of the screening process. It is concrete evidence of the applicant's reliability in meeting rental agreements, which is a key part of evaluating tenant references.

- Government or Social Services: Certain assistance programs require confirmation of current housing costs and payment history to determine eligibility.

- Residency confirmation – Similar to a landlord referral letter, this letter provides written proof that a tenant resided at the stated address.

- Credit Building: In some cases, a consistent proof of rent payment letter can be used by services that report rental payments to credit bureaus, helping to establish or improve a credit profile, which ties into financial health, similar to what's analyzed in an RV Index Score.

For Landlords

While the letter is issued for the tenant's benefit, landlords also benefit from a standardized process:

- Confirm rent payments for financial or tax records.

- Resolve disputes regarding late or missing payments.

- Support eviction or legal claims with documented payment evidence.

- Verify tenant references. Learn more about questions to ask tenant references.

Key Information to Include in Rent Payment Letter

A clear, concise rent payment letter should include all essential details that validate the transaction.

1. Tenant's information

Start by listing the tenant’s full legal name exactly as it appears on the lease agreement. Include the rental property address, including the apartment number, city, and ZIP code, to remove any ambiguity about which property the payment applies to.

It’s also helpful to mention the lease start and end dates to clarify the rental period being verified. If the lease has been renewed, note the current renewal term. This gives a clear payment timeline and strengthens the verification’s accuracy.

2. Landlord's information

Include the landlord’s full name or the property management company’s official name, along with a physical business address, phone number, and professional email.

If the property is managed by an agent or a leasing firm, note their title and contact details. This information confirms that the letter originates from an authorized individual or entity responsible for the property.

3. Date of payment

The exact date the rent payment was received must be specified. This helps differentiate between payments that may cover the same period but were paid at different times such as advance or late payments.

For instance, if rent was due on the 1st but paid on the 3rd, noting the actual date clarifies that payment was made slightly late yet still completed. This transparency protects both landlord and tenant in case of future disputes or accounting audits.

4. Payment period

Next, define the rental period the payment covers—whether it’s a month, a quarter, or a specific custom billing cycle. Writing “for rent covering October 1–31, 2025” is much clearer than stating “for last month”.

When tenants pay multiple months in advance, each covered period should be itemized separately for accuracy. This level of detail avoids confusion, particularly for long-term leases or partial payments.

5. Amount paid

Indicate the total amount paid, and if applicable, break it down to show what that figure includes. For instance, rent may include base rent, utilities, parking fees, or pet charges.

For example:

- Breakdown: $1,700 rent + $100 utilities + $50 parking

- Total Paid: $1,850

Such transparency demonstrates that the tenant has met all obligations for that period. It also helps landlords maintain consistent accounting records, which is valuable during tax preparation or property audits.

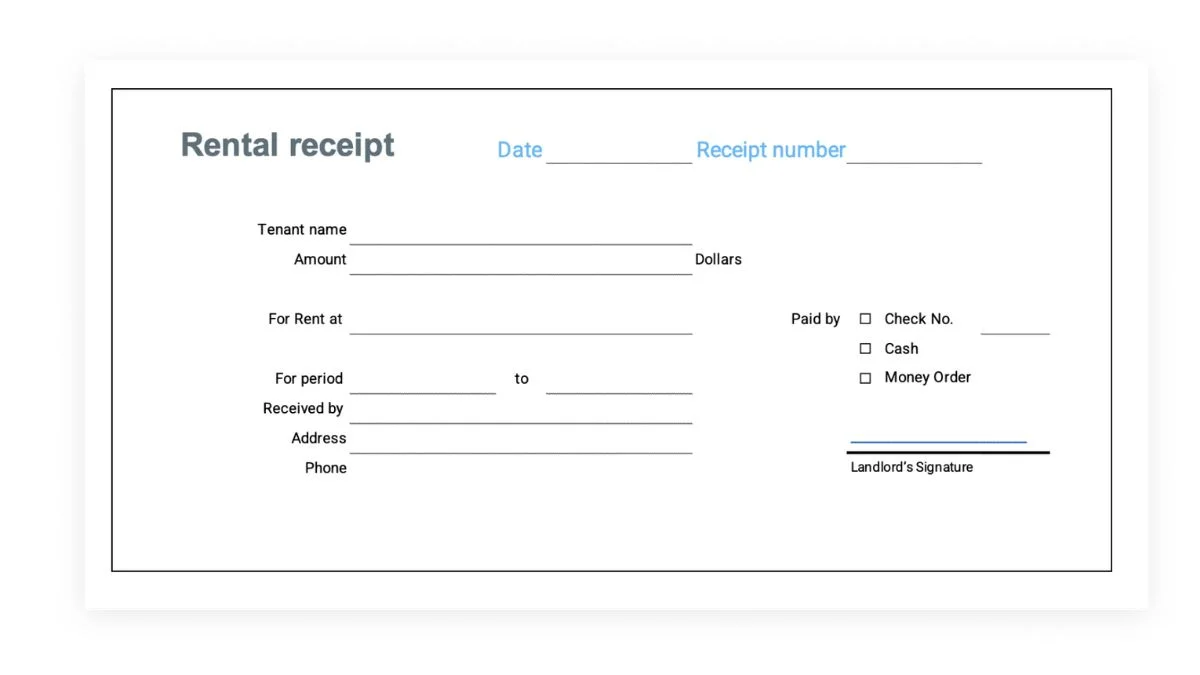

6. Payment method

Clarify the method used to make the payment check, direct deposit, bank transfer, cash, or digital platform (like PayPal, Venmo, or Zelle). This is particularly useful when verifying transactions later, as payment platforms generate timestamps or transaction IDs.

