A rent late fee is one of the most important tools landlords use to encourage on-time payments and protect cash flow. This article breaks down everything a landlord needs to know about the rent late fee: the definition, legal rules, calculation methods, common practices by state, when and how to apply it, and what to do if late payments keep happening.

Whether you’re new to property management or want to make your process more secure, knowing the rules about late rent charges helps avoid costly mistakes. Below you’ll find a quick facts table and reviews of the six criteria you should monitor most closely.

Quick Facts Table: Rent Late Fee Essentials

What Are Late Rent Fees?

The rent late fee is an additional charge landlords can add when rent is not paid by the due date. It is designed not to punish tenants but to help cover the extra time and effort landlords spend managing late payments. This fee encourages tenants to pay on time and helps landlords offset these added tasks.

Some components of a late fee are:

- Flat fee: A fixed dollar amount, added when payment is late.

- Percentage fee: A set % of the month’s rent, usually 5–10%.

- Daily charge: Sometimes, a small fee for each day's rent is overdue.

An important factor is that late fees only apply after the lease’s grace period ends, this is a tenant protection. In many states, it is illegal for landlords to charge late fees before the grace period finishes. The grace period gives tenants extra time (often 3 to 5 days after rent is due) to pay without penalty.

Some landlords only charge a late fee if the lease specifies it. State rules may further limit, require, or prohibit certain types of late fees. For example, in California, the rent late fee must be “reasonable” and tied to actual costs, not excessive or punitive. That means landlords can’t add a high late fee just to scare tenants; the cost must reflect real inconvenience or expenses.

Suppose your rent is $1000, and your lease calls for a $50 late rent charge after a five-day grace period. You pay on day seven. You now owe $1,050—rent plus the late rent fee.

All in all, late fees provide structure and reminders while helping landlords cover missed opportunities and costs. For tenants, these fees encourage timely payments and establish boundaries for what happens if the rent isn’t paid.

What Is the Typical Late Rent Fee for Landlords?

Understanding the typical late charge for rent helps landlords set fair expectations and gives tenants insight into industry norms. The average rent late fee US-wide is around $85, but this varies by location; some states cap late fees as either a percentage or flat fee, while others require fees to be “reasonable” and tied to actual costs.

Variations in late rent fees are:

- Some landlords charge $50 (on a $1000 rent) for late payment, while others set the penalty at 5% of rent.

- In highly competitive markets (New York, California), fees must not be excessive.

- Commercial leases may have entirely different rules for late charges.

The rent late fee is always clearer when it is explicitly outlined in the lease agreement and follows all local and state rent late fee laws. Landlords can set this fee as either a percentage of the rent amount (commonly 5-10%) or a flat fee, as long as these charges comply with regulations and are clearly communicated to tenants in the lease. For help drafting clear lease terms that include late fee policies, visit this LeaseRunner page on lease agreement templates.

For deep dives into how landlords calculate and enforce the rental late fee, check out our past due rent notice resource and guide to raising rent legally. By knowing the typical late charge for rent, both sides can prepare for what may happen if rent is paid late, making it less likely that surprises or disputes arise.

When Can Landlords Apply Late Fees?

For every landlord considering how to apply a rent late fee, understanding the right timing and legal rules is critical. When you can charge a fee depends on your lease agreement, local laws, and policies like the grace period for rent payment. Here are the most common rules landlords face, explained in detail:

- Lease Must Specify Late Rent Charge: Your lease must clearly state when a late rent charge applies; without this clause, landlords usually cannot impose fees. Be sure to include specific language about your typical late fee for rent, including amount, timing, and how it’s calculated, to avoid disputes.

- Grace Period Is Usually Required: Most states require a grace period of about 3 to 5 days after the rent due date during which no rent late fee can be charged. This helps tenants who might have payment delays due to banking schedules or paychecks arriving late.

