For many landlords, receiving an upfront lump sum payment, often referred to as prepaid rent, can feel like hitting a financial jackpot. A tenant offering to pay six or twelve months in advance provides immediate, tangible security and significantly boosts your rental property cash flow.

However, handling prepaid rent goes beyond depositing the funds. Mismanagement can result in accounting errors, tax issues, and even legal disputes. Proper documentation and understanding of relevant laws are essential.

Key takeaway:

What Is Prepaid Rent?

Prepaid rent is a payment made for a future rental period that has not yet occurred. It is, by definition, paying for a future obligation today. From an accounting perspective, this prepayment of rent is not yet earned - it represents a liability until the rental period begins. Once December arrives, the prepaid amount becomes rent revenue.

To illustrate, consider a tenant signing a 12-month lease on June 1st and paying the rent for June, July and August upfront. In this scenario:

- June Rent: Regular rent (earned income immediately).

- July and August Rent: Prepaid rent (unearned revenue/liability until those months arrive).

According to the IRS Publication 527 (Residential Rental Property), prepaid rent “is taxable when received,” even if it applies to a future period, depending on your accounting method.

Prepaid Rent vs Regular Rent

Regular rent is typically paid in advance for the upcoming month. In most U.S. lease agreements, tenants pay on the 1st for that month’s occupancy. So yes, rent is prepaid, not postpaid, by design.

By contrast, prepaid rent refers to extra payments such as when a tenant pays several months ahead to secure a lease or demonstrate reliability.

Impact of Prepaid Rent on Tenants and Landlords

Prepaid rent can benefit both parties under certain conditions but it also comes with financial, legal, and administrative trade-offs. The following comparison outlines how prepaid rent impacts tenants and landlords across multiple dimensions.

Key Points for Landlords

- Prepaid rent boosts immediate liquidity but requires accurate classification and compliance with tax and state laws.

- Tracking rent-to-income ratios can help landlords evaluate tenant reliability before approving large upfront payments.

- Maintaining clear documentation and transparent communication protects against disputes and ensures IRS compliance.

Key Points for Tenants

- Prepaying rent may strengthen rental applications—especially when the rent-to-income ratio is slightly above standard thresholds—but limits short-term financial flexibility.

- Tenants should review refund clauses, request written receipts, and understand local regulations before transferring large sums.

- Consulting a financial advisor is wise when prepaid rent exceeds three months or significantly impacts personal liquidity.

In short, prepaid rent offers stability but also financial complexity. For landlords, it ensures predictable income and reduces default risk, but demands careful accounting and legal awareness.

For tenants, it can improve lease approval chances—especially when their rent-to-income ratio is marginal—but requires disciplined budgeting and a thorough understanding of refund terms. When handled transparently, prepaid rent can foster trust and long-term stability for both parties.

Prepaid Rent in Rental Agreements

When drafting or reviewing a lease, landlords must ensure the rental agreement clearly defines prepaid rent - how much is paid upfront, what period it covers, and whether it’s refundable.

Legal Considerations for Landlords in the U.S.

Under U.S. landlord-tenant law, prepaid rent is legal, but regulations vary by state. Some states limit how many months’ rent a landlord may collect in advance, while others require prepaid rent to be held in a separate account.

For example:

- California: California Civil Code §1950.5 distinguishes between prepaid rent and security deposits, clarifying that prepaid rent is not subject to deposit return laws. Landlords must not treat prepaid rent as additional security unless explicitly stated.

- Texas: Property Code §92.103 requires landlords to refund unearned rent if a tenant vacates early, unless the lease explicitly waives it.

- New York: Landlords in rent-stabilized units may only collect one month’s rent in advance.

Always document prepaid amounts in the lease and issue a written rent receipt for transparency. It’s also wise to clarify how prepaid rent will be handled if the tenant moves out early or the lease is terminated.

Prepaid Rent vs Security Deposit

It’s common for landlords to confuse prepaid rent with a security deposit, but they serve different purposes.

In short:

- Prepaid rent covers a future rental period.

- Security deposits cover potential damages or unpaid rent.

A tenant cannot usually request that prepaid rent be used as a security deposit. For details on managing deposits correctly, review best practices for determining how much is a security deposit for an apartment and learn about move-in fee vs security deposit differences.

If a lease ends, landlords must still follow state rules for security deposit return letters and refunds.

How Does a Landlord Record Prepaid Rent?

Accounting for prepaid rent depends on the method of accounting you use- accrual or cash basis. Each has different implications for when and how you recognize income.