For additional verification, tenants may attach supporting documentation such as bank statements or proof of income documents. These can strengthen the legitimacy of the letter, especially when used in mortgage or government applications.

7. Signature

Finally, every proof of rent payment letter should include a signature from the landlord or authorized property manager. A handwritten signature on a printed document or a digital signature on a PDF both serve as valid forms of authentication.

For digital submissions, landlords can use tools like Adobe Sign, DocuSign, or PDF editing software to apply secure electronic signatures. This not only saves time but also provides an audit trail for compliance purposes.

Writing Tips for Rent Payment Letter for Landlords

Writing a letter from landlord confirming monthly rent doesn’t have to be complicated. Here are simple practices to ensure accuracy and professionalism.

Keep it simple and factual; include a reference number

A proof of rent payment letter should present facts only, no emotional language, unnecessary explanations, or informal phrasing. The purpose of the letter is to confirm the details of a completed transaction.

Each letter should clearly list:

- The tenant’s full name and address of the rental unit

- The payment amount and the period it covers

- The date when the rent was received

- The method of payment (cash, transfer, check, or digital app)

Whenever possible, include a reference number or receipt ID associated with the payment. A reference number helps organize transactions efficiently and provides traceability if either party needs to confirm specific payments in the future.

Send it promptly

Timing matters when issuing a letter from landlord proof of rent paid. Ideally, the letter should be sent immediately after receiving payment. Prompt documentation builds trust and minimizes the risk of recordkeeping errors.

By sending the letter quickly, landlords help tenants meet these deadlines and demonstrate a commitment to professional property management. Nowadays, digital tools like LeaseRunner can make this process faster. Many property management platforms automatically generate and email a proof of rent payment letter template, which landlords can review and sign electronically.

Give options for delivery

Providing flexibility in how the letter is delivered shows consideration and professionalism. Some tenants may prefer printed letters with physical signatures, especially when submitting documents to banks or government offices. Others may only need a PDF version sent via email for online applications.

To accommodate both preferences:

- Offer hard copies printed on official letterhead for physical records.

- Provide digital versions (PDF or Word format) with a digital signature for quick sharing.

Digital delivery is particularly convenient for landlords managing properties remotely. However, even when sending documents electronically, landlords should ensure the file is secure and tamper-proof. Using password-protected PDFs or encrypted email attachments can help maintain confidentiality.

Sample Proof of Rent Payment Letter

Below is a proof of rent payment letter sample that can be adapted for different situations.

Tenants or landlords can also adapt a verification of rent letter template to meet specific legal or organizational requirements.

Legal Considerations for Landlords and Tenants in the U.S.

When writing or requesting a letter from landlord proof of rent paid, it’s important to comply with relevant laws that govern rental documentation and recordkeeping.

Landlord’s Obligations

Under most U.S. state laws, landlords must provide receipts or written acknowledgment of rent payments when requested. Some states, such as New York (N.Y. RPL §235-e) and California (Civ. Code §1499), explicitly requires landlords to issue receipts for cash payments.

Additionally, landlords must maintain accurate records for tax and compliance purposes, especially when renting out multiple units. Learn more about managing rental responsibilities in renting out a house for the first time.

Tenant’s Rights

A tenant has the right to documentation that confirms their compliance with the lease agreement. This directly addresses the question, "how do I prove that I pay rent?"

- Right to Receipt: If a state or local ordinance requires a receipt, the tenant has the right to demand one.

- Protecting Against Disputes: The proof of rent payment letter is the primary defense against future claims of non-payment or eviction proceedings. Tenants should retain these letters (or other verified receipts/bank statements) for at least the full statutory period allowed for debt collection in their state.

Legal Risks and Penalties

Failure to provide proper documentation can lead to legal complications. For instance:

- If a landlord refuses to confirm payments, a tenant may use bank records as evidence in court.

- Incorrect or misleading payment confirmations may expose landlords to fraud or misrepresentation claims, which can be similar to risks encountered when trying to spot a rental scam.

- In some jurisdictions, repeated failure to issue receipts can result in fines or penalties.

Maintaining transparency through written documentation protects both parties and minimizes potential disputes.

Conclusion

A proof of rent payment letter is an essential document for demonstrating financial responsibility and maintaining transparent landlord-tenant relationships. It serves multiple purposes from verifying payment consistency to supporting financial applications or legal claims.

Using a clear format and accurate information ensures the letter meets professional and legal standards. For landlords, sending it promptly demonstrates accountability; for tenants, keeping it on record provides peace of mind.

FAQs

How to show proof of rent payments if landlord refuses?

If a landlord declines to issue a letter, tenants can use bank transfer records, canceled checks, money order receipts, or online payment confirmations. These documents collectively serve as reliable evidence of rent paid.

In disputed cases, these can also support a tenant’s claim during rental verification or court proceedings.

Is a landlord required by law to provide a rent payment letter?

While not all states mandate it, most landlord-tenant laws encourage written acknowledgment of payments. States like New York and Washington require landlords to provide a receipt when requested, especially for cash transactions.

Can I use bank statements instead of a letter?

Yes. Bank statements, digital receipts, or payment app confirmations can substitute a letter from landlord confirming monthly rent, though an official proof of rent payment letter remains more formal and widely accepted for applications.