Knowing how to write a rent receipt is a key skill for landlords. A clear rent receipt template must include the payment date, tenant and landlord names, property address, amount paid, and rental period covered. For example, a receipt showing $1,200 paid on “09/28/2025” for “September 2025 rent” at “123 Ash St” clearly proves payment.

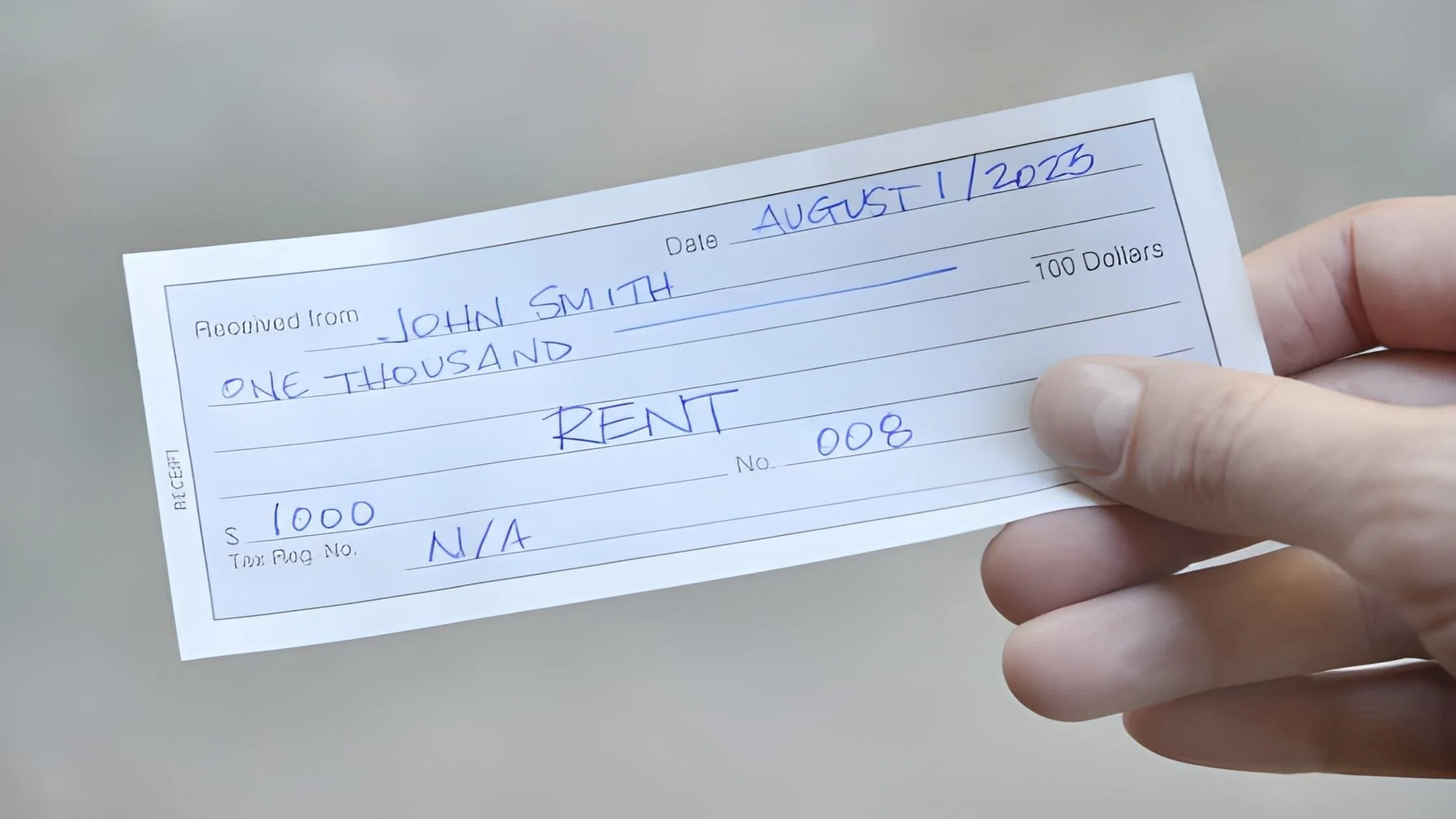

Rent receipt forms can be handwritten, using carbon-copy pads to keep records, or sent as digital versions, which let large landlords fill, print, or email receipts fast. Yet, all versions should include payment methods and extra fees.

