Before handing over the keys to a new tenant, it's smart to request a proof of income letter. This letter helps confirm the applicant’s financial stability and gives you peace of mind as a landlord. In this article, we’ll cover everything you need to know, from what to look for to how to write one yourself.

What is a Proof of Income Letter?

A proof of income letter (also known as an income verification letter for an apartment) is a document that confirms a tenant’s income for landlords or property managers.

It shows you, the landlord, that the tenant earns enough money to comfortably cover the rent before signing a lease agreement, or during lease renewal. This letter usually comes from an employer, accountant, or even the tenant themselves, and it spells out how much they make and how often they get paid.

Why You Should Request Proof of Income as an Apartment Landlord?

Handing over keys to someone you barely know can feel like a leap of faith. An income verification letter for apartment lease can help turn that leap into a calculated step. It gives landlords, like you, solid evidence that your tenant can afford the monthly rent and stay current on payments. It's also a great tool for spotting potential red flags early, like inconsistent income or unverifiable employment.

Key Elements of a Proof of Income Letter for Landlords

To be truly useful for landlords, proof from a letter of income for an apartment needs different details. When reviewing or writing one, look for these:

Tenant's Information

The letter should start with the tenant’s full name and current address. This simple detail prevents mix-ups, especially when landlords manage multiple applicants or properties.

Employer or Income Source

Clearly stating the name of the employer or income source adds a layer of credibility. This could be the company the tenant works for, a freelance client, or even a government benefit provider. Knowing exactly where the money is coming from helps landlords understand the tenant’s work environment and assess how secure that income might be.

Employment Type & Status (Full-time, Part-time, Contract)

Details about whether the tenant is employed full-time, part-time, or working under a contract can reveal the stability of their income. Full-time employees usually have steady, predictable earnings, while part-time or contract workers might experience fluctuations. This information helps landlords judge how consistent rent payments might be over time.

Income Amount and Frequency

How much do the tenants earn, and how often? This is one of the most important sections in the proof of income letter.

For example, a tenant making $3,000 monthly on paper but gets paid weekly may have a different cash flow pattern than someone with a straight $3,000 monthly paycheck. This means even though both earn the same total, the timing of their payments creates very different ways they manage their money for rent.

Frequency and consistency here matter just as much as the dollar amount, since this detail can help predict potential timing issues with rent payments, even if the total income is sufficient.

Employer Contact for Verification

A real name, phone number, or email address adds legitimacy to the letter. This contact point ensures transparency and honesty. It also makes it easier to verify the letter’s authenticity without wasting time chasing vague leads. Having a real person to talk to can clear up any questions about employment dates or income figures.

Date, Signature, and Letterhead (if applicable)

A well-crafted proof of income letter should be dated and signed by the person confirming the income, typically an HR representative or manager. This adds weight and formality to the document. When the letter is printed on official company letterhead, it boosts legitimacy even more.

When Do Landlords Request Proof of Income?

Landlords have a few go-to moments during a tenancy when asking for proof of income makes perfect sense.

During Rental Applications

This is the most common moment landlords ask for proof of income. Before handing over keys, it’s important to see that the tenant can cover the rent month after month. Asking during the application process helps separate serious renters from those who might struggle financially.

During Lease Renewal (Occasionally)

Sometimes landlords want to double-check things before a lease is up for renewal. Proof of income letters don’t always come up at renewal, but they often do when a landlord hasn’t checked finances in a while or suspects changes in income.

When Adding New Roommates or Occupants

When a tenant wants to bring someone new into the household, that changes the financial dynamic. Landlords usually want to know who’s moving in and whether they’ll be contributing to the rent. A proof of income apartment letter from the new roommate helps confirm they’re financially stable enough to be part of the lease.

Before Rent Increases

Before making that change, landlords sometimes request updated income verification to ensure the tenant can handle the new amount. It’s a practical move to avoid putting tenants in a financial bind and to keep things running smoothly.

If There Are Missed Payments or Financial Concerns

Late or missed payments are a red flag that something might be off financially. When that happens, landlords may ask for a current proof of income letter to get a clearer picture of what’s going on. It opens a conversation about next steps.

A helpful tip for busy landlords in these scenarios is to set up online rent collections. It gives landlords an automatic way to track payment patterns without the need to shuffle through papers. This way, you can see if tenants can keep up with their payments monthly, and ask for an income letter right in time.

