A disposition letter is a formal document provided by a landlord to a tenant after the lease ends. It explains how the security deposit disposition is handled, detailing deductions for damages, unpaid rent, or other charges, and showing the final refund amount. Understanding what is the meaning of disposition letter helps landlords avoid disputes, maintain transparency, and comply with state laws.

For landlords, a clear disposition letter also serves as legal documentation if tenants challenge deductions later. Including examples and receipts strengthens the letter’s validity. For instance, if a tenant damages a countertop or leaves significant stains on carpet, itemized costs can be documented in the letter.

What is a disposition letter from a landlord?

A disposition letter from a landlord, also known as a security deposit disposition form, is an official notice sent to a tenant after the termination of a lease. This letter details how the landlord handled the tenant's security deposit, including any deductions for damages, unpaid rent, or other charges.

To understand typical deposit amounts, check out how much is a security deposit for more insights.

Many tenants often ask, “what does disposition mean on a document?” Simply put, disposition refers to the act of settling or allocating a financial obligation, in this case, the security deposit.

The letter typically communicates:

- The original amount of the security deposit.

- Any deductions made for damages or unpaid rent.

- The final amount returned to the tenant.

- A summary of charges or repairs conducted on the property.

Issuing a disposition letter is not just good practice; in most states, it is legally required. For example, in California, landlords must provide a security deposit disposition letter within 21 days of the tenant vacating the property. Failing to do so may result in legal penalties.

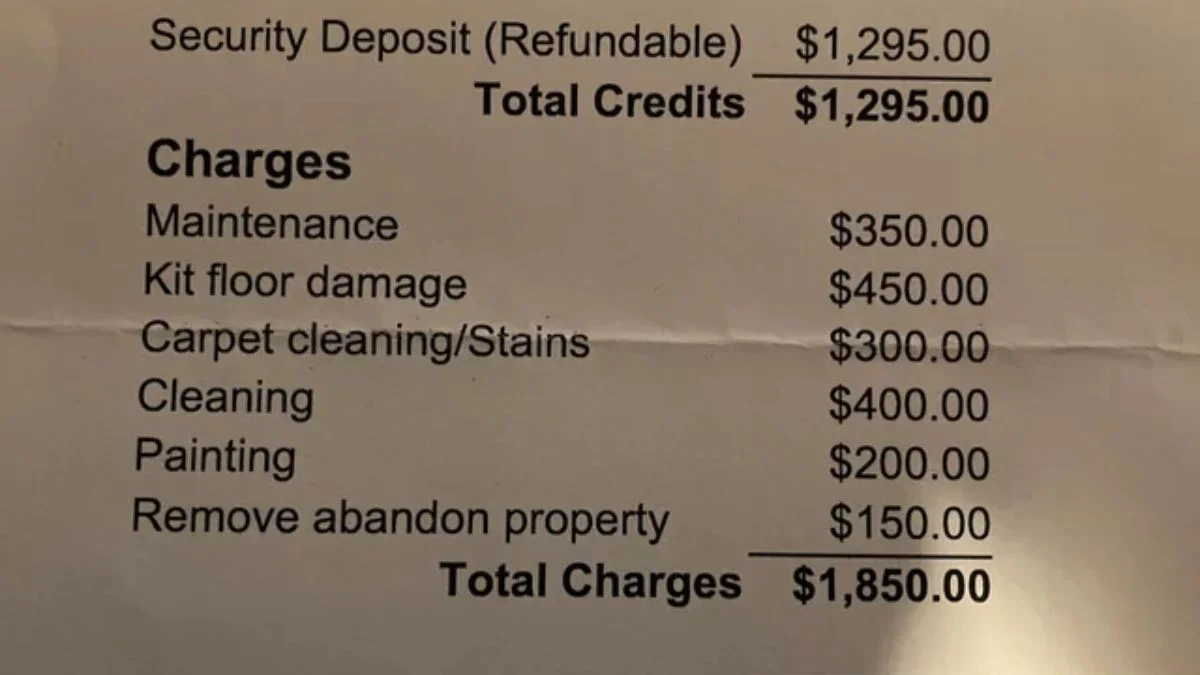

Example: A tenant paid a $1,500 security deposit. After moving out, the landlord found $200 worth of carpet damage and $50 for cleaning. The disposition letter would itemize these deductions and state that $1,250 will be returned to the tenant.

