An adverse action letter is a critical document for landlords, employers, and property managers. It serves as the formal notice issued when an application is denied - whether for a rental property, employment position, or credit request - based partly or entirely on a consumer report.

Drafting this letter correctly ensures compliance with the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA) while maintaining transparency, fairness, and legal protection.

This guide explains what to include in an adverse action letter, provides templates and checklists, highlights common mistakes, and answers frequently asked questions.

What Is an Adverse Action Letter?

An adverse action letter is a formal notification sent when a landlord, employer, or financial institution takes negative action against an applicant. Negative action may include denial of a rental application, refusal of employment, or unfavorable credit terms.

The letter must clearly outline the reasons for the decision and the applicant’s rights. It serves multiple functions:

- Ensures compliance with Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA) requirements

- Provides transparency in decision-making

- Protects landlords and companies from potential legal disputes

Examples include denying an applicant for an apartment due to a low credit score or past eviction history. For tenants, understanding the content of an adverse action letter can clarify why their application was denied and guide corrective actions. Landlords can also reference a rental application denial letter for sample notifications.

For more details on tenant screening, check out what is a tenant screening report and how to check my tenant screening report.

When Is an Adverse Action Notice Required?

Understanding when an adverse action notice is required is essential for landlords. Failing to issue one can result in costly lawsuits and regulatory penalties.

Federal law mandates that an adverse action notice must be provided whenever a decision is influenced, in whole or in part, by information obtained from a consumer report. Common situations include:

- Rental Applications: When a tenant is denied an apartment based on credit reports, criminal background checks, or eviction history.

- Employment Screening: When a job offer is denied due to background checks or credit reports. Learn how to pass a background check for an apartment.

- Credit Decisions: When loans, credit cards, or financing applications are denied.

Examples of when an adverse action notice reasons must be provided include:

- Denying an application due to a low credit score. Refer to what credit score is needed to rent an apartment.

- Rejecting an applicant because of a recent eviction filing found in the screening report.

- Requiring a double security deposit because the applicant’s report showed a high debt-to-income ratio or an adverse credit history.

- Declining an applicant due to certain red flags in background checks , provided the landlord has followed all HUD criminal background check requirements.

Failure to provide the notice when required can result in FCRA violations and potential legal consequences.

What to Include in an Adverse Action Letter (Required Information)

An effective adverse action letter must meet both general legal requirements and specific regulatory requirements, depending on the type of decision.

General Requirements (ECOA)

While the FCRA is the main driver, the Equal Credit Opportunity Act (ECOA) also has a role. It requires creditors to provide specific reasons for denying the request. Although the FCRA covers the notice when a consumer report is used, the letter must clearly state the reason for the denial.

- Notification of Adverse Action: Clearly state that the application was denied or unfavorable action was taken.

- Reason(s) for Denial: Identify the primary factors, such as credit score, eviction record, or income insufficiency. Example: “The application was denied due to insufficient rental history and credit score below 620.” Learn how to verify tenant income.

- Contact Information: Provide the name and contact details of the entity that supplied the consumer report.

Additional Requirements (FCRA)

The Fair Credit Reporting Act (FCRA) adds specific requirements for letters based on consumer reports:

- Name, Address, and Telephone Number of the CRA: The full contact information for the company that provided the tenant screening report.

- Statement that the CRA did not make the decision: The letter must explicitly state that the CRA did not make the decision to take the adverse action and cannot explain why the decision was made.

- Right to Obtain a Free Copy of the Report: The applicant has a right to request a free copy of the report from the CRA within 60 days of receiving the notice.

- Right to Dispute the Accuracy of the Report: The applicant must be informed of their right to dispute the accuracy or completeness of any information in the report directly with the CRA.

Employment Specifics

When adverse action involves employment decisions, additional considerations apply:

- Conditional Approval Notices: If a job offer is rescinded based on background checks, provide details of the process, including the applicant’s opportunity to dispute inaccuracies.

- Pre-Adverse Action Letters: Employers may issue a pre-adverse action letter to allow review of consumer reports before finalizing decisions. This is not inherently negative but ensures compliance.