Acceptable Supporting Documents to Verify Income

Not every tenant will have a formal proof of income letter ready to go and that’s totally normal. Landlords can request one or a combination of the following to confirm a tenant’s financial stability:

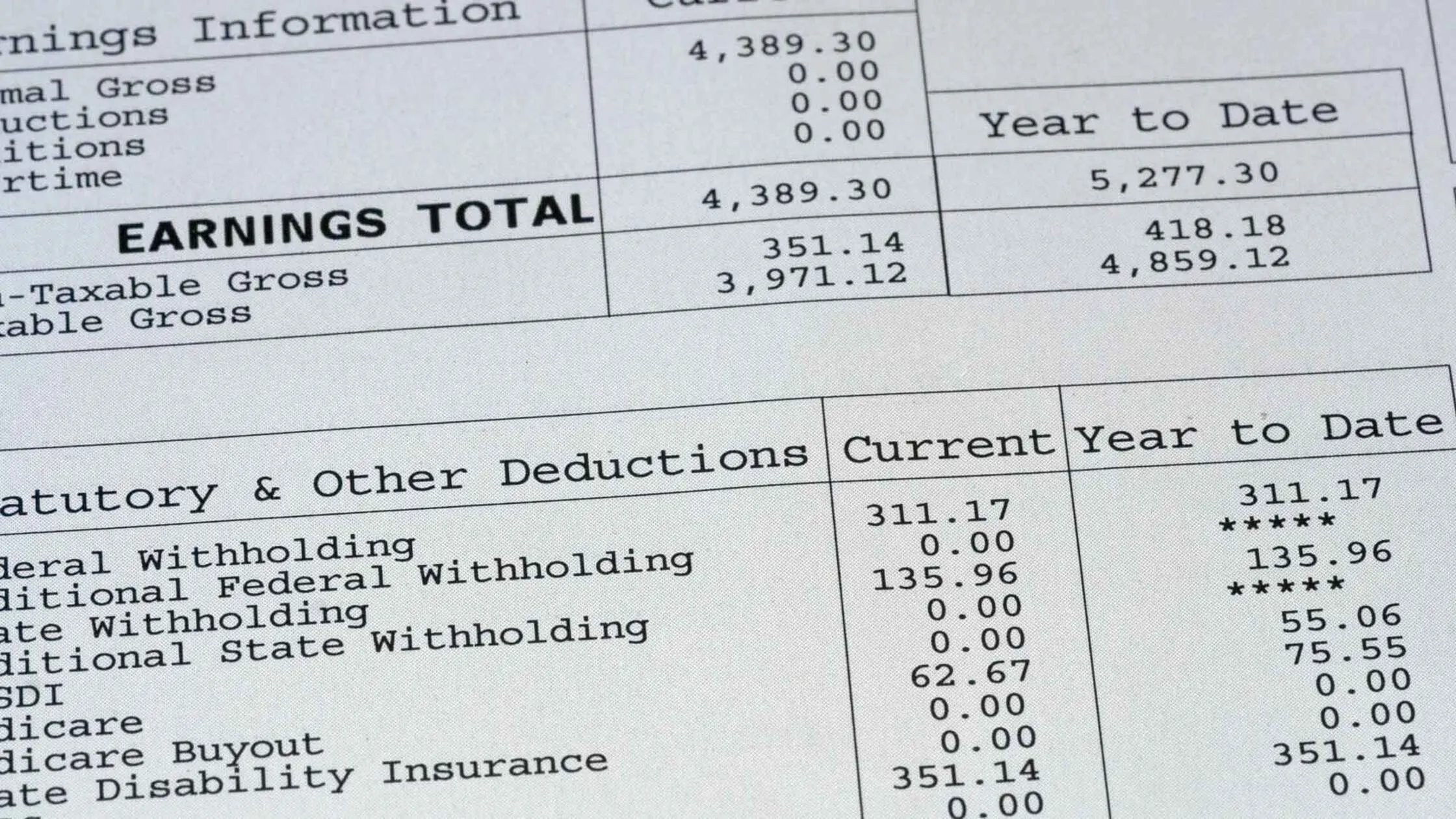

- Recent pay stubs

- Bank statements

- Tax returns (Form 1040 or equivalent)

- Offer letters or employment contracts

- Social Security or pension benefit letters

- Unemployment or government assistance statements

Recent Pay Stubs

This is one of the quickest and most common ways to verify income. Tenants who are employed should be able to provide their last two or three pay stubs. These show not just how much they earn, but how often they’re paid (weekly, biweekly, or monthly). Pay stubs also give insight into things like bonuses, deductions, and job stability over time.