Landlords managing properties can also benefit from reviewing related guides like how to get out of lease early or lease termination letter template for broader lease-end management.

What Is the Purpose of a Disposition Letter?

Understanding what is the purpose of the disposition helps landlords recognize its legal and practical significance. The primary objectives include:

- Transparency: Tenants receive a clear explanation of any deductions from their security deposit.

- Legal Protection: Proper documentation shields landlords from disputes or claims of unfair withholding.

- Record Keeping: A disposition letter serves as official documentation for financial and tax records.

- Conflict Resolution: Early communication via a written statement can prevent misunderstandings and potential litigation.

In essence, the disposition letter ensures that both parties understand the financial outcome of the tenancy, promoting trust and accountability.

What Is Included in a Disposition Letter?

A well-drafted disposition letter must be clear and contain specific details to be legally sound. It should effectively act as a notice of disposition.

Tenant's and Property’s Identification

The letter should begin by identifying the tenant and the property:

- Tenant’s full name.

- Address of the rental unit.

- Lease start and end dates.

This section removes ambiguity and ensures the document is specific to the tenant in question.

Original Deposit Amount

State the total dollar amount the tenant initially paid as the security deposit. This sets the baseline for the accounting. (For a refresher on the difference between this and other fees, check out our guide on move-in fee vs. security deposit.)

Example: “Your original security deposit was $1,500, paid on June 1, 2025.”

Itemized Deductions

List every deduction with clear explanations. Common deductions include:

- Repairs beyond normal wear and tear (normal wear and tear).

- Unpaid rent.

- Cleaning costs.

- Fees for lost keys or security devices.

Each deduction should have a dollar amount and a description, ensuring tenants understand the reasoning behind each charge.

Final Amount Returned

After listing deductions, specify the amount returned to the tenant. Include information on how the payment will be delivered:

- Check or direct transfer.

- Expected delivery date.

Signature and Date

End the letter with the landlord’s signature, printed name, and date. This confirms authenticity and provides a point of reference in case of disputes.

How to Write a Security Deposit Disposition Letter

Writing a security deposit disposition letter may seem daunting, but following a structured process ensures clarity and compliance.

Step-by-Step Guide for Landlords

- Gather Documentation: Collect the original lease agreement, security deposit receipt, repair invoices, and inspection reports.

- Identify Tenant and Property: Clearly state the tenant's name and rental address.

- List Deposit Details: Mention the original deposit amount.

- Itemize Deductions: Include detailed explanations for each deduction.

- Calculate Final Return: Subtract deductions from the original deposit to state the balance.

- Provide Delivery Instructions: Indicate how and when the remaining funds will be returned.

- Include Signatures: Sign and date the document for verification.

Following this structure ensures the letter is legally sound and easy to understand.

Template or Letter of Disposition Sample

While state laws vary, most letters follow this basic structure:

This template can be adapted based on state-specific requirements and landlord preferences.

How Do I Get a Disposition Letter as a Tenant?

Tenants often ask, “How do I get a disposition letter?” The process is straightforward:

- Request in Writing: Send a written request to the landlord, ideally via email or certified mail.

- Provide Forwarding Address: Ensure the landlord has the correct address for deposit return.

- Understand Timelines: Be aware of state laws dictating how long a landlord has to issue a disposition letter and return deposits.

If you have moved, you should always provide your landlord with a forwarding address, typically done in your 30-day notice to vacate. If you don't receive the letter by the legal deadline for your state, you should contact your former landlord immediately. This document is crucial for understanding the what does disposition of property mean as it relates to your deposit funds.

