Tenant Background Screening Online Reports

See the full insights behind a prospective applicant with complete renter background reports. LeaseRunner integrates Experian® credit data, eviction history, and detailed tenant background checks into one streamlined dashboard, supporting landlords to uncover the full applicant profile and make leasing decisions you can trust.

What's Coverred?

Get Complete Tenant Insights with

All-Inclusive Screening Reports

Instantly access comprehensive tenant background checks with everything a landlord needs to rent confidently.

Landlords get a full suite of tools for renter screening online—criminal background and income verification, credit

reports, eviction records, and beyond—designed to help simplify the overall tenant screening process.

Eviction Check

Avoid costly risks with a nationwide eviction check. LeaseRunner searches 36M+ records and court filings across the country to flag prior eviction history, helping landlords protect properties and reduce vacancy cycles.

Credit Report

See beyond a tenant’s application, know their true financial stability. LeaseRunner combines Experian® credit data, VantageScore® 3.0, and a tenant risk model to reveal payment history, creditworthiness, and long-term reliability.

Income Verification & Cash Flow Report

Verify more than pay stubs—confirm steady income, employment verification, and cash flow consistency to ensure tenants can comfortably cover monthly rent.

LeaseRunner Dashboards

One

Dashboard,

Complete View of Tenant Profile

A unified and secure tenant screening

dashboard for all your rental decisions. Order, track, and review Experian®

credit,

eviction, and background reports—without handling sensitive data.

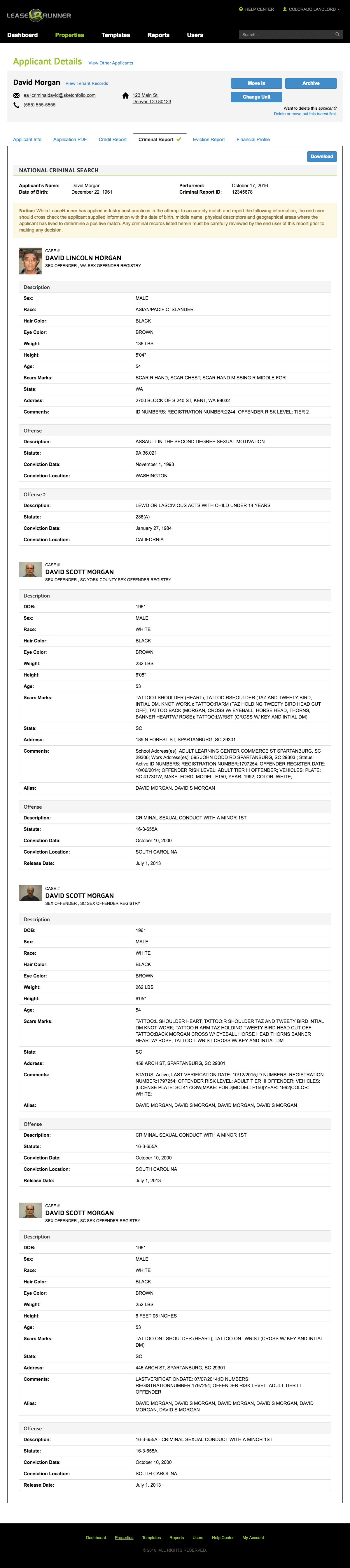

Nationwide Search for Peace of Mind

Our criminal

background check runs a nationwide search across 50+

states and county

court records for information on:

Applicant’s description and offenses

Criminal records cover probation/parole, watch lists, inmate

records,

etc.

Property damage claims, unlawful detainers,...

Identify Prior Landlord-Tenant Disputes

Avoid costly disputes

with LeaseRunner’s eviction report. Look into the

applicant’s eviction

history, including:

Applicant information

Eviction case(s) information & judgements

Property damage claims, unlawful detainers,...

A Deep Look at Financial History

Instantly assess a

prospective tenant's ability to manage rental

payments. With Experian as

our credit bureau, we design a

comprehensive credit report, including:

VantageScore evaluation

LeaseRunner’s tenant risk screening model (New!)

Applicant’s credit summary

Public records, inquiries, and tradelines

Check the Applicant's Ability to Pay

Not only credit data,

LeaseRunner gives landlords clear financial

insights to confirm whether

applicants meet income requirements. This

optional report includes:

Bank transactional detail

Documented income sources

Financial overview (cash trends, balance, deposits vs. withdrawal

graphs)

Credit Report Sample

Want to edit and create a customized form? Download now to get started!