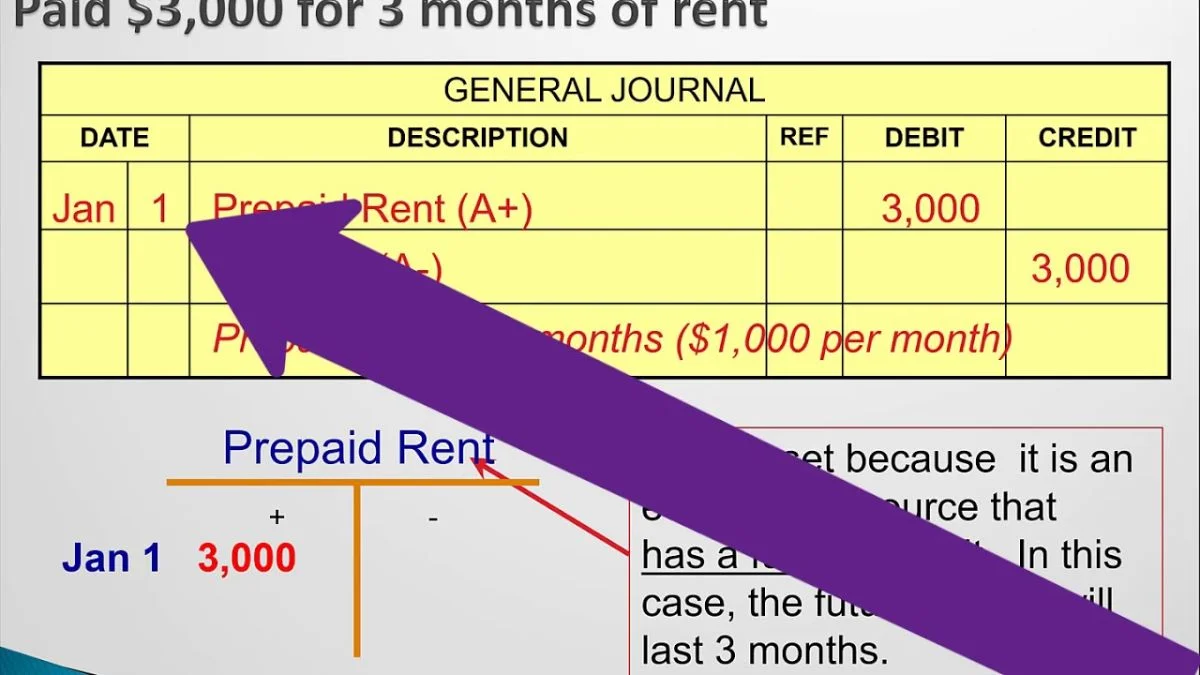

Accrual Basis Accounting

Under the accrual basis, landlords recognize income when it is earned, not necessarily when received.

If a tenant pays December rent in November, you record it as a liability (unearned rent revenue) in November. Then, once December begins, that amount is moved from the liability account to rental income.

Example entry:

- November: Debit Cash, Credit Unearned Rent Revenue

- December: Debit Unearned Rent Revenue, Credit Rent Income

This approach aligns income with the period it is earned and complies with IRS guidelines for landlords using accrual accounting.

Cash Basis Accounting

Under the cash basis accounting method, landlords recognize income when payment is actually received. This means that prepaid rent is recorded as income in the month it is collected, even if it applies to a future rental period.

For example, if a landlord receives $1,200 in November for December’s rent, the full amount is treated as income for November.

While this method simplifies bookkeeping, it can distort taxable income. Collecting multiple months of rent upfront in a single month, such as December, may inflate annual income and potentially push the landlord into a higher tax bracket.

How to Handle Refunds or Early Termination?

When a tenant moves out before the prepaid period ends, landlords must handle the unearned portion properly.

- Refundable Prepaid Rent: If not stated otherwise, you must refund the unused amount.

- Non-Refundable Clauses: Legal only if clearly written and compliant with state laws.

- Re-rental Situations: If a new tenant takes over mid-period, landlords can offset lost rent but must provide accounting transparency.

For instance, If a tenant pays $4,500 for three months and moves out after one, the landlord may retain $1,500 (earned) and must refund $3,000 unless the lease specifies otherwise.

When refunding, always issue a written rent receipt or security deposit return letter documenting amounts applied or returned.

Prepaid Rent and Tax Implications

Taxes can get tricky when it comes to prepaid rent. Understanding when prepaid rent is taxable and how to record it properly helps landlords stay compliant with IRS rules.

When Is Prepaid Rent Taxable?

According to the IRS Publication 527, prepaid rent is taxable when received, regardless of the period it covers. Even if the tenant pays for six months ahead, landlords using cash basis accounting must report the full amount in the year received.

For landlords using accrual accounting, prepaid rent is recognized as income in the period it applies to.

Common Tax Mistakes Landlords Make

- Reporting prepaid rent twice (once when received, again when earned).

- Treating prepaid rent as a security deposit to delay taxation.

- Omitting prepaid income during year-end reconciliation.

- Failing to maintain clear lease documentation distinguishing advance rent from deposits.

Best Practices for Compliance

- Always specify “prepaid rent” in the lease agreement.