In states like New York, landlords must return the deposit and provide a written statement within 14 days of the lease ending. If a landlord delays or refuses, tenants may seek legal recourse.

What Are the Legal Requirements for Disposition Letters in the U.S.?

Landlords must understand both federal and state-specific regulations when issuing disposition letters.

Federal vs. State Laws

While there are no federal laws specifically regulating security deposit disposition letters, federal laws such as the Fair Housing Act still impact deposit handling, especially concerning non-discriminatory practices. The majority of legal requirements exist at the state level, including:

- Timelines for returning deposits.

- Acceptable deductions.

- Documentation standards.

Key State-Specific Timelines

Each state establishes rules regarding when landlords must return deposits and provide a disposition letter:

California: Under California Civil Code Section 1950.5, landlords must provide a written security deposit disposition within 21 days after the tenant vacates the rental unit. The letter must include an itemized list of deductions and the remaining balance of the deposit.

- For example, if a tenant moves out on March 31, the landlord has until April 21 to return any remaining funds. California also allows tenants to challenge deductions they consider unreasonable, and landlords may be liable for damages if the letter is delayed or inaccurate.

Texas: In Texas, landlords are required by the Texas Property Code Section 92.103 to return the security deposit within 30 days of lease termination. If deductions are made, landlords must include an itemized list detailing the charges.

- For instance, if a lease ends on June 15, the landlord must provide the disposition letter and return any remaining deposit by July 15. Failure to comply may expose the landlord to legal action, including the tenant suing for the deposit plus damages.

New York: New York landlords must return the security deposit and issue a written statement of disposition within 14 days after the lease ends, according to New York General Obligations Law Section 7-103. This shorter timeframe emphasizes the importance of prompt processing.

- For example, if a tenant vacates on September 1, the disposition letter and deposit must be delivered by September 15. Non-compliance can result in the landlord being liable for double the amount of the deposit, making timely action critical.

Other States:

- Florida: 15 to 30 days depending on lease type.

- Illinois: 45 days after lease termination.

- Massachusetts: 30 days with interest accrual requirements.

Landlords should always verify local statutes to ensure compliance and avoid penalties.

Penalties for Non-Compliance

Failing to provide a proper security deposit disposition letter can result in:

- Tenant lawsuits for double damages.

- Court-ordered payment of deposit plus interest.

- Administrative fines in certain jurisdictions.

Understanding the legal framework prevents costly disputes and maintains good landlord-tenant relationships.

Landlords can also benefit from guides like how long does a landlord have to fix something and move-in fee vs security deposit for broader property management knowledge.

Conclusion

A disposition letter is an essential tool for landlords to maintain transparency, comply with state laws, and foster positive relationships with tenants. By understanding what is a disposition letter, including all critical components such as tenant identification, original deposit, itemized deductions, and final returned amount, landlords can avoid disputes and ensure smooth lease terminations.

Properly documenting security deposits and issuing disposition letters promptly demonstrates professionalism and builds trust with tenants. It also ensures compliance with state-specific laws, avoiding potential legal penalties and misunderstandings.

Ready to streamline your property management and simplify lease-end processes? LeaseRunner offers comprehensive tools for landlords, including templates for security deposit disposition letters, automated reminders for deposit returns, and easy tracking of tenant communications. Visit LeaseRunner today to manage your leases more efficiently, stay legally compliant, and provide your tenants with clear, professional documentation.

FAQs

Is a disposition letter the same as a refund statement?

Yes, essentially. The terms are often used interchangeably. A disposition letter is a refund statement, as it details the disposition (final handling) of the deposit, whether the final amount is a refund, a partial refund, or a notice that the entire deposit was retained.

Can I dispute a disposition letter from my landlord?

If you are a tenant who feels the deductions are unfair or for damages that are normal wear and tear, you have the right to dispute the letter. The first step is to write a formal letter back to the landlord challenging the specific charges and asking for proof (receipts, invoices).

If an agreement can't be reached, you may need to pursue the matter in small claims court.