Bank Statements

When pay stubs aren’t available, like with freelancers, gig workers, or cash-based earners, bank statements can step in. These show the actual money coming in and give landlords a sense of how consistent the income is. Typically, reviewing the last two or three months’ worth is enough.

Tax Returns (Form 1040 or Equivalent)

Tax returns are solid proof of annual income. They’re especially useful for self-employed tenants or anyone with multiple income streams. A recent Form 1040 shows gross income, deductions, and even employment types. Keep in mind, though, that taxes show what someone made last year, it won’t always reflect what they’re currently earning. Still, it’s a great way to confirm long-term income trends.

Offer Letters or Employment Contracts

Someone just started a new job? No problem. An official employment verification letter apartment or signed employment contract can show their new salary, start date, and job title. Just make sure the letter confirming employment and salary includes the company’s info and a contact name for verification.

Social Security or Pension Benefit Letters

Tenants who are retired or on disability can provide award letters from Social Security or pension statements. These documents show exactly how much they receive each month and that the income is reliable. It's steady, government-backed, and easy to verify.

Unemployment or Government Assistance Statements

If a tenant is currently receiving unemployment benefits or other government assistance, recent statements from the issuing agency can count as proof of income. These documents clearly outline how much the tenant is receiving and for how long the support is expected to continue.

How to Verify a Proof of Income Letter

Getting a proof of income letter is great but taking it at face value? Not always the best move. Tenants might forget details, get creative with templates, or unintentionally leave things out. It’s smart to verify the letter before moving forward.

Cross-Check Employer or Business Contact Info

Start with the basics. A quick online search can usually confirm whether the company exists and that the contact listed actually works there.

- Call the company’s main phone number (not just the one on the letter) and ask to speak to the person who signed it.

- Keep the conversation professional and brief, just enough to confirm the tenant’s job title, employment status, and income.

For self-employed tenants, check their website, reviews, business licenses, or even LinkedIn.

Use Verification Tools and Resources

Landlords don’t have to do all the heavy lifting manually. With LeaseRunner, you can request a Cash Flow & Income Verification Report that collects real data from the tenant's bank. You can also run background and credit checks, collect e-signatures, and send digital leases. This speeds up your screening process and helps you spot red flags early.

Watch for Common Red Flags

Even legit-looking letters can hide red flags. Keep an eye out for:

- Generic templates with missing details (like no company letterhead or vague contact info)

- Rounded numbers (like “$5,000/month exactly”) with no breakdown or context

- Inconsistent formatting, fonts, or logos that don’t match the actual company’s materials

- Refusals to provide additional documents or hesitation when asked for verification

If something feels off, it probably deserves a second look. Most good tenants have no problem being transparent

How to Handle Proof of Income for Non-Traditional Tenants

Unlike tenants with regular 9-to-5 jobs, non-traditional renters may not receive a steady paycheck or have conventional tax forms. They often need extra attention:

- Income isn't always predictable. Freelancers and gig workers often experience income spikes and dips depending on project cycles or seasons.

- Some rely on non-employment income. Retirees may live off pensions, investments, or Social Security.

- Students often don’t earn income at all. They may rely on parental support, scholarships, or loans.

- Housing assistance programs like Section 8 require specific lease and payment structures.

Let’s explore how to handle one common group:

Students with No Employment

Students are a unique case. They may have little to no personal income but still have access to funds from various sources. As a landlord, you should follow these steps:

- Require a co-signer or guarantor. Usually, a parent or guardian with a solid income and credit history.

- Consider prepaid rent or shorter lease terms. This reduces your risk and gives you flexibility.

- Be clear in lease terms about payment expectations. Avoid misunderstandings by outlining due dates, late fees, and who is legally responsible.

Retirees with Pensions or Investments

Retired tenants often have stable passive income from multiple sources, even if they're no longer working. In this case:

- Calculate based on consistent passive income. Ask for documentation from pension providers, Social Security, or investment accounts.

- Verify long-term sustainability. If they're drawing from savings or investments, make sure the funds are substantial enough to last through the lease.

- Accept a fixed income ratio instead of employment status. Focus on whether they can afford the rent, not whether they’re actively employed.

Housing Voucher Tenants (Section 8 Program)

Renters with housing vouchers are backed by government programs, which can actually reduce your financial risk.

- Confirm your property is approved for the program. In some areas, landlords must register or pass inspections.

- Understand who pays what. Typically, the housing authority pays a portion of the rent, and the tenant covers the rest.

- Follow HUD/local housing authority rules in the lease. This includes rent ceilings, inspections, and documentation requirements.