A proper rent receipt form should clearly show when rent was paid and for what period. Mastering different ways to write a rent receipt with tools like LeaseRunner helps landlords stay organised and build trust. Scroll down now for more information!

What Is a Rent Receipt?

A rent receipt is a written paper or digital form that shows proof that a tenant paid rent. It records key details like the payment date and amount. This document creates a clear money trail and protects both landlord and tenant in case of disputes. Understanding what a rent receipt is also helps landlords document rental payments correctly.

A rent receipt’s main role is to confirm that rent was paid on a specific date for a set amount. For example, a tenant hands over $1,200 cash for October rent. The landlord should give a receipt stating the payment date, amount, tenant and landlord names, and rental address. This shows the tenant paid and prevents future confusion.

A basic rent receipt template usually includes these parts:

- Payment date and time (e.g., October 1, 2025)

- Tenant and landlord full names

- Property address (e.g., 123 Main St, Apt 4B)

- Exact payment amount and method (cash, check, online)

- Rental period covered (October 2025 rent)

- Signatures of both parties (or digital confirmations)

There are various receipts for rental property formats. Some landlords use simple handwritten forms, while others prefer a printed landlord rent receipt template. Digital rent receipts generated by property management software are useful as well. For example, using an automated system, receipts print instantly when a tenant pays online.

A well-filled rent receipt example shows all these details clearly. Knowing how rent receipts work helps landlords collect rent and issue receipts smoothly. At the same time, you are able to keep accurate records for tax or legal needs.

Why Rent Receipt Matters?

A rent receipt is more than just a note that rent was paid. It helps landlords build trust, protect themselves legally, and manage their rental properties well. In many regions, landlords must provide a rent receipt, especially if tenants pay rent in cash.

For example, when a tenant hands you cash, the law often requires you to give a written monthly rent receipt immediately. Even if tenants pay by check or electronically, issuing receipts remains a recommended practice. Doing so with a clear landlord rent receipt template safeguards both parties and confirms the payment.

Providing a receipt for paying rent prevents future disputes about whether rent was paid and when. For the tenant, this receipt is the single most important document to prove they met their obligations under the lease. It also supports accurate accounting, as keeping receipts for rental property helps landlords report tax return on rental income correctly.

Moreover, transparent payment records foster good relationships with tenants by building trust. A clear rent receipt is essential for the tenant when applying for governmental assistance programs, such as housing vouchers or tax credits, which often require official proof of payment history.

Landlords often use a rent ledger to track all payments systematically. Regardless of format (paper or digital), a well-documented rent receipt serves as proof of rent paid for a specific rental period. This document is the tenant's primary defense in any eviction proceeding based on non-payment of rent. And this is especially important in places with special rules, like those found in rent-stabilised vs rent-controlled markets.

For example, if a tenant claims they paid but you have no receipt, resolving the issue can become difficult. Issuing clear receipts simplifies tenancy reviews, audits, and legal matters. It demonstrates professionalism, protects rental income, and ensures your property management runs smoothly.

How to Write a Rent Receipt Step by Step?

Creating a proper rent receipt is important. It helps keep things clear between landlords and tenants. Following these steps makes sure your receipts are complete and legally valid.

Step 1: Include the Date of Payment

The payment date is one of the most important parts of a rent receipt template. It shows when the rent was actually received. Use the exact day you got the money, not when the tenant claims to have sent it. For cash, write the day you held the payment. For checks, use the date you received the check, even if you deposit it later.

Many landlords use the MM/DD/YYYY format for clear records. Writing the full month can also avoid confusion, especially if you rent to international tenants. For example, "September 28, 2025" is clearer than "09/28/25."

Step 2: Write the Landlord and Tenant Information

Include the full names and contact details of both the landlord and the tenants on the rent receipt form. Use the legal names found in the lease agreement. If there are multiple tenants responsible for rent, list them all, even if just one pays. For instance, if Jane and Mike co-rent an apartment, both should appear on the receipt.

Landlords should also add their legal name or business entity and contact info, such as phone number or email. This makes the receipt valid and clear.

Step 3: Specify the Rental Property Address

Write the full address of the property the rent covers. Include the unit or apartment number, street, city, state, and ZIP code. This avoids confusion, especially if you manage many properties. For example: "Apartment 4B, 123 Elm Street, Springfield, IL 62701."

