Knowing how to spot a rental scam is a skill every renter needs before sending money or signing a lease. Scammers use fake listings, push for security deposits before a tour, or ask for wire transfers with no contract in place. Others trick people by copying apartment rental ads from trusted sites and changing the contact details.

A common red flag is refusing to show the property in person or rushing you to sign quickly. Some even request personal information, such as bank statements or social security numbers, before you qualify.

By knowing these warning signs and staying alert, you can reduce risk, protect your money, and avoid falling into schemes that target both landlords and tenants.

What is a Rental Scam?

A rental scam is a deceptive practice where fraudsters pose as landlords or property managers to exploit prospective tenants. These scams often involve fake listings, unauthorized sublets, or demands for upfront payments without providing access to the property.

The goal is to trick individuals into paying deposits or rent for properties that either don't exist or aren't available for rent. According to MarketWatch, 43% of renters who encountered suspicious listings engaged with the scam, and one in five lost money. Victims report losing an average of $1,000 per incident. Scammers prey on urgency and emotion, promising great deals or pressuring for quick decisions.

Is Rental App Legit?

Yes, the rental app is legit. However, renters still need to stay alert, because even safe platforms can expose tenants to people trying to run security deposit scams or push fake listings.

Many renters report scenarios where an out-of-town landlord claims they cannot meet in person but pressures the applicant to send money in advance. For example, a "landlord" may say they live overseas and need the first month’s rent before mailing the keys.

In another situation, people have faced the pay-to-view apartment scam, where a supposed agent demands a fee just to access the property address or schedule a tour. Once paid, the listing disappears.

Another common tactic is pushing renters to sign a lease before paying the deposit without verifying the property details or meeting the property manager. This often results in tenants wiring money to a fraudster and never hearing back again.

Some scammers also advertise no-credit-check rentals, which might sound attractive to applicants with less-than-perfect credit. Yet these listings often hide inflated upfront charges or traps designed to steal banking details.

10 Common Red Flags Tenants Should Watch Out For

So, how do rental scams work? What are the common signs?

Recognizing the warning signs of rental scams can save you from potential house rental fraud. Here are 10 red flags to be aware of:

- 1. Unusually Low Rent Prices

- 2. Pressure to Make a Quick Decision

- 3. Landlord or Property Manager Refuses to Meet in Person

- 4. Requests for Payment via Untraceable Methods

- 5. No Screening Process or Rental Application

- 6. Listing Photos Appear Elsewhere

- 7. Poor Grammar, Generic Replies, and Vague Language

- 8. Incomplete or Inconsistent Listing Information

- 9. They Ask for Sensitive Information Too Early

- 10. Fake Reviews or Overly Perfect Testimonials

1. Unusually Low Rent Prices

Scammers often attract attention by offering properties at prices that are significantly lower than the neighborhood average. This tactic is especially effective in competitive housing markets, where renters may feel pressure to jump on a "deal" before someone else does.

Pro Tip: Use comparison tools to check the average market rate for your target area. If the price is significantly lower than similar units nearby, proceed with caution and verify the source thoroughly.

2. Pressure to Make a Quick Decision

Scammers often manufacture urgency to pressure you into acting fast. You might be told, “I have several people interested,” or “If you want it, you need to send a deposit today.” This psychological manipulation is designed to short-circuit your judgment.

People fear missing out on a great deal and may overlook warning signs in their rush to secure the property.

Pro Tip: A legitimate landlord or property manager will give you time to consider the lease, ask questions, and think it over. Never let anyone rush you into paying money without due diligence.

3. Landlord or Property Manager Refuses to Meet in Person

A core part of any legitimate rental process is seeing the unit in person. Scammers, however, typically create excuses to avoid showing the property. They might claim they’re overseas, busy with work, or dealing with a family emergency. They’ll encourage you to look around the property from the outside or offer pre-recorded videos as substitutes.

The scammer likely doesn’t have access to the property at all, or it may not exist. In some cases, they copy photos and descriptions from real listings to create a convincing facade.

Pro Tip: Always insist on a tour before paying anything. If you're relocating from out of state, ask a trusted friend or real estate agent to view it on your behalf.