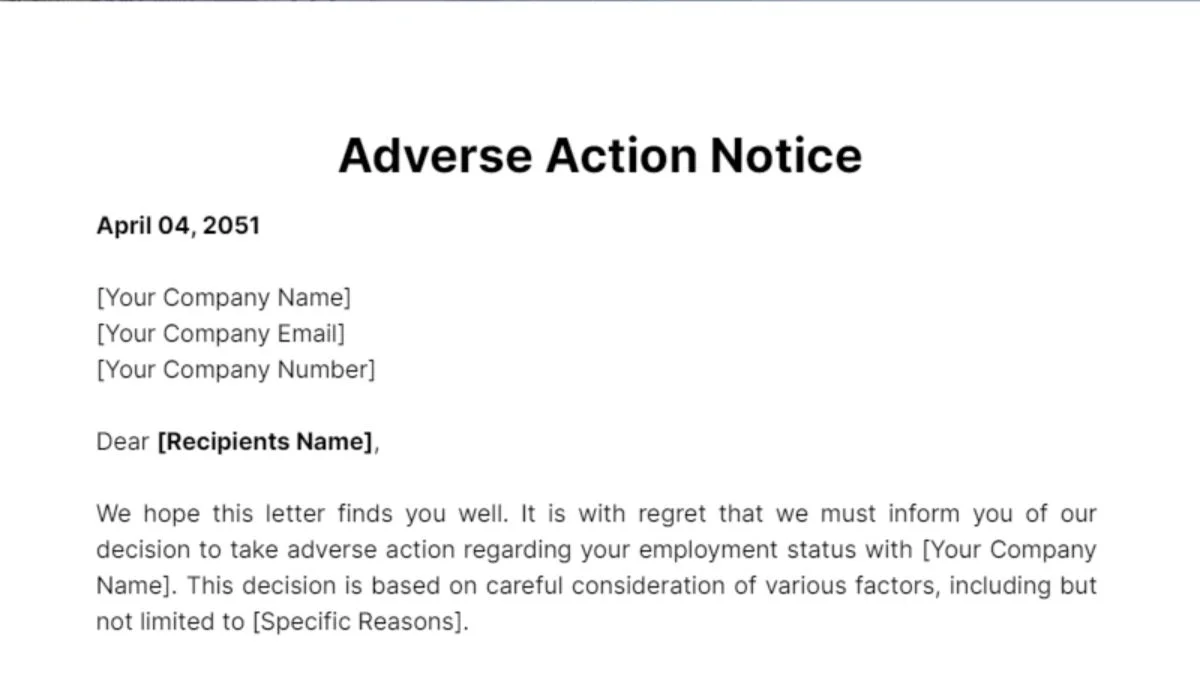

Adverse Action Letter Template

Below is a sample adverse action notice template for landlords denying an apartment application:

This template can be adapted for employment decisions, credit denials, or other adverse actions.

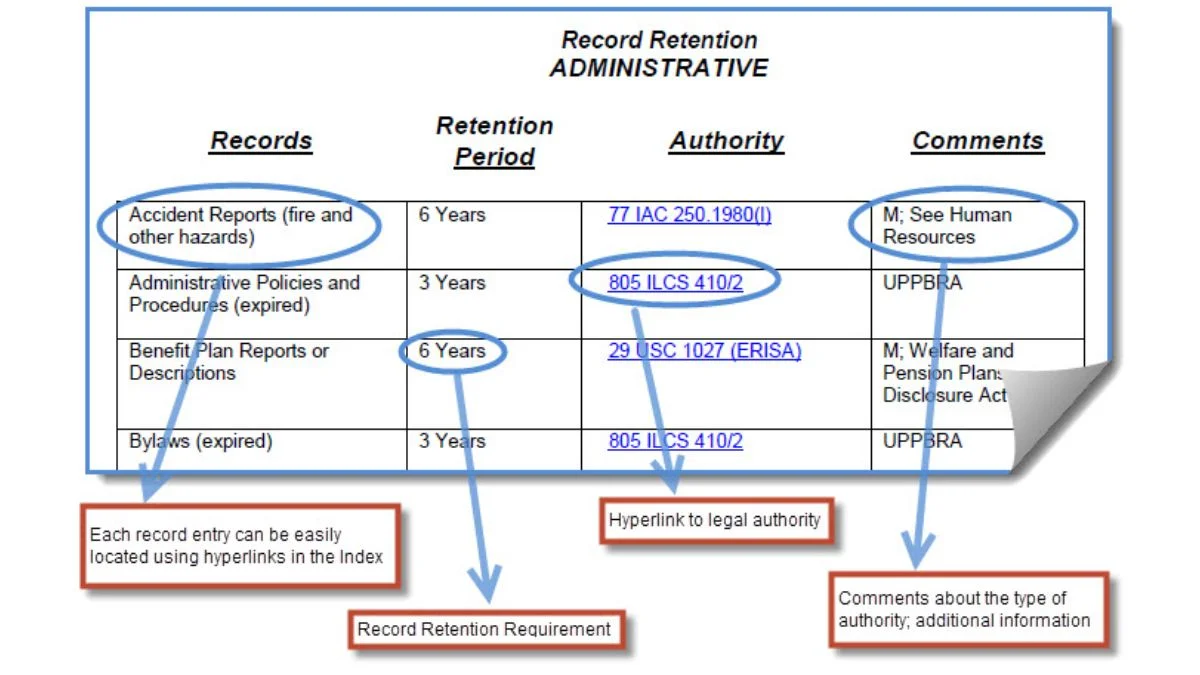

How Long Should Adverse Action Notices Be Retained?