It is crucial to identify the exact rental unit when dealing with multi-unit buildings or when tenants share names or similar rents. Clear addressing helps prevent mistakes in payment records.

Step 4: State the Amount Paid

Write the rent amount both numerically and spelled out to avoid fraud or errors. For example, “$1,250.00 (One Thousand Two Hundred Fifty Dollars and 00/100).” If there are extra charges like late fees or pet charges, list these separately. This allows tenants to see exactly what they paid for and helps landlords track income clearly.

You should definitely learn more about the fees landlords might charge or about the application fee for rental, to decide how best to document charges on receipts.

Step 5: Indicate the Rental Period Covered

Clearly mention the rental period the payment covers. Use start and end dates, such as “October 1, 2025, to October 31, 2025.” This prevents confusion over which rent month the payment is for, which is especially important if tenants pay rent late or in advance (since it’s different between month-to-month rent and longer rent periods).

If tenants pay several months at once or include security deposits, separate those payments on the receipt. This practice keeps your accounting clean and eases tax reporting.

Step 6: Note the Payment Method

State how the rent was paid. Different methods require different details:

- For cash: Write "cash" and keep it secure, ideally with a witness for large amounts.

- For checks: Record check number and bank name.

- Electronic payments: Note the transaction number and platform name (e.g., Venmo, bank transfer).

- Money orders: Include issuer and serial number.

Digital payment platforms and property management software can help generate rent receipts automatically, capturing these details for you.

Step 7: Add a Statement Confirming Payment

Include a clear statement like: "Received payment of [amount] from [tenant name] for rent covering [dates] for the property located at [address]."

This language confirms exactly what the payment is for and prevents misunderstandings.

Step 8: Signature and Contact Information

Sign the receipt as the landlord or authorised agent. If possible, have the tenant sign too, showing they acknowledge receipt of the payment. Keep the signatures consistent with those on lease agreements.

Also, add your current contact details, so tenants have an easy way to reach you if questions arise. This supports the best way to collect rent by keeping communication clear. Following these steps helps landlords create a professional rent receipt that is clear, accurate, and legally sound.

How to Format Your Rent Receipt?

Formatting your rent receipt well makes it easy to read and legally useful. Whether you handwrite it or use a template, clear and complete documentation matters.

By Hand

For small-scale landlords or those with a few units, a handwritten rent receipt form can work well. It should be neat and include all necessary fields such as payment date, tenant and landlord names, property address, payment amount, and rental period covered.

For example, use a carbon-copy receipt book to keep a duplicate for your records while giving one to the tenant. This method suits cash payments, which often legally require a receipt issued at the time of payment, as seen in many jurisdictions.

Using a Template

Templates help landlords stay consistent and professional. Our LeaseRunner rent receipt template comes in various formats like PDF, Word, and Google Forms. It has all the essential fields laid out, so landlords never miss a detail. You can quickly download, fill out, print, or email receipts to tenants.

Using a template also supports recordkeeping for landlords managing multiple properties or tenants. Automation from property management software programs can even compose rent receipts instantly once payment is logged, improving efficiency and accuracy.

Sample Rent Receipt Template

Here’s a LeaseRunner example of a filled-out receipt that landlords can customise for their properties:

This sample shows the core components that every rent receipt should have for clarity and legal effectiveness. Proper formatting helps both landlords and tenants keep clear, trustworthy payment records across all rental transactions.

Digital vs. Paper Rent Receipts: Which Is Better?

Comparing receipt format options helps landlords pick the best fit for their needs. Digital receipts have many benefits. They can be made automatically and stored easily. Tenants get them instantly by email. They often link with accounting software, too. Besides, digital receipts are also better for the environment. Some property management systems can create these receipts when rent is paid. This cuts down on manual work and keeps receipts consistent.

Yet, paper receipts have their own advantages. They are ready right away with no tech needed. All tenants know how to use them. Paper copies also serve as a backup that does not need electricity or the internet. Some tenants prefer paper because it fits their way of keeping records. Therefore, choosing the right format depends on your operation and record-keeping needs.