4. Requests for Payment via Untraceable Methods

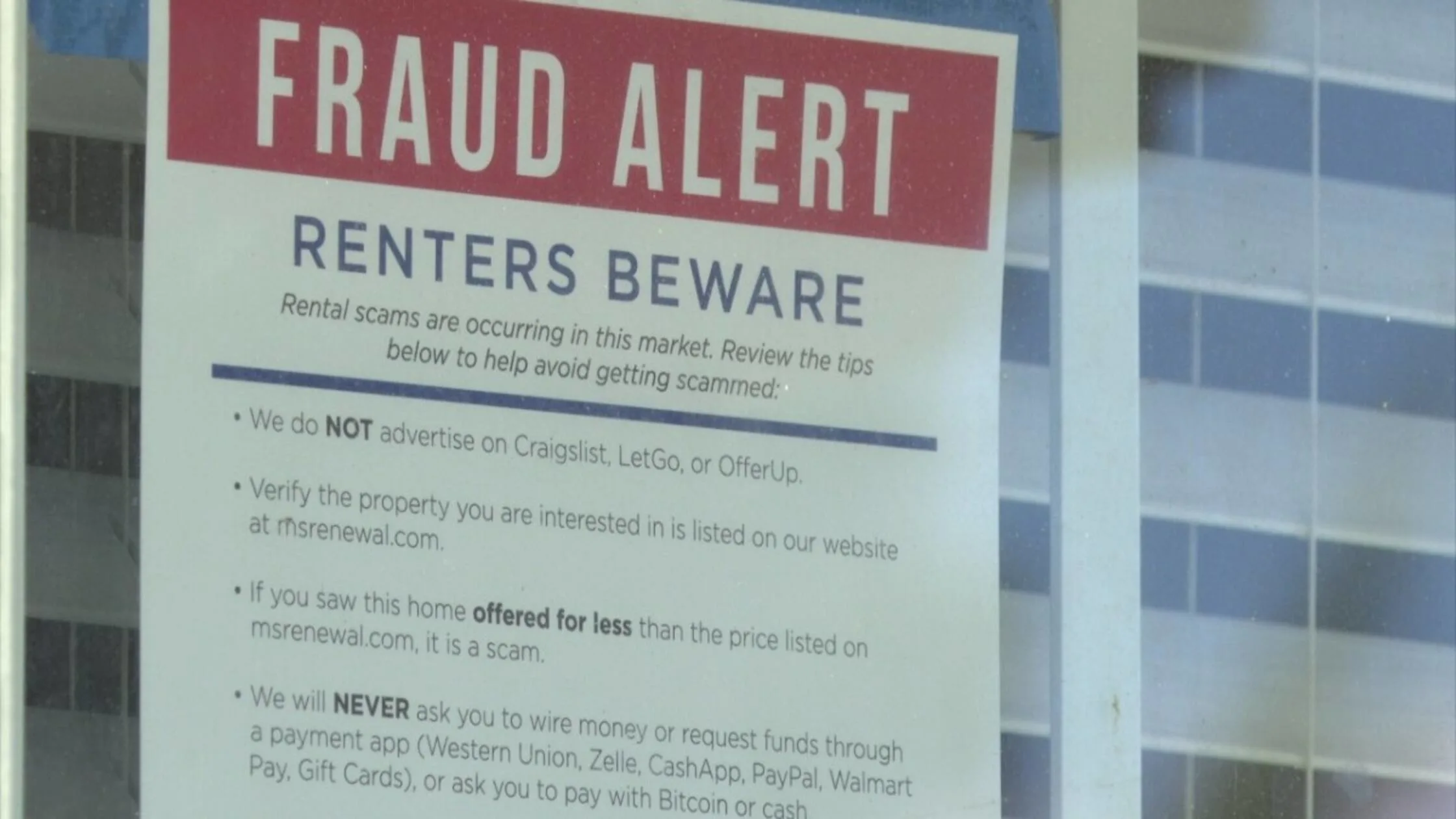

Scammers prefer payment methods that are fast, anonymous, and irreversible. These include wire transfers (like Western Union or MoneyGram), prepaid gift cards, Zelle, Venmo, CashApp, or cryptocurrency. Once the money is sent, it’s almost impossible to recover.

You may even encounter a scam based on a gift card rental payment, which is a major red flag, as these transactions are completely untraceable.

Legitimate landlords typically use secure and traceable channels such as certified checks, property management portals, or direct bank transfers with receipts and formal leases.

Pro Tip: Never send money without a signed lease and verified identity.

5. No Screening Process or Rental Application

A lack of vetting is a huge red flag. Landlords usually ask for references, proof of income, and credit reports, and may even require you to know how to pass a background check. If someone is ready to rent to you after one conversation, it's a sign that they’re not interested in who you are but just in your money!

Pro Tip: Be skeptical of any landlord who doesn’t request basic information. Real property owners have a vested interest in protecting their investment and will want to know you’re a reliable tenant.

6. Listing Photos Appear Elsewhere

Scammers routinely copy legitimate property photos from real estate platforms or listing websites. They repost them with different contact information, fake addresses, or altered details.