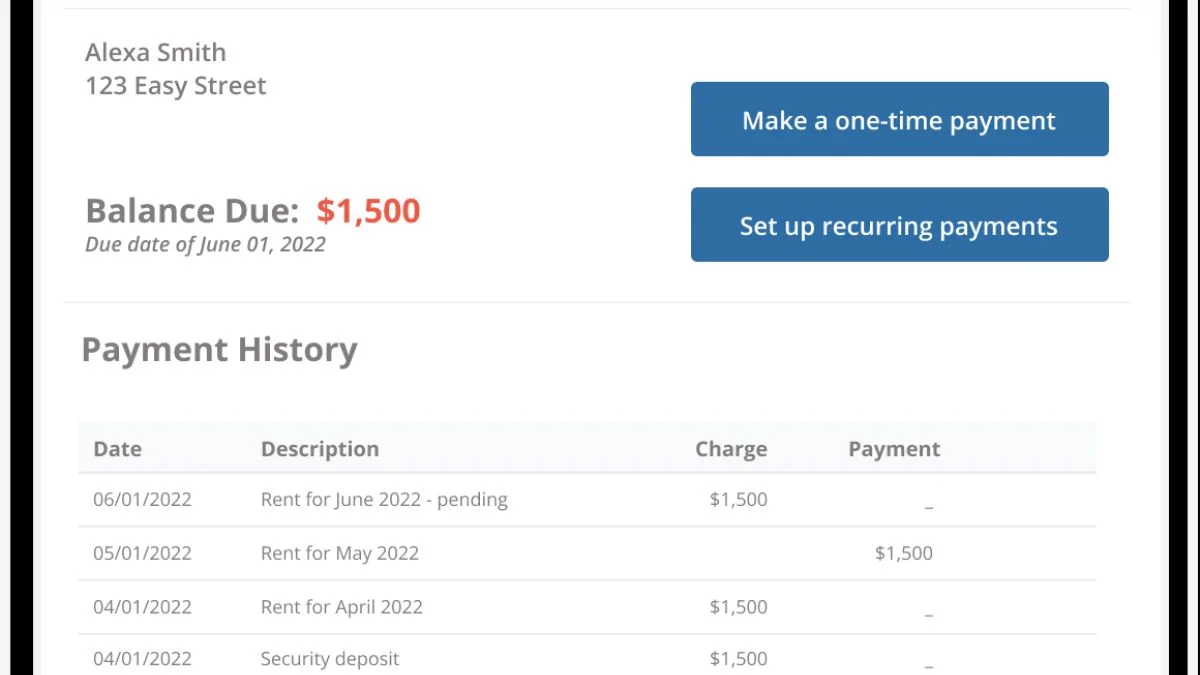

- Keep ledgers tracking rent prepayment dates, amounts, and coverage periods.

- Review IRS Schedule E (Form 1040) for proper income reporting.

- Understand your grace period on rent and rent late fee policy to prevent confusion.

- Store copies of receipts and tenant communications for at least 3 years, per IRS record-keeping guidelines.

For example, a landlord in Texas leases a home for $2,000/month. The tenant pays six months upfront ($12,000).

- Under cash basis, the landlord must report $12,000 as 2025 income.

- Under accrual basis, only January’s $2,000 counts for that year, and the rest is deferred.

If the tenant vacates after three months, Texas law (§92.103) requires refunding the remaining unearned portion ($6,000), unless the lease expressly states non-refundability.

Failure to refund may result in forfeiture of double the amount wrongfully withheld, under §92.109.

Conclusion

For landlords, managing prepaid rent correctly is essential to maintaining accurate books and avoiding tax complications. Whether you use cash or accrual accounting, the key is consistency and documentation.

Always distinguish prepaid rent and rent expense clearly, keep tenant agreements up to date, and comply with local laws regarding deposits and rent handling.

Ready to simplify your rental management? LeaseRunner offers easy-to-use tools for tracking rent payments, generating receipts, and staying compliant with landlord-tenant laws. Start optimizing your rental operations today with LeaseRunner.

FAQs

What type of asset is prepaid rent?

From an accounting standpoint, prepaid rent is a current asset if you’ve paid it as a tenant, or a liability if you’re the landlord who received it. The classification changes once the rental period begins.

Is prepaid rent refundable?

In most cases, prepaid rent is non-refundable unless stated otherwise in the lease. However, if the tenant vacates early and the landlord re-rents the property quickly, partial refunds may be reasonable depending on the terms.

How long can a landlord hold prepaid rent?

Landlords can typically hold prepaid rent until the covered period begins. However, some states limit the number of months that can be collected in advance, often to two or three months. Always check local landlord-tenant laws.

Can prepaid rent be used as a security deposit?

No, prepaid rent cannot replace a security deposit unless clearly written in the lease. Each serves a different function—prepaid rent covers future occupancy, while deposits protect against damage or unpaid rent.