Digital Receipt Advantages:

- Automatic generation and delivery

- Easy storage and backup

- Integration with accounting software

- Instant search capabilities

- Environmental benefits

Paper Receipt Advantages:

- No technology requirements

- Immediate availability

- Physical backup security

- Universal tenant familiarity

- Simple for small operations

Legal validity considerations show that both digital and paper receipts are generally accepted in legal proceedings when properly created and maintained. Understanding what a rent ledger is helps integrate receipt systems with comprehensive record-keeping approaches.

Common Mistakes to Avoid When Writing Rent Receipts

Understanding frequent errors helps landlords maintain professional standards and avoid legal complications.

Most Common Receipt Mistakes:

- Incomplete or missing information: This often includes failure to note the full names of both the landlord and tenant, the full property address, the exact date the rent was paid, the specific amount received, the period the payment covers, and the method of payment (e.g., check, cash).

- Inconsistent formatting across receipts: Using different layouts, font sizes, or numbering schemes for each receipt makes verification and future auditing difficult.

- Poor record-keeping and storage practices: Receipts are simply printed and then thrown in a drawer or filed randomly, making it impossible to quickly retrieve a specific proof of payment.

- Legal compliance oversights: Forgetting to include state ( or province) mandated details (like specific warnings or tax identification numbers) or not providing a receipt when legally required to do so (e.g., for cash payments).

- Timing errors in receipt issuance: Issuing the receipt several days or weeks after payment is made instead of immediately or within the legally stipulated timeframe.

- Illegible handwriting or unclear details: Handwritten receipts that use sloppy writing, smudges, or unclear abbreviations that a judge or auditor would be unable to decipher.

- Missing backup copies: Only providing the original receipt to the tenant and failing to make and securely keep a duplicate for the landlord's own records.

- Inadequate security measures for sensitive information: Storing physical receipts where they could be easily accessed by unauthorized persons or saving digital copies on unencrypted drives.

LeaseRunner’s templates are designed to eliminate these mistakes by guiding every entry step.

How Long Should You Keep Rent Receipts?

Keeping your rent receipts for the right amount of time is key to running a smooth rental business. It protects you legally and helps with taxes and recordkeeping. The IRS generally says landlords should keep rental income records for at least three years after filing tax returns. But it can be smart to hold onto them for up to seven years. This helps if you face audits or legal issues long after a tenancy ends.

For example, if you ever need proof of rent payments to resolve disputes or support your tax filings, having detailed receipts for rental property is crucial. Different states may require landlords to keep records for different lengths of time, usually between three and seven years. Some states want special records for tenant security deposits, rent control rules, or fair housing laws. Knowing these rules helps landlords stay compliant and avoid penalties.

Digital storage offers big benefits for keeping rent receipt forms over time. You can store unlimited documents without taking up physical space. It also makes it easy to back up your files and search for past receipts quickly. Cloud systems help landlords avoid losing records and allow access from anywhere. This modern approach makes managing rental finances safer and more efficient.

Historical payment data also matters when determining things like how much the landlord can raise rent. Also, for landlords new to the business, keeping good records supports renting out a house for the first time by proving good faith and professionalism.

By keeping your rentals' financial history well-organised, you protect your business and make tax time less stressful, all good reasons to keep rent receipts carefully filed for the long haul.

Conclusion

Learning how to write a rent receipt is simple, but it must include key details. A good rent receipt template has the date, tenant and landlord names, property address, payment amount, and rental period. Handwritten rent receipt forms work for small landlords. Use carbon-copy pads to keep a copy. Digital templates help large landlords quickly create and send receipts by email.

A clear rent receipt form protects both sides from disputes. It shows when rent was paid and the payment method. Mastering ways to write a rent receipt keeps landlords organised and trusted.

FAQs

Are Rent Receipts Required by Law?

Yes, in many places, rent receipts are mandatory for cash payments and advisable for all forms, especially for dispute protection. Check local statutes and LeaseRunner templates for compliance details.

Do tenants need to sign rent receipts?

Yes, Signatures are not always required from tenants, but a landlord or property manager's signature or electronic authorisation is crucial for verified “rent receipt” documentation.

Are digital receipts legally valid?

Yes, they are. Digital “rent receipt” forms are recognised in most jurisdictions if they include all key details and confirmation of payment.

Can a rent receipt be used for tax purposes?

Absolutely. “Rent receipt forms” serve as official documentation for both landlords' rental income and tenants seeking deductions. Ensure all core elements are present for audit readiness.