You might even find the original listing is active but listed under a real agent at a completely different price.

Pro Tip: Perform a reverse image search using Google Images. Upload the photo or paste the image URL. If it appears on multiple unrelated listings, you’re likely dealing with a scam.

7. Poor Grammar, Generic Replies, and Vague Language

Scam messages often contain spelling errors, awkward phrasing, and vague responses. You might receive emails that contain non-specific information about the apartment, or use unnatural English. These scammers may operate internationally, and the lack of professionalism can be a giveaway.

Pro Tip: Watch for poor grammar, overly generic answers, or evasive replies when you ask direct questions about the lease.

8. Incomplete or Inconsistent Listing Information

Scam listings often lack basic information: no address, missing amenities, vague lease terms, or incomplete contact details. Inconsistencies are also common. For example, a listing may say "2 bed, 1 bath" in the title but "3 bed, 2 bath" in the description.

Pro Tip: Cross-reference listings on reputable platforms. Look up the address in Google Maps.

9. They Ask for Sensitive Information Too Early

A major red flag in rental scams is being asked to hand over personal or financial details too soon. Scammers may request your Social Security Number, bank account information, driver’s license, or even a full credit report.

Once they have these details, they can:

- Steal your identity

- Open credit cards or loans in your name

- Drain your bank accounts

- Sell your data on the dark web

This tactic is especially dangerous because it feels like a normal part of the rental process, especially for first-time renters who aren’t familiar with what’s appropriate. While LeaseRunner does need the applicant’s Social Security Number, it is never shown directly to the landlord or stored in LeaseRunner’s database.

Pro Tip: Never provide personal or financial information before verifying the landlord’s identity and the property’s legitimacy.

10. Fake Reviews or Overly Perfect Testimonials

On platforms like Craigslist, Facebook Marketplace, or unofficial rental websites, scammers often try to build trust by using fake reviews and testimonials. These reviews may look legitimate at first glance, but are usually written with overly generic or exaggerated praise.

Sometimes, the entire profile (including a fake name, stock photo, and a network of “reviewers”) is fabricated to look trustworthy. This social proof trick plays on emotions and gives renters false confidence.

Pro Tip: Trust verified reviews from platforms like Google.

How to Spot a Rental Scam?

Finding a place to live or even a roommate can be stressful enough without having to worry about fraud. Knowing how to spot a rental scam is essential because these schemes are becoming more advanced every year.

By identifying rental scam red flags early, you protect your personal information. More importantly, you can also save money and avoid months of frustration. Below is a step-by-step guide on both recognizing scams and understanding how to avoid rental scams.

Step 1: Watch Out for Unusually Low Rent Prices

Criminals often attract victims by advertising units at unusually low rent prices. If a two-bedroom apartment in a popular neighborhood costs half the market rate, it’s most likely a trap. Ask yourself why the rent seems so cheap.

Scammers rely on urgency to pressure renters into committing fast. Always compare the listing price with other properties in the same area before moving forward.

Step 2: Research the Listing and the Landlord

Fake ads are common, and many suspicious rental listings come from people who don’t even own the property. Check for property ownership proof through online county records or official websites. Some fraudsters even install fake rental property signs to trick walk-by renters.

This is a crucial step, whether you’re renting from a large company or a private landlord, as scammers will pose as anyone to gain trust.

If the contact person claims to be an out-of-town landlord, request a live video tour and insist on landlord ID verification. Reliable identity checks, such as identity proofing vs. identity verification, can help confirm legitimacy.

Step 3: Avoid Paying Before a Tour

Beware of pay-to-view apartment scam tactics. Some ask for money before a tour. Others push you to sign a lease before paying a deposit, but only show fake papers. Always see the property first. Review any lease for errors.

Many fraudsters hand out fake rental lease documents that look official but contain flaws. A good way to cross-check is by using reliable lease agreement templates.

Step 4: Verify the Lease and Financial Information

Check employment history and tenant background before finalizing anything. Renters and landlords alike should follow a tenant screening checklist that includes verifying pay stubs, references, and rental history. Fraudsters often hand over forged income documents.

To protect yourself, read guidance on how to spot a fake pay stub using resources such as this guide. Also, confirm that a legitimate property listing verification exists by cross-checking with multiple rental platforms.

Step 5: Use Safe Payment Methods

Many con artists request unusual payment methods (wire transfer, gift cards, Zelle, cryptocurrency), hoping tenants will panic or rush to secure a rental without questioning the legitimacy. These transactions are hard to trace and almost impossible to recover.