Criminal Report Sample

Want to edit and create a customized form? Download now to get started!

Income & Cash Flow Verification Sample

Want to edit and create a customized form? Download now to get started!

Eviction Report Sample

Want to edit and create a customized form? Download now to get started!

Tenant Screening Process

Screen a Tenant in Four Simple Steps

Screen tenants in 4 simple steps:

start from your dashboard, send the request online, and receive the report

instantly—no

printing or mailing needed.

Request a Screening

Create an account with LeaseRunner. From your LeaseRunner dashboard, generate the screening request by selecting the reports you want (credit, criminal, eviction, income verification, or rental application) and decide who covers the fee.

Invite Applicant

With one click, easily invite the applicant by sending a secure email link, or sharing your custom application URL. Applicants don’t order themselves; they use only the secure link you provide.

Applicant Verifies

The applicant uses the secure link to complete the rental application and provide required screening information. Payment is processed automatically—either by the applicant or the landlord, depending on your setup.

Get The Report Right Away

Once authorization and payment are complete, reports are sent to your dashboard within minutes. You’ll receive credit, criminal, eviction, income, and rental application results in one place. If no credit history exists, the credit report is skipped, the fee is adjusted, and you’re notified.

Benefits

Instant Tenant Screening Reports

with Direct-Source National

Records

Trust your decisions, and let our data back you up. LeaseRunner’s renter screening online tools make the

process

easier, faster, and more secure than ever. Perfect for landlords and property owners who

want confidence and

control in every lease.

See Verified Detail of Tenant’s Background

No more waiting for reports or tracking down info

by info. LeaseRunner gives

landlords one centralized dashboard with immediate access to

Experian® credit,

national eviction history databases, and criminal records.

Tailored to Local Laws By Default

Our solutions automatically adjust to local regulations and preferences (including admissible records and eviction laws), ensuring your leasing process is legally compliant by default.

Skip Setup Delays

Skip the tedious setup and messy paperwork. Go from sign-up to first screening in under 10 minutes. Send applications, screen tenants, and sign leases, all online with no physical paperwork required.

Control Who Pays for Screening Reports

Gain full financial flexibility without sacrificing time. Control who covers the report cost (applicant or landlord) while guaranteeing results are delivered right away.

Verify Identity Across Multiple Points

Stop application fraud before it starts. LeaseRunner uses advanced, multi-point verification across financial and public records to guarantee the identity of every applicant on every submission.

Built for Professionals

Tenant Screening Solutions for

Real Estate

Professionals

Purpose-built tools that give

landlords, property managers, and tenants the clarity and confidence to move faster

in

every rental decision.

Landlords

LeaseRunner equips self-managing landlords with an all-in-one dashboard to centralize tenant applications, screening reports, and payments without the need for expensive or complex software.

Property Managers

Portfolio-ready tools that streamline bulk applicant invitations, standardized criteria, and automated verifications—allowing property managers to scale efficiently, stay compliant, and focus on long-term portfolio growth.

Tenants

For tenants, LeaseRunner offers a transparent screening experience with exclusive PTSR. Securely submit information at a landlord’s request, track progress in real time, and share your PTSR with multiple landlords—all while knowing your data is protected by strict standards.

Portable Tenant Screening Report (PTSR)

One Report. Unlimited Applications. Save on Extra Fees.

For tenants across the U.S, more states are now open to accepting reusable tenant screening reports. With LeaseRunner, you’re ahead of the curve. Order your PTSR online in minutes, share it instantly, save on fees, and increase your approval chances.

One report, multiple uses

Buy once, share indefinitely in 30 days. Tenants purchase their screening report just one time and can share it with any landlord, eliminating the need for repeated payments.

Trusted compliance

Gain landlord trust immediately. Landlords receive a professional, FCRA-compliant report that meets legal standards, giving them the confidence to rely on your data.

Faster apply, faster approval

Skip the line and the duplicates. Eliminate time-consuming administrative delays to speed up approvals and cut unnecessary application costs.

Save on application fees

One-time payment is all you need. You pay a single fee for the report and never pay extra to resubmit the same information. Maximize your savings on your rental search.