Record retention plays a critical role in demonstrating compliance with federal regulations. Under the Equal Credit Opportunity Act (ECOA) - which applies to rental decisions, landlords are required to keep all written records related to a rental application for 25 months after sending an adverse action notice.

Documents that must be retained include:

- The original rental application: Typically preserved for 1–2 years after denial.

- The tenant screening report.

- The written adverse action notice.

- Any internal notes or documentation used to support the decision.

For other types of decisions:

- Employment applications: Must be retained for at least two years following the adverse action.

- Credit-based decisions: Retention requirements follow FCRA recordkeeping rules.

For guidance related to credit reporting, refer to the soft and hard credit check resource, which provides additional insight into best practices for managing and retaining credit-related records.

Common Mistakes to Avoid when Sending Adverse Action Letter

Even minor errors in adverse action notices can result in regulatory scrutiny. The most common mistakes fall into three categories:

Procedural Errors

- Failing to Send the Notice: The most severe mistake is not sending the notice at all when the decision was based on a consumer report.

- Missing the Deadline: The notice should be sent promptly after the decision is made. While the FCRA does not provide a specific number of days, "promptly" is generally interpreted to mean within a few days, ideally no later than 10-14 days.

- Using the Wrong Address/Method: The notice must be sent to the applicant’s current mailing address. Sending it via email alone may not be sufficient unless the applicant has explicitly agreed to electronic-only communication.

Content and Information Errors

- Vague Reasons: Listing insufficient or vague reasons is a major error. Stating "Failed to meet our standards" is unacceptable. The letter must list the specific adverse action notice reasons, like a credit score of 550 or an unpaid debt over $1,000.

- Incorrect CRA Information: Including the wrong name, address, or phone number for the Consumer Reporting Agency prevents the applicant from obtaining their free report or filing a dispute.

- Excluding Rights: Failing to include the applicant's right to a free report within 60 days and the right to dispute information is a serious FCRA violation.

Communication and Compliance Errors

- Discriminatory Reasons: The reasons provided must be non-discriminatory and align with Fair Housing laws. Even if the credit report is poor, the landlord cannot deny an applicant based on race, religion, familial status, etc.

- Mixing Credit and Non-Credit Reasons: If the denial is based on both the report (e.g., credit) and the application itself (e.g., job history), the landlord must ensure the notice addresses the use of the consumer report as a partial factor.

Proper training and internal tenant screening procedures can mitigate these errors. See valid reasons to deny rental application for examples of compliant decision-making.

Conclusion

A well-crafted adverse action letter is essential for landlords and property managers to ensure compliance, transparency, and professionalism. By including all required information under ECOA and FCRA, clearly stating reasons for denial, and retaining records properly, landlords can reduce legal risks while maintaining trust with applicants.

Following best practices also streamlines the tenant screening process. Tools like LeaseRunner’s tenant screening services provide comprehensive reports on credit history, eviction records, and background checks, making it easier to issue accurate adverse action notices.

FAQs

What is an FCRA adverse action letter?

An FCRA adverse action letter notifies an applicant that a decision, such as a rental denial or employment rejection, was made based on a consumer report. It must include the CRA information, reasons for the decision, and the applicant’s rights to dispute inaccuracies.

When is an adverse action notice required?

An adverse action notice is required whenever a decision is based, in whole or in part, on information from a consumer report. This includes rental applications, employment decisions, and credit approvals or denials.

Is a pre-adverse action letter bad?

No. A pre-adverse action letter informs an applicant of potential negative decisions before finalizing action. It allows review and correction of errors in consumer reports, protecting both parties.

What are the reasons for adverse action notice?

Reasons include, but are not limited to:

- Low credit scores

- Eviction history or adverse rental history

- Criminal background records

- Insufficient income or employment verification

What is an adverse credit history?

An adverse credit history is a term used to describe a history of negative financial events reported to the credit bureaus. For landlords, this typically includes:

- Late payments (especially 60 or 90 days past due).

- High debt-to-income ratio.

- Accounts in collection or charged off.

- Bankruptcies or foreclosures.

- Judgments or tax liens

Adverse credit histories are common reasons for rental application denials or employment screening challenges. For more details, see credit check.