Many of the recent common rental scams 2025 involve requesting gift cards or cryptocurrency, which are nearly impossible to trace. Some signs of the scams revolving around gift card rental payment or cryptocurrency rental fraud are claiming it’s “quicker” or “more secure.” The safest approach is to use bank transfers or checks linked to financial institutions.

When possible, follow a safe way to pay rent deposit through secure payment processors that come with fraud protection.

Step 6: Handle Background Checks Safely

Be mindful when asked to provide sensitive details. Scammers may request your social security number before you’ve even met them. A smarter option is reviewing how background checks without a Social Security number work.

Trusted guides like this resource about performing background checks without an SSN explain safer ways to confirm tenant reliability without putting your identity at risk. In addition, landlords often rely on tools for tenant background screening that align with federal and state compliance rules.

Step 7: Confirm the Landlord’s Screening Process

Fake landlords often don’t bother with the usual checks. A legitimate property owner will care about your rental history, conduct employment checks, and ask for references. If someone skips this process, treat it as a red flag.

This is especially important if you’re looking to get into a unique rental situation like house hacking, where due diligence is key.

Professional property managers use structured steps for how landlords verify employment and watch for red flags in background checks. Scammers, on the other hand, want fast money, not reliable tenants.

How to Avoid Rental Scams When Looking for a Roommate?

When searching for roommates, the scams change slightly but remain dangerous. Here are practical methods to stay safe.

- Check social media and references: Scammers posing as roommates may provide fake names or profiles. Ask for references from past roommates.

- Use video calls: Always hold a video meeting before agreeing to live together. If the other person refuses, that’s a red flag.

- Split payments carefully: One common scheme involves convincing you to handle the full rent upfront while your “roommate” pays you back later. Protect yourself with agreements and clear payment methods.

- Review lease terms together: Make sure the lease agreement names all roommates equally. This prevents one person from being legally tied to the whole rent.

- Check property ownership: Fraudulent roommates sometimes pretend to have their name on the lease when they don’t. Always confirm with official records or through the actual landlord.

How Landlords Can Fall Victim to Rental Scams by Tenants

While rental scams are often associated with fake landlords targeting tenants, landlords themselves are also vulnerable to sophisticated scams. Below are some of the most common cases and how to spot those rental scams before it’s too late.

1. Fake Tenant Applications

Scammers often submit fraudulent rental applications using false identities, stolen information, or altered documents. This is typically done to gain access to a rental property under deceptive circumstances, often to avoid background checks, hide evictions, or perpetrate further scams.

They may use:

- Fake names or Social Security Numbers

- Forged pay stubs or bank statements

- Fabricated references (often friends posing as employers or landlords)

Tip: Always verify tenant information with third-party screening services. Call employers directly using publicly listed phone numbers, not those listed on the application.

2. Subletting Scams

Some tenants sign a lease with no intention of living on the property. Instead, they illegally sublet the unit, often at a higher price, to someone else. They even rent it to multiple parties at once, particularly in hot housing markets.

In cities with strong tenant protection laws, it can be extremely difficult and time-consuming to remove unauthorized subtenants.

Tip: Add explicit no-subletting clauses to your lease.

3. Wire Transfer Fraud

Landlords can also fall victim to payment house rental fraud schemes, where a tenant overpays using a wire transfer or check and then requests a refund for the difference. Days later, the original payment bounces, leaving the landlord out of pocket.

Tip: Never refund overpayments unless the initial payment has fully cleared.

4. Fake Repair Claims and Chargebacks

Once moved in, scam tenants may manufacture complaints about fake repairs or property damage to:

- Demand partial rent refunds

- Threaten legal action for "unsafe conditions"

- Initiate credit card chargebacks on rent payments

They may also work with dishonest contractors to inflate repair costs and demand deductions or reimbursements.

Tip: Maintain thorough records of inspections, repairs, and communication.

5. Filing False Discrimination Claims

In rare but increasing instances, scam tenants may file false Fair Housing complaints as retaliation, such as after a rejected application or eviction notice. These complaints can tie landlords up in legal costs and investigations, even if the claims are baseless.

Tip: Treat all applicants equally and maintain written records of the screening process.

6. Fake Lease Disputes

Some bad-faith tenants intentionally misinterpret the lease or fabricate lease violations by the landlord. They may use these tactics to delay rent, break the lease early, or initiate legal disputes to avoid paying what they owe.

Tip: Keep a communication log with timestamps for all tenant interactions and maintenance requests.

7. Fake Emotional Support Animal (ESA) Letters

Some tenants try to get around no-pet rules or pet fees by using fake ESA letters purchased online. They may threaten you with legal action if you deny their request.

Tip: Learn your rights under the Fair Housing Act. You can request a letter from a licensed healthcare provider with a real relationship with the tenant.