Freelancers and Gig Economy Workers

These renters might be Uber drivers, graphic designers, or Airbnb hosts. Income varies, but they can prove their credibility:

- Use income averaging over 6–12 months. Ask for bank statements, tax returns, or 1099 forms.

- Ask for a higher deposit or a backup co-signer. This can buffer against unpredictable income months.

- Reassess at renewal if income is inconsistent. Set a lease review point at 6 months to evaluate ongoing stability.

In summary, non-traditional tenants just need different methods of income verification to prove they are reliable. You can request these acceptable alternatives to the usual proof of income:

- Bank statements (showing consistent deposits or savings)

- Tax returns (especially for freelancers or self-employed applicants)

- Letters of support (from guardians, institutions, or government agencies)

- Award letters (for Social Security, disability, pensions)

- Housing voucher approval documents

- Scholarship or financial aid letters

- Pay stubs or invoices (for freelancers and gig workers)

Note: Make sure the documentation spans at least the past 3–6 months so you can identify any patterns or red flags.

Samples of Proof of Income Letters

When a formal letter is needed, here are three proof of income letters for apartment template types you can request or provide templates for. Each corresponds to a different tenant type:

Employer-Issued Income Letter (with company letterhead)

Employer-issued income letter template (Source)

Best for: Full-time or part-time employees

This employment verification letter for an apartment is written by the tenant’s employer, confirming job status, income, and length of employment. It should be signed and on official company letterhead.

Tip: Always verify with the company directly if you’re unsure about its authenticity.

Freelancer or Self-Employed Income Letter

Freelancer or self-employed income letter template (source)

Best for: Gig workers, freelancers, business owners

This letter can be self-written by the tenant, outlining their income sources, average monthly income, and length of self-employment. Ideally, it’s backed up with supporting documents (like client invoices or bank statements).

Tip: A letter from a regular client vouching for ongoing work can also help.

Government or Assistance-Based Income Letter

Government or assistance-based income letter template (source)

Best for: Retirees or individuals on disability, unemployment, or housing aid

This letter is issued by the relevant agency (such as the Social Security Administration or your local housing authority) and confirms how much you receive and how often.

It’s often called a “benefit letter” and you’ll typically need it for things like applying for loans, securing housing assistance, or any situation where you must verify your income. The details in the letter are tailored to your specific benefits, such as Social Security, Supplemental Security Income, or Medicare.

Tip: Always check that the letter is recent and includes clear contact info for verification.

What to Do If Income Proof is Missing or Inconclusive

Even with flexible guidelines, there may be times when a prospective tenant just can’t provide sufficient proof of income. Maybe their documentation is incomplete or outdated. In these cases, it’s best to carry out 3 strategies:

Ask for Co-Signers

One of the most effective ways to reduce risk is to ask for a co-signer (someone with a steady income and good credit who agrees to be legally responsible for rent if the tenant can’t pay). Co-signers are commonly parents, close relatives, or even friends. As long as they meet your income requirements and understand their role, this can be a great way to green-light a tenant who may not qualify on their own.

Require a Higher Security Deposit

Depending on your state laws, you can often request up to two months’ rent as a security deposit. This acts as a cushion against missed rent, damages, or early termination. It also shows the tenant is serious and financially committed. Just be upfront about why you're asking for more.

Suggest a Guarantor

If adding a co-signer to the lease isn’t an option, consider a guarantor instead. A guarantor signs a separate legal agreement promising to cover rent if the tenant defaults. This is especially useful in cases where you want to keep the lease straightforward but still need a financial safety net. Like a co-signer, a guarantor should have solid income, good credit, and ideally reside in a jurisdiction where the agreement can be enforced if necessary.

Conclusion

Not every great tenant comes with a neat stack of pay stubs. Sometimes, a well-written proof of income letter backed by creative documentation is all you need. So, save this guide and bookmark the sample proof of income letter formats!

FAQs

Q1. How to prove income for an apartment?

To prove income for an apartment, you can provide documents that show consistent earnings and financial stability. Common options are recent pay stubs, tax returns, bank statements, employment offer letters, or a proof of income letter from your employer. If you're self-employed or freelance, you can use 1099 forms, client invoices, or a letter written by yourself outlining your income sources.

Q2. What is proof of income for an apartment rent statement letter?

A proof of income for apartment rent is any document that confirms you have the means to pay your rent regularly. A rent statement letter is a specific type of document that shows your rental payment history.

![What Is an Admin Fee for Apartments? [2025 Landlord’s Guide]](https://www.leaserunner.com/storage/413/01KAJSZKW3TMYDTGTKJV8VHGPN.webp)