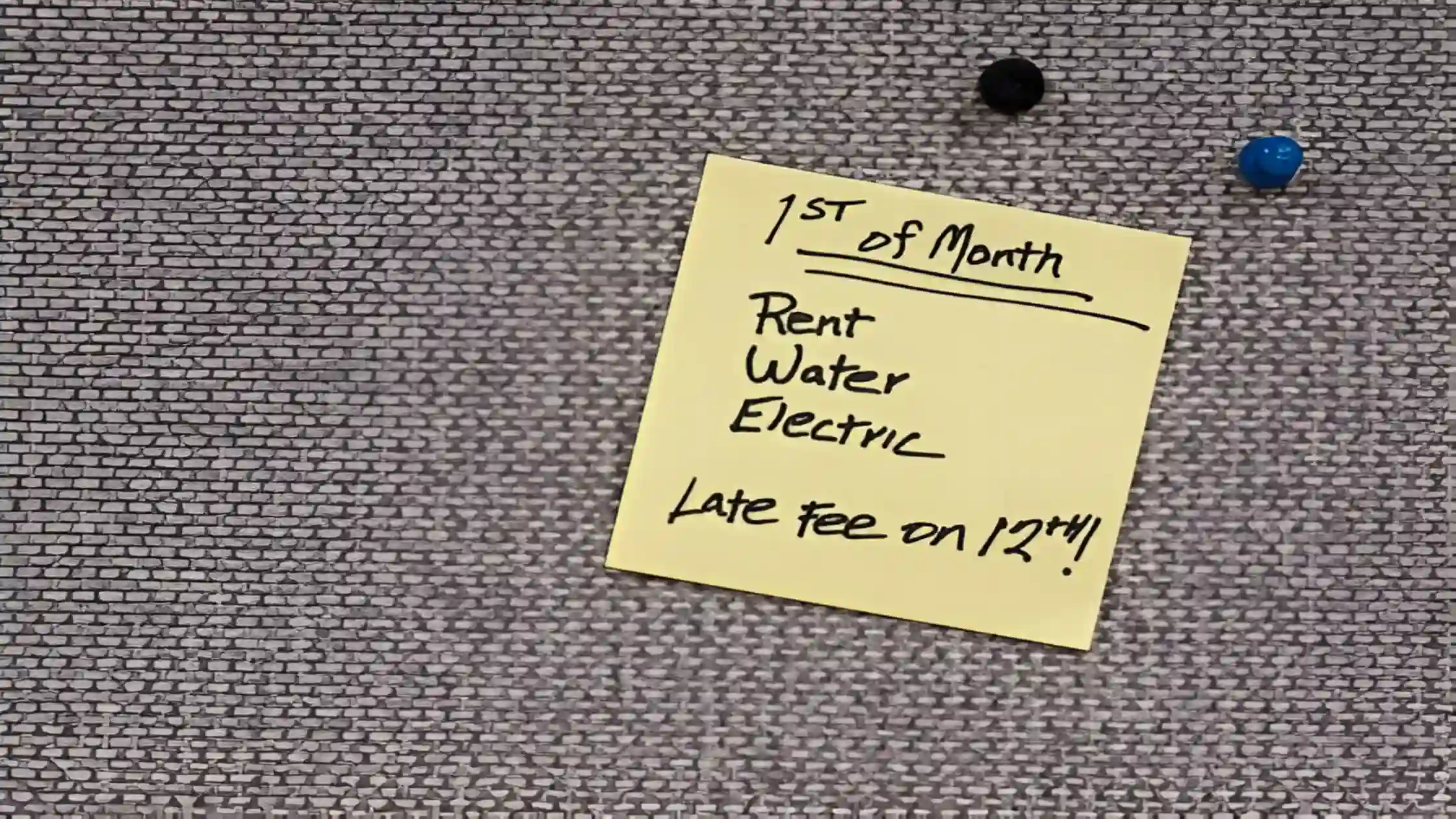

For example, if you have rent due on the 1st, and your lease allows for 5 days of grace for late rent payment, charging a late rent amount before the 6th day would be questionable.

- Late Fee Timing Starts at Rent Due Date: The clock to assess a rent late fee runs from the agreed due date, which usually is the first day of the rental period. Charging fees before this date or during the grace period can lead to legal issues. Be consistent and transparent about this timing in your lease.

- Exemptions from Late Fee Regulations: Certain states restrict late rent fees during an extraordinary time period- for example a pandemic or natural disaster. Some states merely limit the amounts that can be charged, or postpone/not enforce applying fees. Be aware of temporary regulations and local ordinances that may impact your ability to charge late fees.

By knowing exactly when landlords can apply late fees, you protect your rental income while following all applicable rent late fee laws. This clarity benefits both landlords and tenants and supports a fair renting experience. If late fees and other attempts at collection fail, you may want to know more about what happens when unpaid rent goes to collections.

How Late Fees Vary Across Different States?

Every state has different rules for late rent fees. This means that landlords must know local laws before charging a rental late fee. What works in one state might be illegal or limited in another. To help landlords navigate, here is a summary of the common limits and rules in six key states: California, Florida, Illinois, New York, Texas, and Kansas.

Landlords in California must know the California rent late fee laws well. These laws require the fee to reflect actual costs and not be punitive. Charging a high late fee without cause can lead to legal problems.

Some states, like Florida, do not have hard limits but expect fees to be fair. Always check for a stated grace period for rent payment. This period means you cannot charge late fees immediately after rent is due.