8. Squatters and Tenants

These tenants move in, pay the first month, and then stop. They know the legal system well and use eviction laws to stay for free, sometimes for months.

Tip: Thoroughly screen all applicants. Avoid rushing to fill vacancies.

9. Rent Payment Excuses

Some tenants stall rent with endless excuses: “the check’s in the mail,” “bank issues,” “mistyped the account number.” They may send fake payment confirmations to trick you.

Tip: Set clear rent due dates and use online platforms that confirm when payments are made.

10. Filing for Bankruptcy to Stop Eviction

Some scam tenants abuse bankruptcy protection laws to delay or avoid eviction. When a landlord files for eviction, the tenant quickly files for Chapter 7 or 13 bankruptcy, which triggers an automatic stay that freezes all collection and eviction efforts.

In extreme cases, serial fraudsters move from rental to rental, filing repeat bankruptcies under multiple aliases.

Tip: If you suspect this tactic, consult a landlord-tenant attorney immediately. You can file a motion for relief from the automatic stay to continue with the eviction.

How Can You Protect Yourself From Rental Scams

Rental scams can cost victims thousands of dollars. Fortunately, tenants can take smart, proactive steps to protect themselves by employing these tips to spot rental scams.

Tip #1: Verify the Identity of the Other Party

Before signing anything or sending money, confirm that the person claiming to be the landlord actually owns or manages the property. You can:

- Ask to see a government-issued ID and proof of property ownership (like a deed or tax bill).

- Look up the owner’s name via public property records (available online in most cities).

- Research the company or agent through Google, the Better Business Bureau, or state real estate licensing boards.

Tip #2: Use Trusted Platforms for Transactions

- When searching, stick to reputable rental websites.

- Avoid sending money through peer-to-peer payment apps like Cash App or Venmo unless it’s to a verified business account and the transaction is explicitly tied to a secure lease or application platform. Use secure, verified payment methods, like LeaseRunner.

- Don’t make payments in gift cards, crypto, or cash. These are all common scam methods.

Tip #3: Never Send Money Without Seeing the Property or Meeting in Person

One of the most common and costly rental scams involves someone sending money (usually a security deposit) before ever seeing the home or meeting the landlord or tenant.

- Don’t pay deposits or application fees until you've physically toured the property or had a verified virtual walkthrough conducted by a legitimate agent.

- Be cautious of landlords who are "out of town" or apply pressure for you to pay quickly without allowing a visit.

Conclusion

With rental scams on the rise, understanding how to spot a rental scam isn’t optional anymore. Share these tips with friends, fellow landlords, and tenants to help others avoid costly traps! Want more expert insights on tenant screening, lease tips, and rental safety? Visit the LeaseRunner website for practical advice and updates every landlord should know.

FAQs

Q1. How to catch a rental scammer?

Catching a rental scammer starts by recognizing the signs early. Look for red flags like:

- A landlord or tenant who refuses to meet in person

- Pressure to pay quickly, often via wire transfer, gift cards, or cash apps

- Poor grammar, vague property details, or inconsistent contact information

- Deals that seem “too good to be true” compared to market rates

If you suspect fraud, stop all communication.

Q2. How to tell if a rental is legitimate?

To verify that a rental is real and not part of a scam:

- Cross-check the rental listing on multiple platforms

- Visit the property in person or request a live video tour

- Ask for proof of ownership (like a tax bill or utility in the landlord’s name)

- Research the landlord or agent to confirm they are licensed or publicly known

- Look up the address in county property records to match the owner’s name

Remember: a legitimate landlord or property manager will never rush you, refuse to meet, or ask for payment before a proper lease is signed.

Q3. How to spot a fake lease agreement?

A fake lease agreement may look convincing at first glance, but several details can give it away:

- Missing the landlord’s or tenant’s full legal names

- No address or legal description of the property

- No mention of local rental laws or required disclosures

- Generic formatting, typos, or unusual clauses (like paying in gift cards)

- No contact info, signatures, or dates

When in doubt, ask a real estate attorney or property manager to review the document.

Q4. What should I do if I have already paid a rental scammer?

If you realize you’ve been scammed after sending money for a rental, act quickly:

- Stop communicating with the scammer. Block their number, email, and any social media profiles.

- Report the incident to the platform where you found the listing.

- Contact your bank or payment service (PayPal, Venmo, Zelle, etc.) to report the fraud and request a chargeback or freeze the transaction. While not guaranteed, some services offer limited protection or may flag the scammer’s account.

- File a police report with your local authorities. This can help you document the crime and may be required by your bank or insurance company.