Our Offerings

Pricing Plans

Pay-as-you-go and decide who covers the fees, with complete transparency in pricing.

Basic Screening

$17/per applicant

*Paid by applicant or landlord.

Pro Screening

$40/per applicant

*Paid by applicant or landlord.

Ultimate Screening

$54/per applicant

*Paid by applicant or landlord.

Most popular

Premium Screening

$64/per applicant

*Paid by applicant or landlord.

Criminal Background Records

Custom URL and Applications

State-Compliant Data

Address History

Identity Verification

Full Credit Report

VantageScore 3.0

Eviction Records

Nationwide Eviction Database

Judgment Amount Details

Income Verification & Cash Flow Report

Payroll Deposits

Income & Expense Summary

Bank Account Balance

About LeaseRunner

Built By Landlords,

For Landlords Nationwide

Created by landlords who understand your challenges, LeaseRunner streamlines tenant screening into

a flexible, secure, and unified solution—so you save time, cut risks, and make smarter leasing

decisions.

Best Tenant Screening Flexibility

Customize your tenant screenings with LeaseRunner’s flexible options. Order only the reports you need (credit, eviction, criminal, or income) and easily bundle them for a complete, tailored screening package.

Mobile-Optimized Applications

More than 60% of renters complete applications on their phone.. LeaseRunner is built for mobile, so applicants can securely apply, verify identity, and submit documents anytime, anywhere, helping landlords and agents fill vacancies faster.

Data Security Assurance

LeaseRunner keeps sensitive information safe with encrypted systems and FCRA-compliant standards. Applicants enter their own Social Security and financial data, so landlords never touch private information, reducing liability risks.

Simple, Effective, No Monthly Fees

With LeaseRunner, the payment options are flexible. You can pay per report or pay for your own bundle. On average, landlords can save $500+ per year compared to subscriptions, while still accessing professional, instant tenant screening services.

Awards & Recognitions

Recognitions That Speak Volumes

From industry innovation awards to nationwide adoption, LeaseRunner is trusted by thousands of landlords,

property professionals, and organizations across the country.

10,000+

Trusted by landlords across over 10,000 ZIP codes nationwide.

50+

Providing seamless leasing solutions in all 50 states.

500,000+

Serving over 500,000 clients and growing every day.

Testimonials

Over 12 Years of Trust and Success

Discover More Features

FAQs

Frequently Asked Questions

A tenant screening report provides essential information to evaluate a prospective tenant's background history and rental responsibilities, including credit scores, criminal background checks, payroll verification, and eviction records. LeaseRunner offers comprehensive, all-inclusive reports in one platform that helps landlords make informed, data-driven leasing decisions with ease.

No, tenant screening does not impact a tenant's credit score. At LeaseRunner, we use soft credit inquiries, which allow us to gather the necessary data without affecting your applicants' credit standing, ensuring a smooth screening process.

LeaseRunner offers affordable and transparent pricing for tenant screening. We offer both tenant screening packages and separated reports, depend on your preferences, with À la Carte options including:

- Credit Report: $23

- Eviction Report: $14

- Criminal Background Check: $17

- Payroll Verification & Cash Flow Report: $10

For a complete listing of Tenant Screening Packages, visit LeaseRunner Pricing.

Most LeaseRunner tenant screening results are delivered immediately through your dashboard. Comprehensive reports, including credit, criminal, and eviction history, are available in real-time. Only specific, advanced verifications like payroll or bank cash flow analysis may require a brief delay, which depends on the applicant's response time.

Yes, applicants can pay for their own screening directly with LeaseRunner. This feature saves the landlord time and money by eliminating fees and the need to handle sensitive financial details. The process is entirely secure and applicant-paid for full transparency.

Absolutely, LeaseRunner tenant screening is 100% FCRA compliant. We strictly follow the Fair Credit Reporting Act (FCRA) guidelines, ensuring that all reports—including credit and background checks—are accurate, secure, and legally reliable for making housing decisions.

LeaseRunner stands out by offering direct-source Experian® data and a flexible pay-per-use model with zero setup fees or monthly subscriptions. We differentiate ourselves with unique reports like Payroll Verification and Cash Flow Analysis, giving landlords deeper, unparalleled insight into a tenant's financial reliability that competitors often lack.

Insights