Remember, many states require landlords to provide tenants written notice about fees and their amounts. Consistent enforcement of fees in line with each state’s rules keeps the rental relationship smooth. By understanding the local rent late fee laws, landlords can calculate the typical late charge for rent properly and protect their income lawfully.

How Are Late Rent Fees Calculated?

Calculating a rent late fee involves a clear and legal approach. Landlords must follow state laws and lease terms to charge fees properly. The goal is to be fair, transparent, and effective in encouraging timely payments.

1. Flat Fee

Many landlords choose a flat fee when calculating the late rent fee because it is simple and predictable. This method charges a fixed dollar amount once rent is late beyond the designated grace period. For instance, a lease might specify a $50 rent late fee if payment arrives more than three days after the due date.

The flat fee approach is common in states like California and Illinois, where the law requires fees to be reasonable, covering only the landlord’s actual costs without becoming a penalty. Tenants appreciate this clarity, knowing exactly what they owe if late.

2. Percentage of the Rent

Another common method is charging a percentage of the monthly rent as the late rent charge. This is often between 5% and 10%, adjusting the penalty based on the rent amount. For example, if a tenant’s monthly rent is $1,200, a 5% late fee equals $60.

This method makes the late rent fee proportional and fair across different rental amounts. It works well in markets with varying rent levels, ensuring that landlords recover costs effectively without excessive charges.

3. Daily Penalty

The daily penalty method charges an additional fee for each day rent remains unpaid after the grace period ends. A lease might say, “A $10 daily late rent fee applies after the third day.” If rent is paid six days late, the tenant owes $30 in fees plus rent.

This structure discourages chronic lateness by increasing costs the longer rent is unpaid. However, many states limit daily penalties with caps or require reasonableness, so landlords should verify local rent late fee laws before enforcing this method.

By choosing one of these methods and clearly stating the terms in the lease, landlords can solidify expectations and protect their income. Consistent and legal enforcement of the rental late fee supports a smooth landlord-tenant relationship. For further reading, our guide on net rent vs gross rent explains how rent calculations interact with these fees.

How to Apply a Late Rent Fee for a Landlord?

Applying a rent late fee involves more than simply adding an extra charge. Landlords must follow a clear, fair, and legal process. This helps protect income while maintaining a good relationship with tenants. Here’s a step-by-step guide to applying a late fee correctly.

1. Include a Late Fee Clause in the Lease

The lease is the foundation for charging any late rent charge. Always spell out how you calculate the fee, the amount, when it applies, and how you will notify tenants. For example, a clause might say, “A $50 rent late fee applies if rent is unpaid 3 days after the due date.”

This upfront clarity means tenants know exactly what to expect if they pay late. Make sure your lease complies with local rent late fee laws to avoid disputes. Avoid vague language like “tenant may be charged a fee.”

2. Define a Grace Period

A fair lease gives tenants a grace period for rent payment. This is a set number of days after the rent due date when no rental late fee applies. Common grace periods range from 3 to 5 days.

For instance, some leases allow a 5-day window to cover banking delays or paycheck timing. Including a grace period avoids unfairly penalizing tenants who pay slightly late but without ill intent. Be sure to communicate the grace period clearly in lease discussions and written documents.

3. Charge the Late Fee After Grace Period

Always wait until the grace period ends before charging any late rent fee. For example, if rent is due on the 1st with a 5-day grace period, apply the late rent charge starting from the 6th.

Charging early can violate state laws or result in unfair treatment claims. Follow both your lease terms and applicable rent late fee laws strictly to remain compliant.

4. Communicate with the Tenant

Maintain open communication anytime rent is late. Explain the consequences of missing the payment and the extra cost from the rent late fee. Offering options like payment plans or partial payments builds trust. Tenants often appreciate a clear, respectful approach rather than surprise fees. Proactive communication can reduce habitual late payments and tenant stress.

5. Enforce Late Fees Consistently

Consistency is key. Always apply the agreed rental late fee fairly to all tenants according to your lease. Never waive fees arbitrarily or only for some tenants. Inconsistent enforcement can lead to legal problems or accusations of discrimination. Make sure your process is transparent, structured, and easy to follow.

Why Some Landlords Choose to Implement a Grace Period?

The grace period for rent payment is more than a simple courtesy. It helps build trust between landlords and tenants and keeps rental units occupied. Many landlords, including us at LeaseRunner, find that offering a grace period reduces conflicts and improves tenant satisfaction.

Tenants often experience financial delays due to factors beyond their control. Paychecks may arrive late, banks can have processing delays, or holidays might disrupt regular payment schedules. A grace period of 3 to 5 days after the rent due date gives tenants a little breathing room to get their payments in without penalty.

This small allowance signals that the landlord is understanding and reasonable, which can be an advantage when tenants choose where to rent. Charging a rent late fee without first providing a grace period can cause unnecessary disputes and even lead to legal challenges.

Some states require a grace period before any late rent charge can be applied, while others look unfavorably on fees that seem harsh or punitive. By allowing a grace period, landlords show fairness and avoid damaging relationships with tenants who might otherwise face financial stress.

At LeaseRunner, we have seen that a well-implemented grace period helps maintain better relationships and reduces tenant turnover. It fosters open communication, making it easier to enforce rental late fee policies when needed.

What Happens After the Grace Period Ends?

Once the grace period for rent payment is over, landlords have several steps to follow:

- First, apply the late rent charge exactly as described in the lease. It is important to keep your lease up-to-date so these charges are clear and enforceable.

- Next, send a clear past-due rent notice to the tenant that specifies the amount owed, including any late rent fees and additional charges.

- Finally, if the tenant still does not pay, consider offering a payment plan before moving toward eviction. Flexibility can sometimes avoid lengthy and costly legal processes. Throughout this time, document all communications and payments carefully. This record-keeping will help you demonstrate if disputes arise.

Repeated late payments might suggest deeper tenant problems, so keeping detailed records of rental late fee assessments and grace period observations can be important. Clear documentation supports the fairness of your process and is useful if a case goes to court.

Many landlords also use a well-known benchmark to evaluate tenants’ financial responsibility, the “3 times the rent” rule. This guideline ensures tenants have income sufficient to cover monthly costs comfortably. For more, see our detailed explanation of the 3 times the rent rule.

How to Deal with Tenants Who Consistently Pay Late?

When rent comes late every month, landlords need a plan. Not only does the rent late fee help, but a smart, repeatable system keeps your rental business running smoothly. Follow these steps for success.

Step 1: Open Communication

Start with a quick, polite call or text. Ask why the payment is late and listen for any problems. For example, a tenant may explain their paycheck arrives after the rent due date.

Offering a clear reminder about the grace period for rent payment could resolve the issue fast. Good communication builds trust, opens the door for solutions, and often prevents future delays with the rental late fee already in place.

Step 2: Review Lease Terms and Send Written Notices

Give the tenant a copy of the lease. Point out the rent late fee and the late rent charge sections. Use written notices to mark each late payment.

Written notices make the rules clear. Remind the tenant of any typical late charge for rent and that every missed deadline could affect their record. Always keep a copy of every notice sent. This is particularly important as many legal actions, like evictions, require a specific notice period.

Step 3: Enforce Late Fees and Offer Payment Plans

Apply the agreed-upon rent late fee without delay. Show how you calculated their late rent charge based on lease terms. For example, a $50 late rent fee after a three-day grace period is easy to explain. If the tenant struggles, offer a payment plan in writing. Get both sides to sign it. The plan should show missed payments, due dates, and allow real tracking for the average rent late fee owed.

Step 4: Issue Pay-or-Quit Notices if Needed

If payments are still late, give a formal pay-or-quit notice. List the total late rent charge and how much must be paid in full. Use the required format for notices in your state. For tenants in California, review our month-to-month rent increase guide for more on local rules about California rent late fee laws.

Step 5: Consider Alternatives to Eviction

If the tenant is usually responsible, try mediation, or consider switching to month-to-month. Keep the relationship positive. Remember: strict, consistent action with your rent late fee and policy is the best way for landlords to protect income and maintain control.

Conclusion

Every landlord needs a rent late fee strategy to stay profitable and professional. Following state laws about rental late fee limits, communicating clearly about the late rent charge, defining the grace period for rent payment, and being fair to tenants make management easier for everyone.

As we’ve shown, knowing how much a landlord can charge in late fees and how to calculate late rent fees leads to smooth and legal operations that benefit both sides.

Our LeaseRunner resources give you proven, up-to-date tools for notices, fee calculations, lease updates, and best practices for rent late fee laws, so you never feel lost, no matter what state you operate in.

FAQs

What If Rent Is Due on a Weekend or Holiday and Your Tenant Doesn’t Pay?

Most leases and state statutes provide that payments due on weekends or holidays get a one-day extension. The grace period for rent payment often takes this into account, but it should be clarified upfront in your lease agreement.

What Happens After the Grace Period Ends?

After the grace period for rent payment ends, landlords can charge the written late rent fee or late rent charge. LeaseRunner suggests sending an official notice and being open to payment plans before taking further action.

What Should You Do If Your State Lacks a Maximum Late Rent Fee?

Where there is no set maximum rent late fee, landlords should rely on “reasonableness.” Never charge excessive penalties; base the fee on real inconvenience or costs. Clarify the terms with tenants and consider trends in your market.